They say an ounce of prevention is worth a pound of cure. But if the sickness is excessive portfolio volatility, “prevention” can entail more than one step.

Let’s start at the beginning and illustrate why managing investment risk is so important.

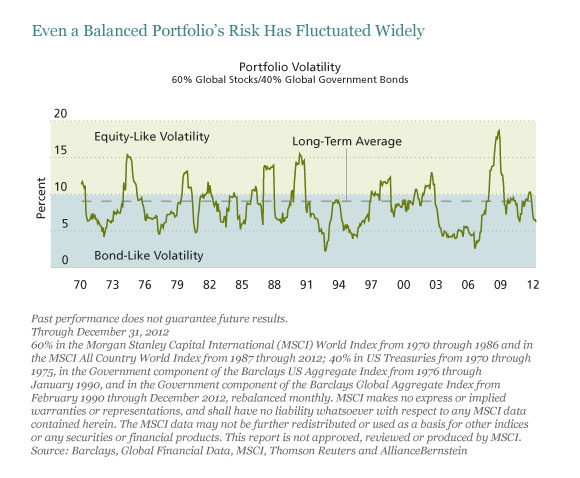

Since 1970, the annual volatility of a portfolio with 60% in global stocks and 40% in global government bonds has averaged 9%—but has seldom actually been 9% (Display). Indeed, such a portfolio’s volatility has usually been at levels more typical of stocks or bonds. Investors who bought into this classic balanced allocation frequently didn’t get what they bargained for.

Our research suggests that carefully calibrated short-term shifts in asset allocation, driven by research into near-term market risks and returns, can help control fluctuations in portfolio volatility. For a 60/40 stock/bond mix, we’d expect to reduce volatility by about 10% over time without detracting from long-term return. Our experience in deploying this strategy—which we call Dynamic Asset Allocation—has so far borne out our research findings.

Our research suggests that carefully calibrated short-term shifts in asset allocation, driven by research into near-term market risks and returns, can help control fluctuations in portfolio volatility. For a 60/40 stock/bond mix, we’d expect to reduce volatility by about 10% over time without detracting from long-term return. Our experience in deploying this strategy—which we call Dynamic Asset Allocation—has so far borne out our research findings.

Investors who sign up for such a strategy should expect to miss out on the full upside of an ebullient market—and escape the worst damage in dismal times. The result is a “thinner” bell curve of returns more in line with investors’ risk tolerance. There are several benefits:

- Keeping investors near the risk profile they feel comfortable with;

- Reducing the frequency of the portfolio encountering negative “tail events”; and thus,

- Helping investors stay in the markets during the inevitable rough patches.

Buying “Insurance” via OptionsDynamic Asset Allocation can entail more than simply making adjustments to the stock/bond mix. It can also deploy another strategy designed to bolster protection against negative tail events: buying stock-market put options, which set a floor price for the market index they cover. In essence, they “insure” against excessive risk.

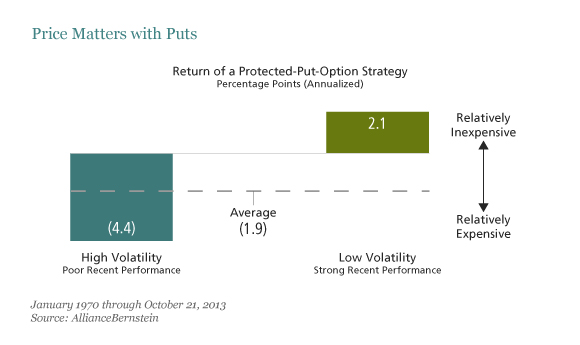

In our view, it’s a mistake to always own these options, since their cost can be quite high. Indeed, on average, the cost of buying stock-market puts would have been large enough to reduce stock-investor returns significantly—by almost two percentage points a year annualized (display). But once again, the average experience doesn’t tell us much.

The obvious strategy—to buy put options when market volatility is high—is not optimal. The cost of options is typically high at such times, and has detracted very meaningfully from performance. Perhaps surprisingly, we find buying puts most attractive when market volatility is on the low side and market momentum is favorable. In those conditions, puts are inexpensive and likely to add to portfolio performance, since market downdrafts are common.

In early 2013, the stock market was relatively calm by historical standards, interest rates were low, and valuations were favorable. As a result, we were holding a slight overweight in stocks (which we maintained, to varying degrees, as the year progressed). Still, investors remained uneasy about continuing macroeconomic risks, suggesting the potential for a sharp market decline. This, we believed, was a perfect environment for taking a modest position in put options. Such a strategy would help counterbalance our tilt toward equities with some protection against the downside.

In other words, integrated risk management requires being open to multiple signals and avoiding obvious conclusions. And it’s good to avoid that “pound of cure” if you can do it.

For a more detailed discussion, see our article on risk management in the September 2013 article in The CPA Journal.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.