The Utility Benefit: Can’t Live Without It

What’s been supporting the sector in such a challenging environment? Much stems from tech’s new role as a utility—something consumers and businesses simply can’t live without. Many people switch on their smartphones first thing in the morning and shut them off just before going to sleep. Broadband, mobility, internet deliveries and streaming video are now essential services. These necessities have become even greater as the pandemic increased the need for remote shopping, learning and working.

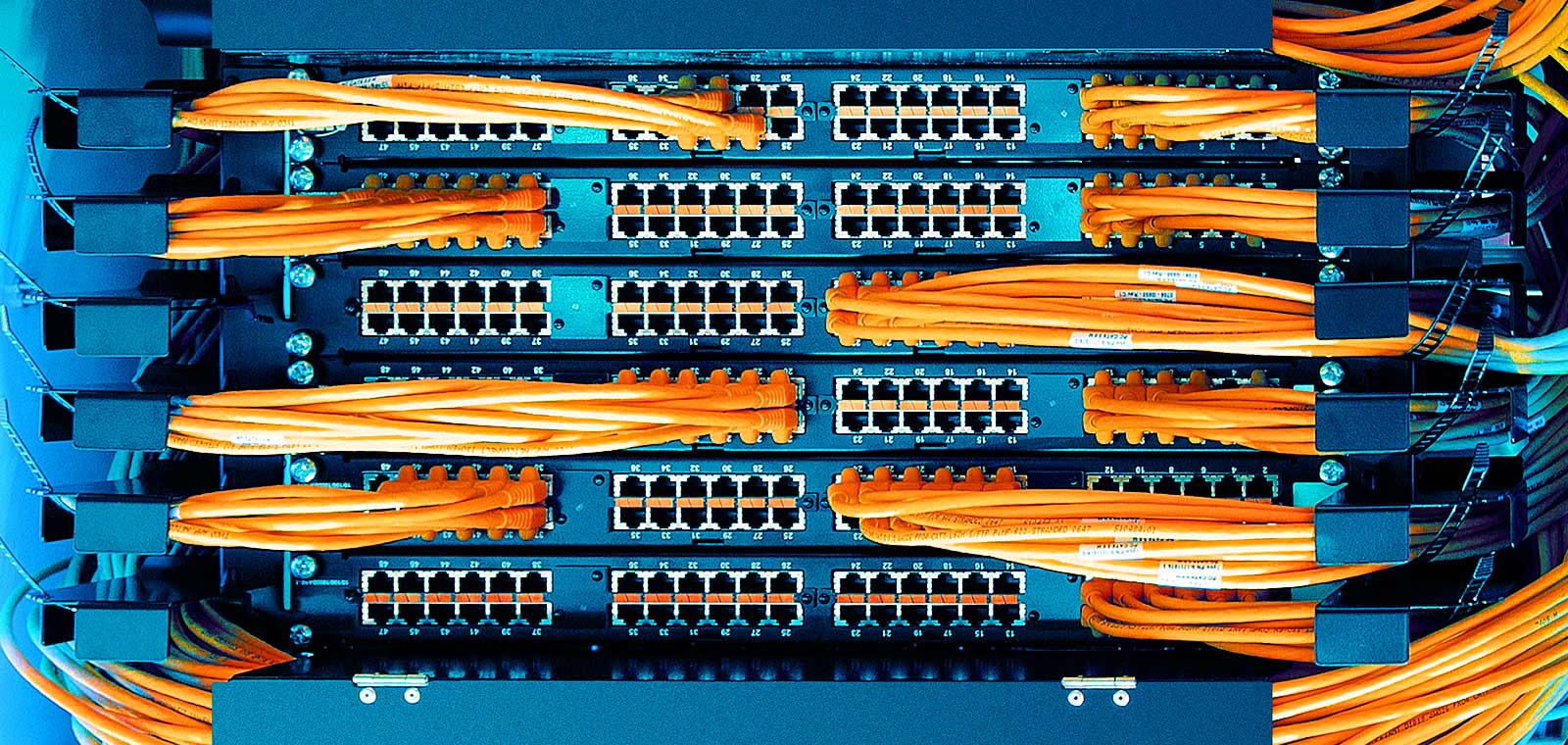

For companies and other enterprises, technology is more indispensable than ever. Without a robust digital infrastructure, companies can’t operate efficiently in work-from-home mode and students won’t have access to online classes. Government and healthcare organizations rely on technology platforms to mass communicate time-sensitive information to the public. Employees and customers expect airtight cybersecurity. Invoicing and payment systems must function seamlessly in a world of remote business operations.

Reliability Supports Sustainable Growth

Today, people expect technology to deliver the same reliability as a water supplier or power generator. Expectations of operational stability underpin recurring revenue streams that help support returns in tough market conditions. These are the same dynamics that utility stocks have provided for investors through thick and thin.

At the same time, since many uses of technology are new, investors can benefit from sustainable growth trends, too. However, not all tech companies are alike. So to capture long-term return potential in the sector, investors should look for companies that are enabling the tech revolution or empowering the digital transformation, in areas such as:

- Cloud infrastructure: With companies in remote working mode and increased demand for services from distance learning to telemedicine, cloud computing has become an even more crucial infrastructure component. Companies that keep the cloud functioning smoothly or provide innovative cloud-based applications are well positioned for the evolving environment. Examples include Twilio, a cloud-based communication platform software provider that helps companies improve digital customer engagement, and Ciena, an optical system provider that helps provide critical elements for the upcoming 5G network build-out and improves connectivity and speed for data centers.

- Automation technologies: With global supply chains being redesigned and companies considering “reshoring” capacities back to developed markets, automation technologies will be essential. Companies need more automation to support efficient and reliable production capacity and to provide more flexibility in their cost structure. The Internet of Things will become a key feature for automation as 5G networks expand. In addition to unmanned factories and warehouses, we will also see more human–robot collaboration, powered by companies with enabling technologies such as Keyence, Teradyne and IPG Photonics.

- Payment systems: In a world of social distancing, cash is no longer king. Companies like PayPal and Adyen, for example, will be at the center of a surge in e-commerce and the increasing use of contactless payment systems—even in physical stores.

Of course, technological transformation in these areas was underway well before the current crisis. But the coronavirus has accelerated changes that should prompt higher demand for many products and services across the sector. Innovative companies driving these changes—which are often not included in the benchmark—should enjoy pricing power, even in harsh macroeconomic conditions, in our view.

Innovation Leaders Provide Stability and Growth

Tech leaders like these are not necessarily cheap. Global technology stocks trade at a price/forward earnings ratio of 21.9x, a 26% premium to the MSCI ACWI’s 17.3x. Yet we believe it’s worth paying more for select companies that offer innovative technologies to foster sustainable growth, especially in today’s low-growth environment and amid significant uncertainty about the path to recovery.

Investing in technology requires specialized skills. As technological innovation lowers entry barriers and the pace of disruption accelerates, investors need a deep understanding of transformative trends to select winners. Investors who jump on the tech bandwagon because of recent performance might not have the expertise to distinguish pioneers with durable business models from companies riding on near-term euphoria.

Discovering tech stocks for a post-coronavirus world requires a strategic focus on the evolving business dynamics that are fueling demand for the services of tomorrow. With the right approach, investors can find tech companies that resemble defensive utilities—which supports returns in down markets—but are also rooted in innovation to drive growth for better times ahead.