For liability-driven investors, exposure to global bonds offers important benefits: a strong correlation to domestic debt, with greatly reduced volatility. However, these are not the only positives. Today, we’ll look at some other important benefits—such as greatly expanding the investable universe and offering a natural hedge against the tail risk of a domestic credit crisis—and then examine some of the practicalities of introducing global bond allocations within an LDI framework.

Although tail-risk events are—by definition—rare, recent financial problems in Greece and several other European nations, and the resulting turbulence in their government bond markets, have made sovereign credit risk a more prominent issue for investors. For liability-driven investors in these countries, the traditional approach of immunizing liabilities through exposure to domestic-only debt could be very risky.

US investors don’t share the same level of concern about a domestic credit crisis, and US Treasuries do still rally during flights to quality, but the risk of a credit event is not zero. The US faces a significant structural budget deficit, which is projected to increase as spending on Social Security and Medicare accelerates in the latter part of this decade.

The current assumption is that the threat of a potential crisis will ultimately spur the US government to act, but if the current political divide were to result in a deadlock preventing meaningful deficit reduction, further credit-rating downgrades could ensue, and financing costs could escalate as investors require greater compensation for holding US debt.

In any of these cases, exposure to global bonds offers what amounts to a natural hedging strategy against domestic tail risk: global bonds offer a high correlation to domestic long-term bonds but have historically protected against large downside losses in domestic bonds.

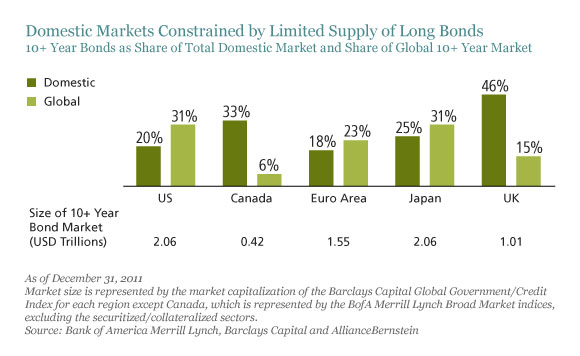

Another important benefit of going global is that it greatly expands the universe of investable bonds, as three of my colleagues—Alison Martier, Erin Bigley and Ivan Rudolph-Shabinsky—note in recently published research. This is especially relevant to investors using LDI strategies, since the supply of longer-dated bonds—the best match for long-term liabilities—is relatively scarce in many markets. While long bonds make up nearly half the market in the UK, they account for less than a third of the domestic markets of the US, the euro area and Japan, as shown in the display below. Investors in any of these regions could more than triple their long-maturity investment universe by looking globally.

Having looked at the benefits of going global and the sizing of the appropriate global allocation in earlier blog posts, let’s conclude this series by asking how investors can go about introducing a global allocation to their fixed-income portfolio.

- Investors can add an international component to their asset allocation. This involves adding a portfolio of only nondomestic bonds. The investor (rather than the portfolio manager) must then monitor and adjust the size of the allocation to nondomestic bonds versus domestic bonds.

- Investors can make a global allocation. In this case, nondomestic bonds are part of the portfolio benchmark and therefore allocations are strategic in nature. The portfolio manager can actively shift allocations within the portfolio between domestic and nondomestic bonds.

- Investors can permit the opportunistic use of nondomestic bonds within their domestic portfolios—a “core plus” approach to an LDI portfolio. In this case, the portfolio manager allocates between domestic and nondomestic bonds, but nondomestic bonds are not part of the benchmark; therefore, these allocations are tactical rather than strategic.

The specific solution will vary depending on the circumstances of the investor, but in general, our research strongly suggests that the evidence in favor of adding a global bond allocation to LDI portfolios is compelling.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.