The Wall Street Journal published an article on January 7 challenging the safety of municipal bonds as “not [being] the reliable bet they once were.” While its headline may startle some investors, we’ve been endorsing this view for years. Municipal bonds simply aren’t a set-it-and-forget-it choice.

But that doesn’t mean we reject the notion of investing in municipal bonds as a core strategy for investors. In fact, we’ve adapted to and embraced the new municipal investment environment. Here’s why—and how—we do it.

The Market Has Evolved

It’s true. The muni market doesn’t look like it did before the global financial crisis of 2008. That crisis, when munis suffered alongside riskier markets, was the catalyst for a transformative period for an asset class that had seen little change for decades.

John Coumarianos, the author of the Journal article, spent some time discussing “high-profile distress and bankruptcy.” This is one small area where we take issue with the author while agreeing in principle on most of his other points. But it’s important, because default fears tend to loom large, while as always, default risk in the municipal market remains remote.

Only a tiny portion of the muni universe has defaulted in the 10 years since the financial crisis. The primary credit risks in the muni market remain upgrades and downgrades, not defaults. Upgrades and downgrades occur with far greater frequency than defaults.

But the municipal market has changed since 2008, and dramatically so:

Bond insurance. Thanks to muni bond insurers becoming entangled with the subprime mortgage crisis, municipal bond insurance has collapsed. In 2007, 46.8% of municipal bonds issued came with insurance. By 2017, that figure had dropped to 5.3%.

Credit quality. The demise of bond insurance exposed the underlying quality of issuers. In 2007, 69% of bonds were rated AAA. In 2017, roughly 14% of the market was AAA-rated. The net result was the creation of a municipal credit market, with commensurate risks and opportunities.

Investing challenges. Net municipal issuance has been flat since the financial crisis, as municipalities have chosen an austere path. Also, in light of regulatory changes, primary dealers are not stocking bonds on balance sheets as they once did. In 2007, dealer inventories were $50 billion. This had dropped to $14 billion by 2016.

Transaction costs. Pre-crisis costs on a purchase of $25,000 to $100,000 would have run 1.2%. We estimate that the same purchase today would cost as much as 1.6%. This is a significant penalty for individual municipal bond purchases. Further changes are afoot later this year for disclosure rules.

The capital markets, including the municipal market, are dynamic and continue to evolve. Your manager should be dynamic and evolving too. And that means being active.

Be an Active Muni Investor

There’s no question, then, that municipal market risks have increased over the past decade. What’s more, municipal market risks aren’t static. This means that they must be actively managed, not left to the vagaries of a passive ladder.

But risks aren’t the only problem with passive muni ladders.

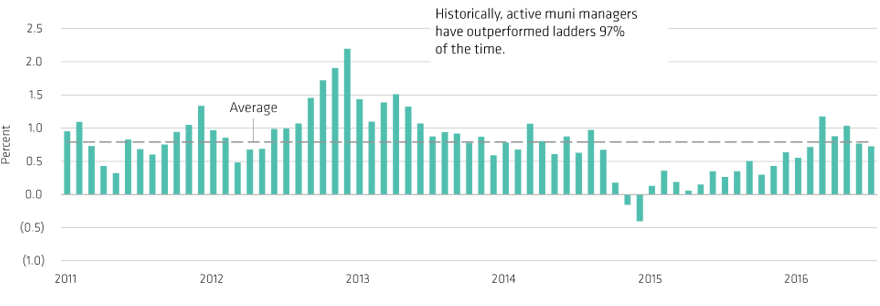

Year after year, passive muni investors lose out on yield and return. Since 2009, the average active municipal bond manager has outperformed passively managed municipal ladders (Display) in an astounding 97% of two-year rolling periods—and by an average of nearly 80 basis points.