When US auto sales were in the dumps three years ago, an investor predicting a rebound was considered about as credible as a used car salesman. Today, a bumper year for car sales is providing a great example of the enduring principles of long-term investing.

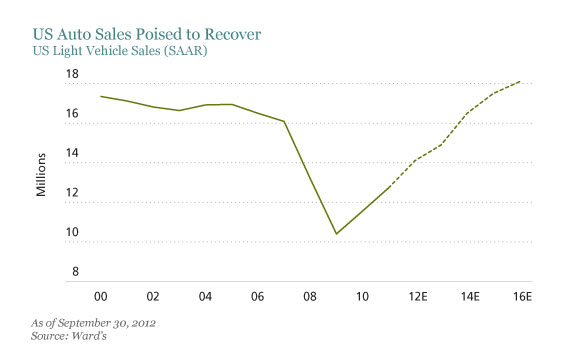

Back in 2009, the US motor vehicle industry faced an epic crisis. Demand had collapsed because of the recession and an oil price spike. Ford, GM and Chrysler were fighting for their financial survival. Annual unit sales fell below 10 million—a 25-year low—from more than 16 million before the crisis, undermining global vehicle manufacturers from Toyota to Volkswagen, which relied heavily on the US market. At the time, it seemed ludicrous to suggest that by 2012, US car sales would ever reach nearly 15 million units a year again, as recent data indicate (Display).

Yet it wasn’t impossible to predict. The key was really to rely on research and to focus on facts, even when headlines were filled with doom and gloom while stock prices tumbled. Back in 2009, we noticed some trends which led us to conclude that US car sales would recover faster than widely expected.

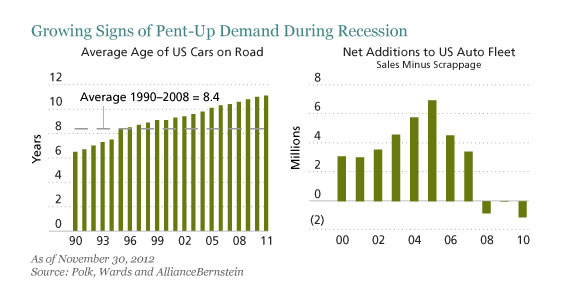

First, as the crisis dragged on, Americans held onto their cars for longer (Display). The average age of cars on the road increased to about 11 years, from a longer-term average of 8.4 years before the recession. And more cars were being scrapped than sold, so there was a lot of pent up demand in the industry.

Second, fears about the future led many young adults to stay at home for longer than usual. The number of new household formations declined from about 1.5 million annually during the previous decade to 0.4 million in 2009. Along with many irked parents waiting for their empty nest, we waited to see when new household formation would perk up again as a potential leading indicator for consumer confidence that would prompt a bounce in car sales.

Third, even in the credit crisis, car loans were relatively stable. While losses did increase, car owners prioritized car payments ahead of mortgages, which limited the damage. Since car loan quality was relatively untainted, credit availability rebounded quickly for auto purchases, unlike in the mortgage market.

These factors paved the way to the recovery. What really happened was that the destruction of demand came alongside a decline in used car supply, as people drove their cars for longer and cash-strapped carmakers reduced output. And after massive restructuring and cost cuts, the big three US carmakers can now break even on annual nationwide sales of about 10 million units a year, so profitability is much more sustainable than in the past.

The bust and boom in US auto sales reminds us that applying disciplined research in fear-stricken markets can pay off. Shares of global automakers have rebounded since the end of 2011, with the MSCI World Auto & Components Index outperforming the MSCI World by 2,900 basis points through March 8. Shares of Volkswagen, Toyota, and GM led the gains. GM, which was in bankruptcy in 2009, has returned 49% since hitting its trough and now trades at a valuation of 3.4x EV/EBITDA, which would have been unthinkable three years ago.

In many other industries—from technology to financials—there are plenty of undervalued stocks with strong potential that haven’t yet recovered because risk-averse investors still fear buying into industry controversies. As markets refocus on fundamentals, we expect investors who have consistently connected their research dots to be increasingly rewarded for reaching contrarian conclusions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.