Despite compelling evidence in favor of global diversification, investors in many markets around the world continue to have a strong “home bias”—a preference for domestic over foreign assets. Nowhere is this tendency more apparent than in the ranks of liability-driven investors. But our research shows that LDI investors, too, can reap significant benefits from going global.

On the surface, liability-driven investors’ preference for domestic bonds makes good sense. The primary concern of liability-driven investors, after all, is not maximizing returns, but ensuring adequate funding levels to match long-term liabilities such as pension obligations. The current value of these liabilities is generally sensitive to domestic interest rates—hence the common assumption that the purchase of long-duration domestic bonds is the best way to reduce the risk of funding shortfalls.

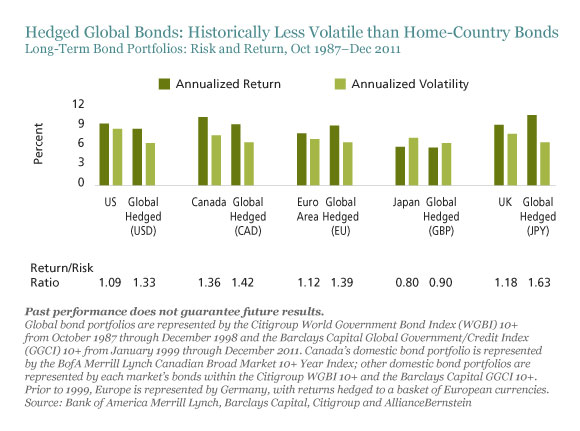

But is it possible to improve the investment outcome by going global? Three of my colleagues—Alison Martier, Erin Bigley and Ivan Rudolph-Shabinsky—have recently published research indicating that investors in several of the world’s major markets have historically been able to achieve comparable returns—with significantly lower volatility—by globalizing their long-duration bond portfolios, as the display below shows.

For liability-driven investors, however, absolute returns and volatility are less important than minimizing mismatches between assets and liabilities. For this reason, we looked at the actual pattern of long-dated bond returns. For investors based in the US, Canada, Japan, UK and the euro area, we found that the returns of domestic and currency-hedged global bonds were highly correlated. This suggests that by adding an allocation to global bonds, there is an opportunity to improve the risk/return profile of an LDI portfolio without creating a sizable gap between liabilities and assets.

Importantly, we also found that when the returns of one country were at an extreme—either positive or negative—the global average was less extreme. This shouldn’t come as a surprise, since global returns are the average of several countries, reflecting the benefits of diversification. But it suggests that exposure to global bonds can mitigate the impact of very weak or even negative domestic returns.

And that seems especially relevant today. Given the current market environment—with yields on bonds near historical lows in many developed nations—domestic bond returns are likely to be very low or negative once interest rates eventually begin to rise to more normal levels. Although returns for global bond portfolios are also likely to be weak, history suggests that they may suffer less than domestic-only portfolios, reducing downside risk. Of course, liabilities tend to closely track domestic bond returns, so when domestic yields rise and produce negative returns, liabilities may also decline. But a global bond portfolio could take advantage of this opportunity to improve a plan’s funding ratio by “losing less.”

All told, we think these are compelling reasons for liability-driven investors to consider an allocation to hedged global debt. What should the size of this allocation be? We’ll consider this and other aspects of the use of global bonds for LDI in future posts.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.