-

For more ways to pursue good returns and good values in your portfolio, explore Inspired Investing, a new podcast series where senior leaders at Bernstein share their thoughts on investing with purpose, first-hand and check out related blogs here.

Responsible Returns

Better Stocks for a Better World

16 May 2019

4 min read

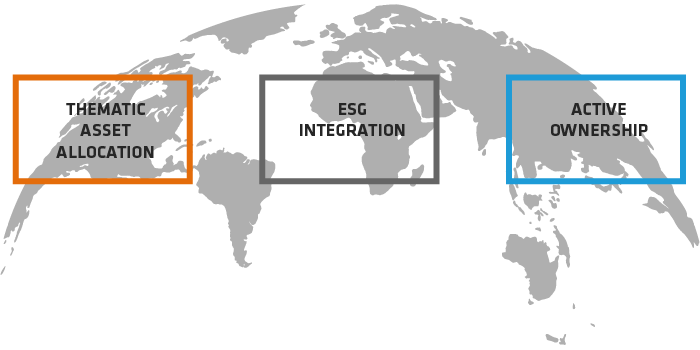

The Three Pillars: How Responsible Investors Contribute to Positive Social Outcomes

Primary Mechanisms Identified by the PRI*

*PRI: Principles for Responsible Investment

Source: PRI, "The SDG Investment Case", October 2017

UN Sustainable Development Goals

A Powerful Framework for Sustainable Theme Selection

Source: United Nations

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

About the Author