It finally feels like a great time to be a value investor again. After several challenging years, market conditions have become much more conducive to finding undervalued, controversial stocks with long-term payoff potential. Even after this year’s equity-market rally, we think the value rebound is just beginning.

The global financial crisis delivered a huge shock to investor psychology. Extraordinary volatility prompted investors to flee from riskier stocks toward safer assets. Fears of global economic collapse dominated market sentiment. Little attention was paid to company fundamentals, so correlations spiked as stocks generally traded in the same direction. It was a toxic environment for stock pickers like us who focus on deep-value stocks that over the last few years have often been found at the riskier end of the equities market.

Company News Is Driving Markets

Things are changing. This year, global equities have shrugged off geopolitical and macroeconomic threats—from the war in Syria to the fiscal standoff in Washington—that would have sent markets into a tailspin in the risk-averse world just year or two ago. Meanwhile, stock correlations have fallen to much more normal levels, indicating that company news is driving markets once again.

This means that investors can successfully use research to identify cheap stocks with much better prospects than widely perceived. Value investing relies on investors’ emotions to create opportunities—yet the payoff can only come when investors realize they have overreacted to bad news and reprice a stock accordingly. This typically comes in response to some stock-specific good news, such as a positive earnings announcement, and it was not happening in anxiety-driven markets. But it is happening today.

Recovery Is Just Beginning

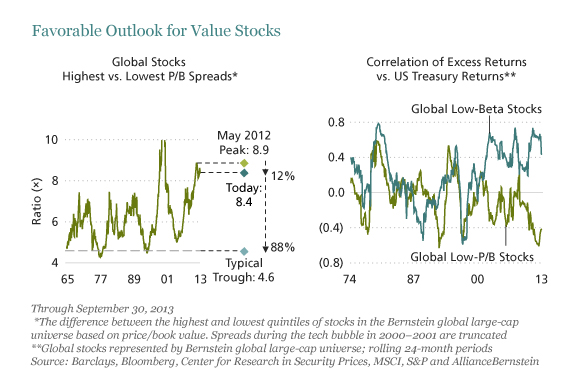

We think the recovery of value stocks is still in its infancy. Our measure of the value opportunity looks at spreads between the cheapest and most expensive quintiles of global stocks based on price/book (p/b) value. Even after this year’s equity rally, these spreads remain very wide (Display). Spreads probably haven’t narrowed as much as you might expect because the market dislocations created by the financial crisis were so profound. The lingering distortive effects of the safety trade left defensive, low-risk stocks at near-record premiums to the market and riskier, cyclical stocks at near-record discounts.

In the past, when these spreads narrowed, value stocks outperformed strongly. Yet by the end of September, p/b spreads had only narrowed about 12% of the way toward a typical trough, meaning there is probably much more to come. Moreover, our research shows that unlike “safer” low-beta stocks, low p/b stocks have low correlations with bond returns, so cheaper stocks should continue to outperform in a rising interest-rate environment.

What’s more, these spreads remain wide across sectors. So we’re finding attractively valued stocks in many different sectors while also maintaining a broad diversification of risk exposures. We’re finding cheap stocks with underappreciated earnings prospects in industries ranging from aerospace to technology to pharmaceuticals.

Are Equities Still Cheap After Rally?

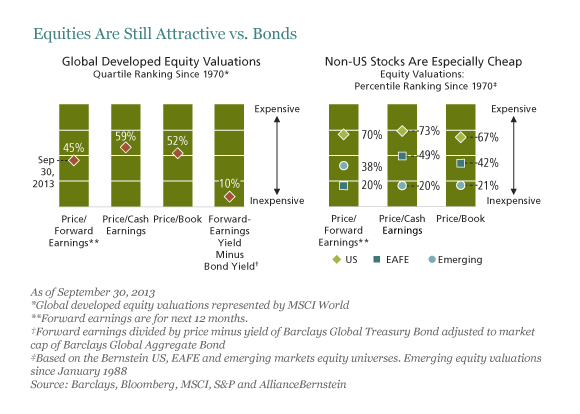

Skeptics might argue that global stocks are no longer as cheap as they were a couple of years ago. It’s true that valuations have rebounded to more normal levels, when looking at quartile rankings since 1970 (Display). But compared with bonds, equity valuations still look like a bargain. And while US equities are indeed trading at relatively rich prices, non-US equities are much cheaper—especially in emerging markets.

Of course, there are still big challenges to contend with—from US fiscal issues to instability in the Middle East. We constantly need to be on the lookout for potential sources of volatility, a relapse of risk aversion and how this could affect company-specific outlooks.

Of course, there are still big challenges to contend with—from US fiscal issues to instability in the Middle East. We constantly need to be on the lookout for potential sources of volatility, a relapse of risk aversion and how this could affect company-specific outlooks.

But investors also seem more willing than they have been for a long time to pay attention to what’s really going on inside companies and fundamental earnings drivers. With so many stocks still trading at discounted prices, we think it’s the right time to get back into value.

This blog was originally published on InstitutionalInvestor.com.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.