-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

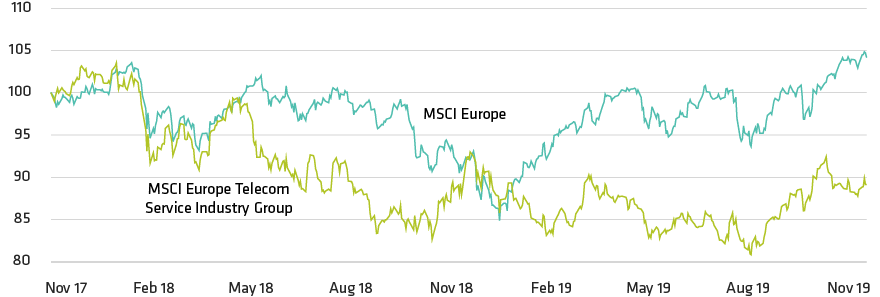

Time to Hang Up on European Telecom Stocks?

Historical and current analyses do not guarantee future results.

Through November 30, 2019

Source: Bloomberg, MSCI and AllianceBernstein (AB)

Historical and current analyses do not guarantee future results.

Through December 31, 2018

Based on reported profitability and cash-flow figures of nine major European telecom groups: BT, Deutsche Telekom, KPN, Orange, Swisscom, Telefonica, Telecom

Italia, Telenor and Vodafone

Source: Bloomberg, company reports and AllianceBernstein (AB)

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.