-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

FANG Stocks Expose Blind Spots in Risk Models

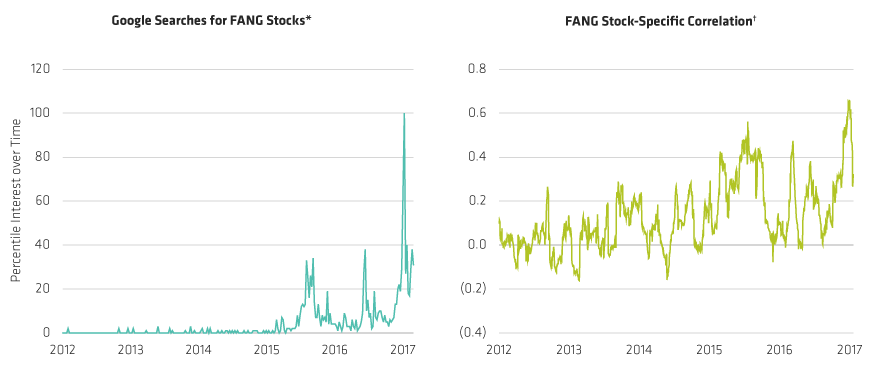

Ledt chart through July 30, 2017. Right chart through July 28, 2017.

*Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. Avalue of 50 means that the term is half as popular.

Likewise a score of 0 means the term was less than 1% as popular as the peak.

✝Average pairwise 30-day correlation in US-dollar terms of stock-specific return. Stock-specific return is the actual return minus the factor return.

Source: FactSet, Google, MSCI, Risk Model:Barra GEMLT (Stable) and AB

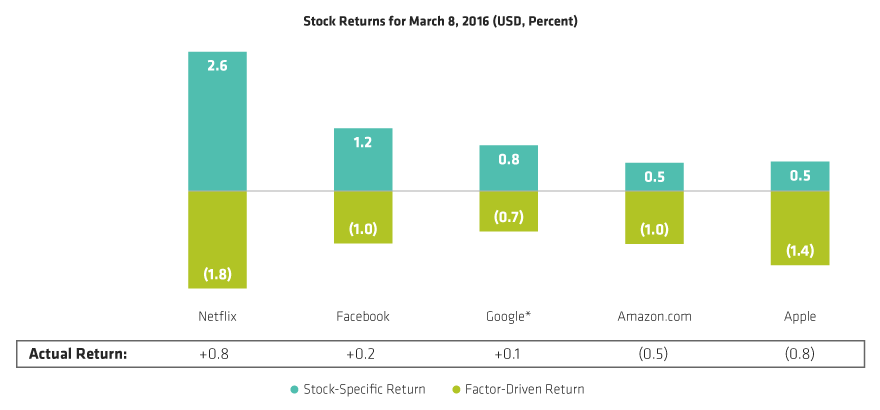

*Alphabet, Inc.

Stock-specific return is the actual return minus the factor return.

Source: MSCI, FactSet, Risk Model: BARRA GEMLT (Stable) and AB

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.