-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Chinese Stocks Poised for Bigger Role on Global Market Stage

18 November 2019

2 min read

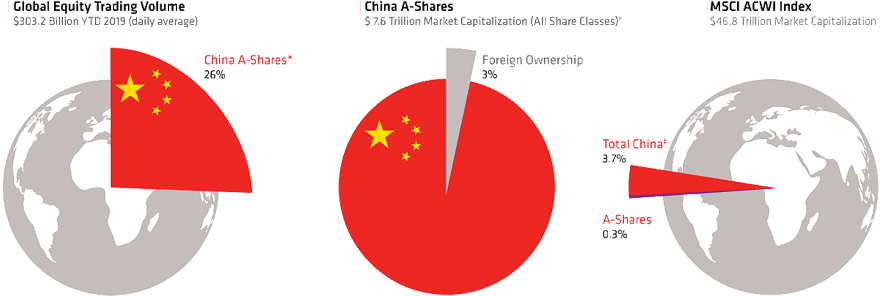

Chinese Equities Are Underrepresented in Global Indices

*Based on the volume of A-shares traded in the Shanghai and Shenzhen stock exchanges divided by the volume of global equities traded in 2019 through 30 September

†Includes shares of state-owned enterprises that are not freely floated

‡Includes offshore shares traded in Hong Kong and American depositary receipts traded int he US.

Historical and current analyses do not guarantee future results.

Global equity trading as per 30 September 2019, MSCI ACWI Index composition as per October 2019, Foreign ownership of China A-shares as per March 2019.

Source: Bloomberg, Goldman Sachs, MSCI and AB.

About the Authors