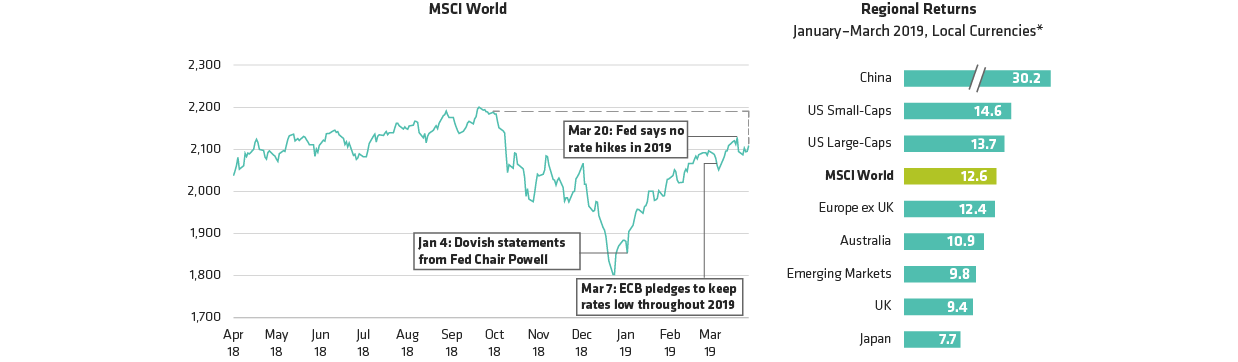

Earnings Outlook Weakens

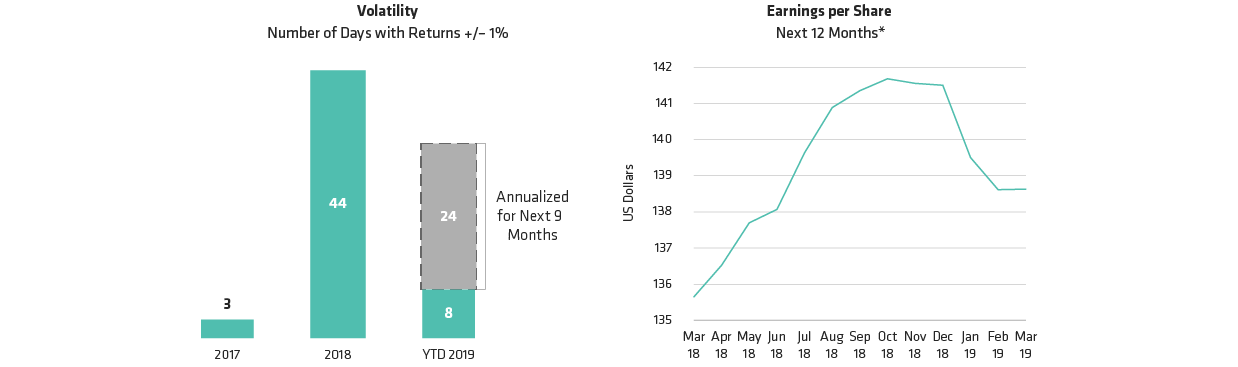

During most of the first quarter, investors shrugged off the risks. In fact, even as stocks moved up, the earnings outlook has weakened (Display above, right) and earnings revisions moved down across all regions and most sectors. At the beginning of the year, global earnings were expected to advance by 7.2% in 2019, according to consensus estimates. By quarter end, that forecast had fallen to 5.6%.

Weakening earnings are adding to signals that the end of the macroeconomic cycle may be near. Perhaps, after a decade of steady GDP growth following the global financial crisis, a slowdown or recession is imminent. Key indicators of global growth such as the Purchasing Managers’ Index and industrial production have been weakening in both developed and emerging markets.

However, our outlook is somewhat more optimistic than the consensus opinion. While a mild downturn is possible, we see a more likely case that economic growth in the US slows but stays positive—potentially for several more years—given benign Fed policy; strong trends in employment, wages, and consumer balance sheets; and the absence of meaningful late-cycle buildups in the industrial economy. We also expect Europe will avoid a recession.

We’re actively monitoring for the buildup of excesses that typically precede a crisis, such as during the technology bubble or the US housing boom. These types of imbalances would trigger a nasty correction in markets and economies, but we are not seeing any danger signs at this point.

Broadening Perspectives on Risk

But other dangers are real and require fresh thinking about risk. These policy-related risks include Brexit, China’s economy, trade wars, global debt and the expanding US deficit. Questions like these are particularly difficult to address with a traditional equity investor’s toolbox. Policy decisions may not be driven by rational profit maximization, and outcomes can be extreme and binary.

In these conditions, we think it’s important for investors to broaden perspectives on identifying risks in portfolios. Many traditional risk frameworks focus on sectors, countries and factors. But when the economic cycle isn’t the primary driver of risk, those lenses could miss evolving themes. Stepping back from the rigidity of standard toolsets can help investors identify new patterns of correlations. For example, cluster risk analysis is an unsupervised machine-learning technique that can help investors identify clusters of stocks whose returns have been moving more closely together and, therefore, could be vulnerable to similar risks.

In 2017, cluster analysis results showed us that Chinese stocks mainly moved as a group of clusters, quite separate from other regions. However, through 2018, as tariffs were announced, we saw a shift. A group of Chinese stocks, which contained consumer discretionary, internet marketplaces and technology, started moving more closely with stocks of companies that faced risks from tariffs such as US energy companies and several global metal and mining companies (the US energy sector relies on steel and aluminum for many projects).

Traditional risk models relying on historical correlations between countries and sectors could not have seen these patterns. Understanding a portfolio’s exposure to this new group can allow more informed decisions about the potential intended or unintended risks to trade-war fallout.

Positioning in Zigzag Markets

So what can investors conclude from the zigzag markets of the last six months? First, continue to focus on long-term company fundamentals without being distracted by short-term market noise; selling out of solid stocks during the downturn would have been a losing strategy. Second, broaden your perspectives on assessing risk, given the persistence of unpredictable policy risk. Third, take a balanced position in an equity allocation that includes some safe assets, which will provide protection if volatility spikes, as well as exposure to higher-risk assets, such as value stocks, which have been beaten down. In a slower-growth world with heightened volatility, this type of diversification can help investors enjoy smoother return patterns through bouts of turbulence.

Recent market trends suggest that global equities might continue to rise for longer than investors had expected at the end of last year, so it’s important to stay invested. But persistent volatility and current valuations mean that investors should temper expectations of long-term returns.