Comparison Shopping with Cash Alternatives in Rocky Markets

8 min read

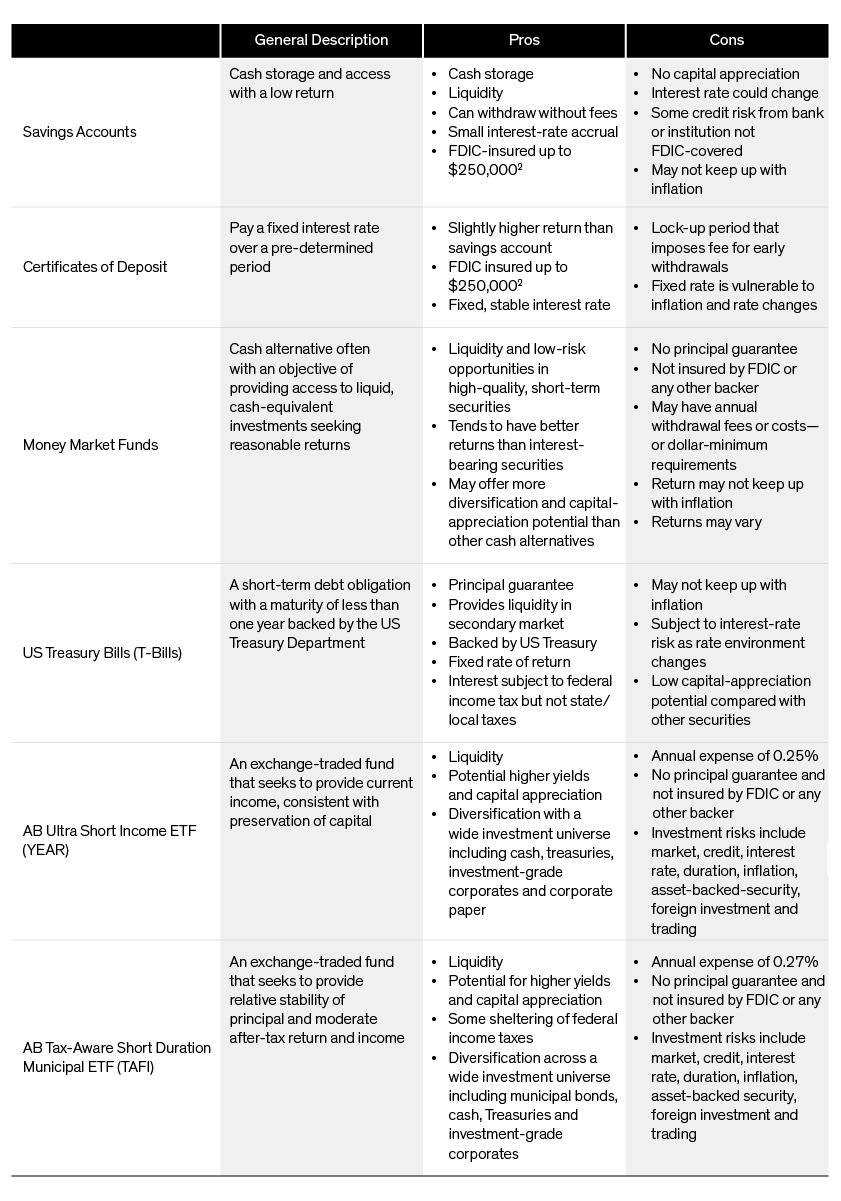

With equity markets remaining rocky in 2023, investors have sought refuge and higher-yielding alternatives to cash. There are many options beyond the ETF world, including savings accounts, certificates of deposit (CDs), money-market funds and Treasuries. When evaluating the choices against actively managed bond ETFs, investors should consider key differences—from risks to fees and investment objectives.

The Playing Field: Cash Alternatives

Savings Accounts can provide storage for cash and a small amount of interest during the year. Investors can withdraw and deposit money when they want, typically with no fees. Depending on the institution, the FDIC insures savings accounts up to $250,000. Savings accounts bring some credit risk from the bank or institution that backs it, and there’s no chance of capital appreciation.

Certificates of Deposit (CDs) are lump-sum investments that generally pay a fixed interest rate over a predetermined time period. When a CD reaches maturity, the original principal is returned along with interest earned. CDs held at certain institutions are FDIC-insured up to $250,000. Investors who withdraw money before the maturity may face a fee. If rates rise, investors may end up stuck in a lower-rate CD for a while.

Money Market Funds are mutual funds offered by an investment company that offer modest interest coupons. They are popular alternatives to holding cash in an investment account. Money-market funds don’t guarantee principal—and, unlike money-market accounts, aren’t FDIC-insured. Interest resets daily and doesn’t benefit from a falling-rate environment.

US Treasury Bills (T-Bills) are fixed-income securities that guarantee investors principal and pay an interest coupon set over a certain time period. Backed by the US Treasury, T-bills are generally considered safe and offer robust liquidity in the secondary market. They can lose value if rates rise before they mature, and offer little capital appreciation potential. Also, building and managing Treasury ladders requires substantial and ongoing operational effort.

Bond ETFs can offer liquidity, attractive yields and potential capital appreciation at a low cost. In volatile times, actively managed ETFs have the flexibility to adjust their underlying holdings in an attempt to capitalize on a changing bond-market landscape. When looking for alternatives to cash, investors may want to consider active short-duration bond ETFs.

Cash Alternatives: Evaluating The Pros and Cons

For a prospectus containing more information, click here for YEAR and click here for TAFI.

Sheltering from Volatility: How AB’s Active ETFs May Help

For investors seeking to explore how ETFs might align with their volatility-management objectives and portfolio design, AllianceBernstein offers two actively managed short duration ETFs—AB Ultra Short Income ETF (ticker: YEAR) and AB Tax-Aware Short Duration Municipal ETF (ticker: TAFI). Both expertly managed solutions provide exposure to various short-duration investments.

1 Broadridge, Morningstar data as of January 2023

2 FDIC = Federal Deposit Insurance Corporation. Savings Accounts and Certificates of Deposits at certain institutions are not covered by FDIC insurance.

Sign Up

AB ETFs. On Active Duty.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

For the most current SEC standardized performance, click here for YEAR and click here for TAFI.

Investing in ETFs involves risks, including loss of principal.

Only authorized participants (“APs”) may engage in creation or redemption transactions directly with an ETF. The ETFs have a limited number of institutions that may act as APs and such APs have no obligation to submit creation or redemption orders. Consequently, there is no assurance that APs will establish or maintain an active trading market for the shares of the ETFs. This may have an impact on the liquidity of the ETFs.

TAFI—Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio, such as credit, prepayment, call and interest-rate risk. As interest rates rise, the value of bond prices will decline. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (aka “junk bonds”) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally, and may be more difficult to trade than other types of securities. Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities or the rights of investors in these securities may negatively impact the yield or value of a municipal security. Tax Risk: The US government and Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income shareholders receive from the Fund by increasing taxes on that income. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

YEAR—Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear two layers of asset-based expenses, which could reduce returns. Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value. Interest-Rate Risk: As interest rates rise, bond prices fall and vice versa; long-term securities tend to rise and fall more than short-term securities. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets. Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage transactions such as reverser purchase agreements magnifies both gains and losses, resulting in greater volatility. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only. Foreside is not affiliated with AllianceBernstein.