-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Why Banking Regulation Is Still a Game-Changer for European Financials

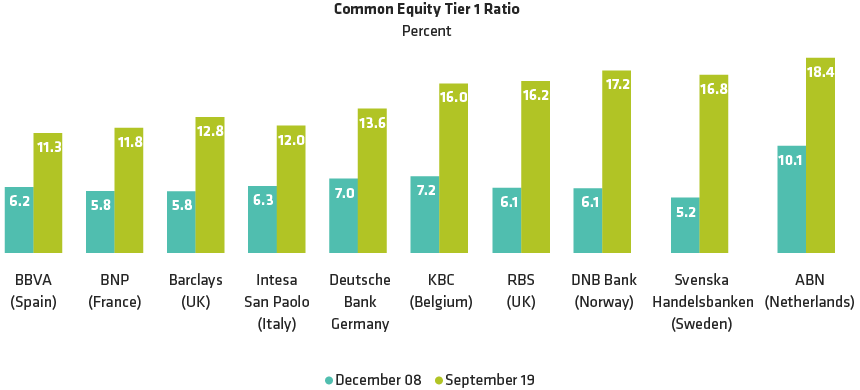

Higher Capital Ratios Provide More of a Cushion for Bondholders

As of 31 December 2019

Analysis provided for illustrative purposes only and is subject to revision. Historical analysis does not guarantee future results.

For Group 1 Banks. As defined by the European Banking Authority, Group 1 banks are those that have Tier 1 Capital in excess of €3 billion and are internationally active.

Source: ECB and AllianceBernstein (AB)

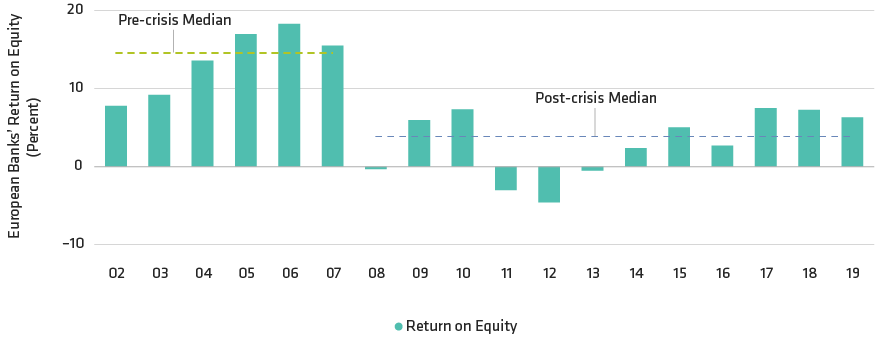

The New Normal Is Painful for Most Equity Holders

As of 31 December 2019

Analysis provided for illustrative purposes only. Historical analysis does not guarantee future results.

Based on SX7E Euro Bank Stoxx

Source: Bloomberg and AB

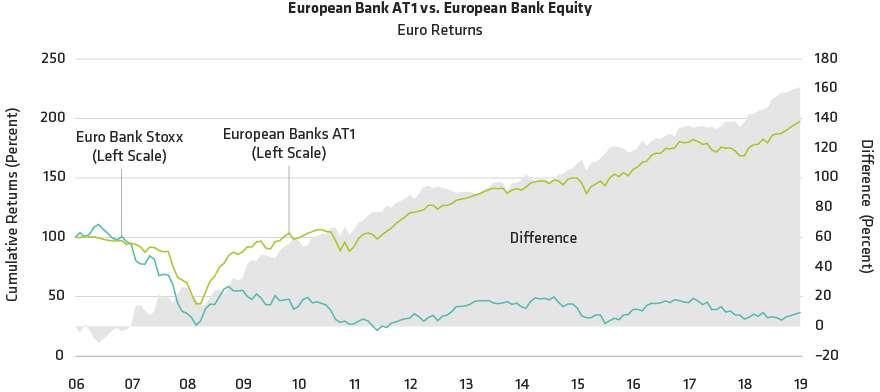

Post-Crisis, Bank Equities Languish While AT1 Soars

Through 31 December 2019

Analysis provided for illustrative purposes only. Historical analysis does not guarantee future results.

Based on SX7E Euro Bank Stoxx and Bloomberg Barclays European Banks AT1 benchmark since 30 May 2014 and the Bloomberg Barclays Global Capital Securities before that (both indices are euro-hedged)

Source: Bloomberg Barclays and AB

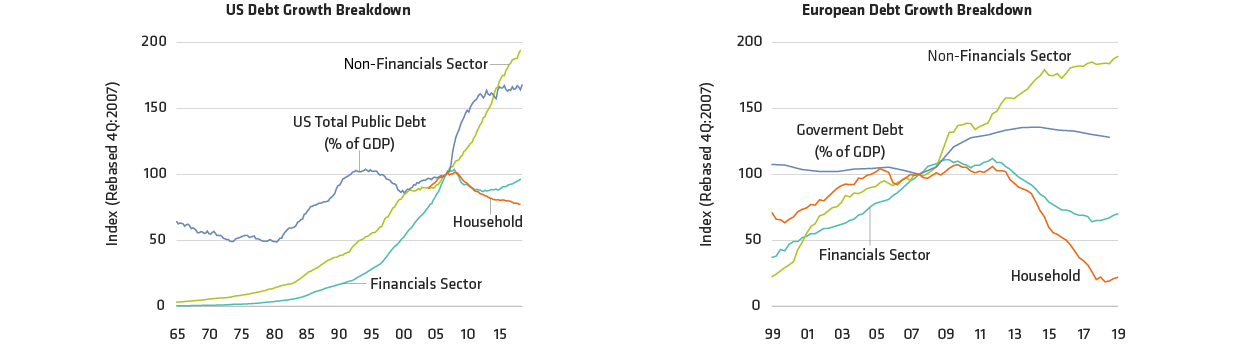

Over-Leveraged Non-Financials (And Some Sovereigns) May Present the Bigger Risk

Through 30 September 2019

Analysis provided for illustrative purposes only and is subject to revision. Historical analysis does not guarantee future results.

Source: ECB and Federal Reserve Bank of St. Louis