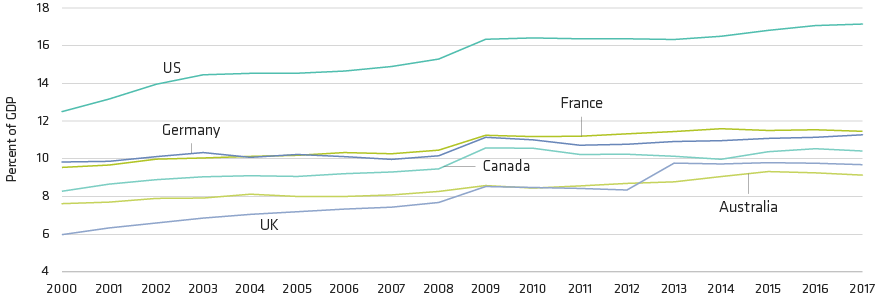

US healthcare costs continue to rise faster than GDP and are a growing burden on household spending as the proportion of drug costs that falls on patients rather than insurers continues to increase. While rising costs affect all parts of the system—hospital costs, drugs, physician visits and so on—drug costs are usually the most visible. So reducing the cost of medicines—including those made and marketed by European companies—will remain a major topic in US politics between now and the presidential election in November 2020. Rhetoric on the subject is likely to continue to weigh on healthcare companies’ stock prices.

But major regulatory reform, such as European-style universal state-funded medical coverage, is unlikely to pass into law, in our view. In the US, healthcare accounts for well over 10% of employment. No politician who wants to be elected will seek to wipe out millions of jobs, often high-paying ones. But pharmaceutical companies enjoy high margins in the US. Their drugs’ prices will remain a tempting political target. So some incremental reform is likely to pass.

Opportunities in European Healthcare

Given the US political risk, where are the return opportunities in European healthcare? One possible safe haven is medical technology and device-makers, whose products are a less visible and politically less sensitive component of healthcare costs. These companies are generally expensive. However, Getinge of Sweden has a well-diversified set of products and geographic exposure and has been doing a good job reducing operating costs, in our view.

Another potentially attractive area is companies that are developing and introducing significant improvements in the standard of care for serious diseases; these tend not to be subject to the same pricing pressures as more mature treatments. In fact, securing payment for meaningful but expensive innovative treatments is typically easier in the US than in much of Europe.

Switzerland’s Roche is a good example. Roche is currently launching Hemlibra, a significant advance in the standard of care for haemophilia. And its pipeline includes treatments for spinal muscular atrophy (SMA), a devastating muscle wasting disease mostly present in children, and Huntington’s disease, which causes movement disorders and dementia, typically starting in middle age.

Yet Roche is currently trading at a discount to its European pharma peers due to concerns surrounding generic competition to three of its largest drugs. Our research suggests that many investors have accurately assessed the impact of generics but are not giving Roche sufficient credit for its industry-leading pipeline of novel drugs that will advance the standard of care in a wide range of indications. We think these products should help shelter Roche from pricing pressure in the U.S.

Investors need to proceed with caution in the healthcare sector as US political risks become more prominent. At the same time, we think select healthcare names can be a significant source of return in a high-conviction European equity portfolio.