Believe it or not, recent US housing market gains, the slight reduction in jobless rates and other signs of a revival in US economic growth are making some investors bearish about US stocks. We think their fears are misplaced.

The bears fear that the economic pickup could prompt the Federal Reserve to reverse course sooner than the market expects, driving bond yields up sharply—and, in turn, pushing down stocks. Yields on 10-year US Treasury notes did rise to as high as 2.058% in mid-March, up 67 basis points from their all-time low last July, but they are still extremely low by historical standards.

During that six-month period, the S&P 500 returned 18%, reflecting both diminished fears of an unlikely but painful shock (such as the breakup of the euro) and increasing evidence that the US economy and corporate earnings were strengthening.

Nonetheless, last week the Federal Reserve reaffirmed its current policy of maintaining interest rates close to zero and buying about $85 billion of longer-term US Treasury securities and mortgages securities per month. The Fed also reiterated that its current policy is appropriate for at least as long as the unemployment rate remains above 6.5%, and it projects that inflation will be no more than a half percentage point above its 2% target. The Fed may reduce its bond purchases as the economic recovery shows further progress, but we don’t expect a major interest-rate policy shift for another year or two, making an abrupt rise in bond yields unlikely.

Furthermore, our research suggests that a slow increase in bond yields from today’s extremely low levels is likely to be good for stocks.

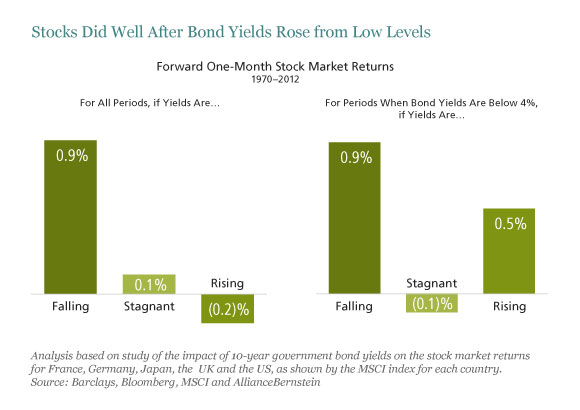

We looked at the relationship between changes in 10-year government bond yields and subsequent stock market returns since 1970 in each of five countries: France, Germany, Japan, the UK and the US.

As you would expect, we found that in the first month after bond yields declined, stocks rose, returning 0.9% on average, as the left side of the display below shows. That’s because bond yields typically decline when central banks are trying to stimulate a weak economy; the stock market gains on hope that the stimulus will succeed and corporate revenues and earnings will rise. We also found that in the month after bond yields rose, the stock markets fell, delivering a (0.2)% average return. Fundamentally, that’s likely driven by periods when bond yields rose because central banks were trying to cool off an overheating economy and prevent inflation from rising.

But that’s not the case now. The Fed is still trying to stimulate the US economy, where the jobless rate remains too high, at 7.8%, and inflation remains quiescent, as a result of widespread idle capacity at home and abroad.

Digging deeper, we looked at periods after bond yields rose from very low levels (below 4%)—that is, in periods that resemble conditions in the US today. We found that the stock markets rose 0.5% per month at such times, as the right side of the display shows. Rates rising from very low levels signal that the economy is normalizing, not on the verge of overheating. That should be positive for stock returns.

The display also tells a cautionary tale: If rates stagnate at low levels for too long, it may signal that the stimulus is not succeeding, which is bad for stocks. In Japan, for example, interest rates and economic growth have been extremely low for nearly two decades—and the stock market has stagnated for most of that time. We think that experience is unlikely to be repeated in the US, but we will continue to watch growth trends closely.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio managers.