-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Rediscovering the Potential of Downtrodden Value Stocks

*Historical analysis does not guarantee future results.

As of May 31, 2020

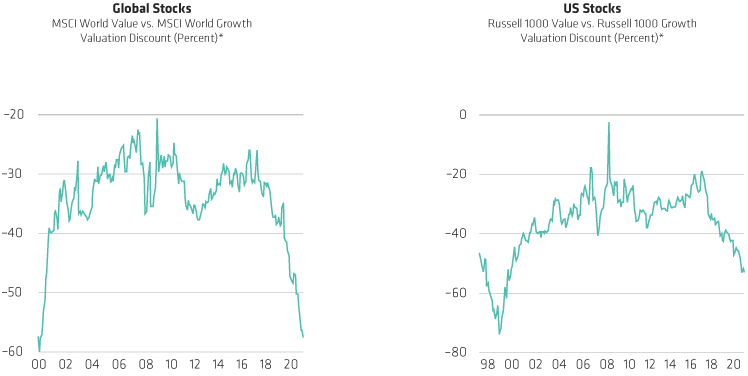

*Valuation discount based on an average of price/sales ratio, price/cash flow ratio and price/forward earnings ratio. For global stocks, valuation discount and monthly percentile rank measure from May 31, 2000 to May 31, 2020. For US Stocks, valuation discount and monthly percentile ranks measured from November 30, 1998 to May 31, 2020

Source: FactSet, Russell Investments and AllianceBensntein (AB)

Historical analysis does not guarantee future results.

As of May 31, 2020

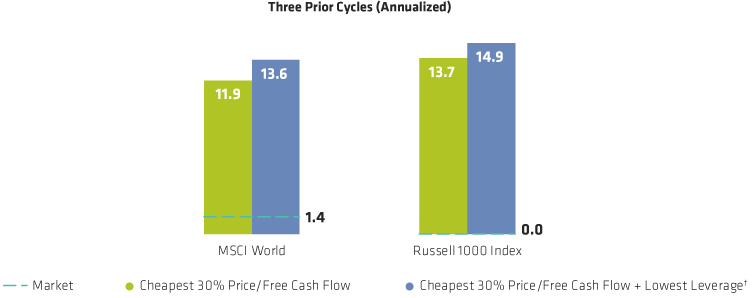

*Valuation spreads based on an average of price/sales ratio, price/cash flow ratio and price/forward earnings ratio of the value index versus the growth index, calculated on an equal weighted basis. Based on three previous periods in which valuation spreads exceeded the 70th percentile historical rank at the starting point, then returned to equilibrium at the 60th percentile historical rank, with a minimum time lapse of 36 months. The three periods are January 1999 to June 2002, June 2003 to Jun e2006 and September 2007 to September 2010. Global financial crisis from September 2007 to September 2010.

✝Leverage defined as net debt/equity.

Source: FactSet, MSCI, Russell investments and AllianceBernstein (AB)