-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

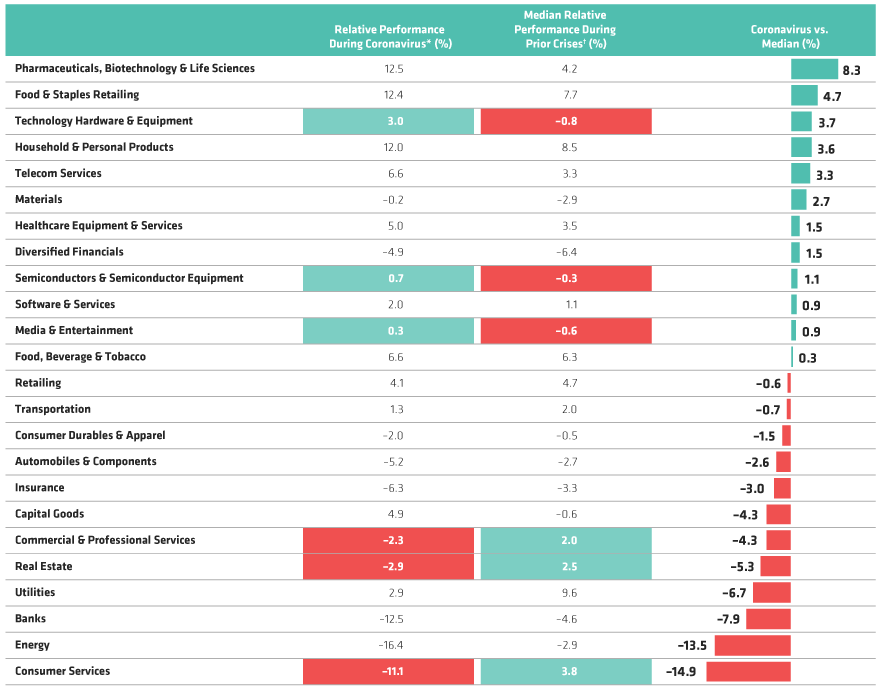

Defensive Stocks Redefined in COVID-19 Sell-Off

Past performance does not guarantee future results. Data represent the relative performance for MSCI World industry groups.

*Coronavirus (some February peak): February 19, 2020 – March 31, 2020. Prior crisis is include: rising rates + slowing grows in China and Europe: September 2018 – December 2018; inflation + said tightening: January 2018 – March 2018; China’s economy + swimming oil price: November 2015 – February 2016; grease + China stock market crash: July 2015 – September 2015; Concerns about Europe: May 2012 – Jean 2012; Eurozone debt seers III: October 20 11 – November 2011; euro zone debt fears II: May 2011 – October 20 11; Eurozone debt fears I: April 20 10 – May 2010; global financial crisis: May 2008 – March 2009; SARS: November 2002 – March 2003; 2000 to crash: March 2000 – October 2002; 1998 Asian crisis: July 1998 – August 1998.

As of March 31, 2020

Source: MSCI and AllianceBernstein (AB)

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.