-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

UN Sustainability Goals

A Road Map for Responsible Investing

01 February 2017

5 min read

A Great Starting Point: UN Sustainable Development Goals

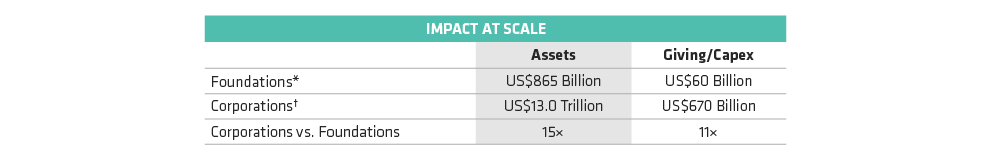

SDG Progress Will Take Corporate Involvement

As of December 31, 2016

*Includes 86,726 registered charitable foundations

†Includes 500 largest US nonfinancial companies

Source: George Serafeim, The Role of the Corporation in Society: An Alternative View and Opportunities for Future Research, Harvard Business School working paper, May 2014; and Foundation Center

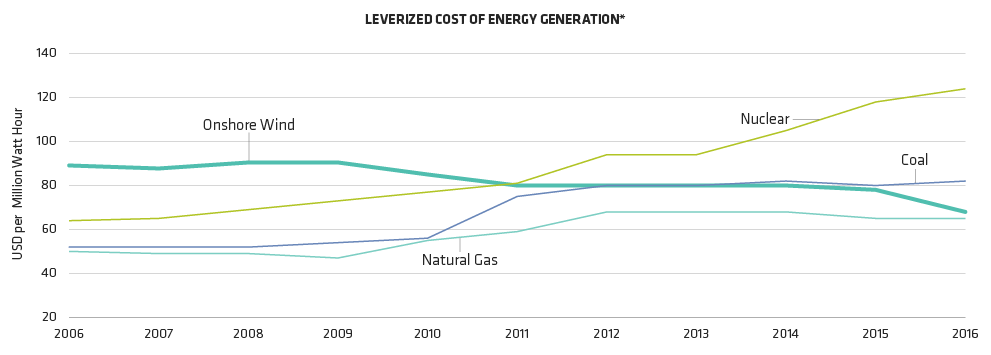

Improving Economics Will DRIVE Renewable Investment

Through December 31, 2016

*Levelized cost of energy (LCOE) is the net present value of the unit-cost of electricity over the lifetime of each source of power generation.

Source: Bloomberg New Energy Finance, National Renewable Energy Laboratory and US Department of Energy

About the Author