-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

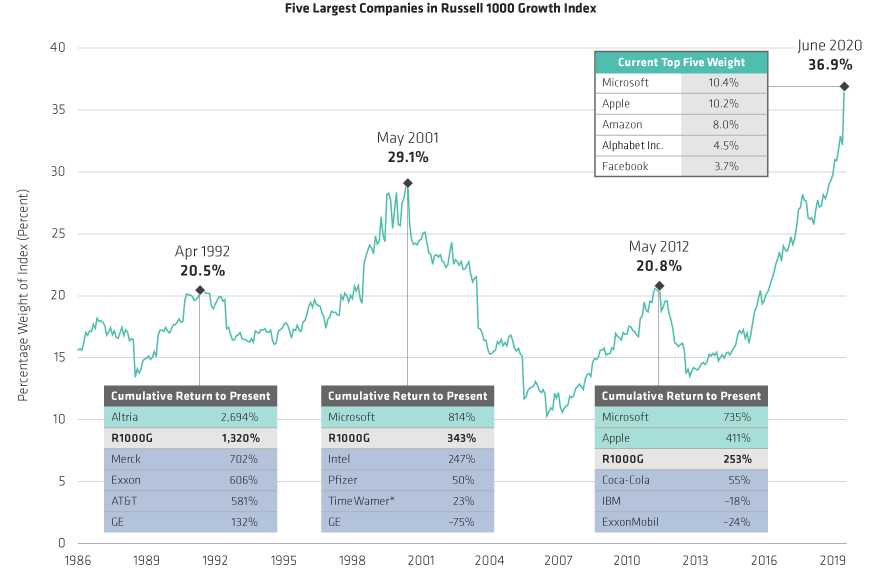

Record US Index Concentration Adds Hazards for Investors

06 July 2020

2 min read

US Growth: Largest Stocks and Top Performers Have Shifted Over Time

Past performance does not guarantee futur results.

As of June 30, 2020

*Cumulative returns shown for Time Warner are from June 1, 2001 to June 14, 2018, prior to AT&T merger

Peaks shown are for the last day of each month displayed.

Source: FactSet, Russell Investments and AllianceBernstein (AB)

Fund Focus

ES AllianceBernstein Concentrated US Equity Fund

Seeking Consistent Earnings Growth from High Quality US Companies to Drive Long-term Returns

Capital at Risk

About the Authors