AB’s Low-Volatility ETFs: Defense and Discipline in Unfriendly Markets

Key Takeaways

- Global trade disputes are stark reminders that equity portfolios must be designed with resilience.

- Strategies seeking to reduce losses in downturns may outperform over time by emphasizing quality, stability and price.

- The AB International Low Volatility Equity ETF (NYSE: ILOW) and AB US Low Volatility Equity ETF (NYSE: LOWV) could help investors weather unruly markets.

The Tariff Test: A Reminder of the Need for Defense

This year’s tariff turmoil has tested investors, but cutting equity exposure and trying to time re-entry can lead to painful missteps— April’s selloff and rebound is a case in point. We believe it’s better to lean on an equity strategy that aims to reduce losses in selloffs and capture most of the gains in rebounds.

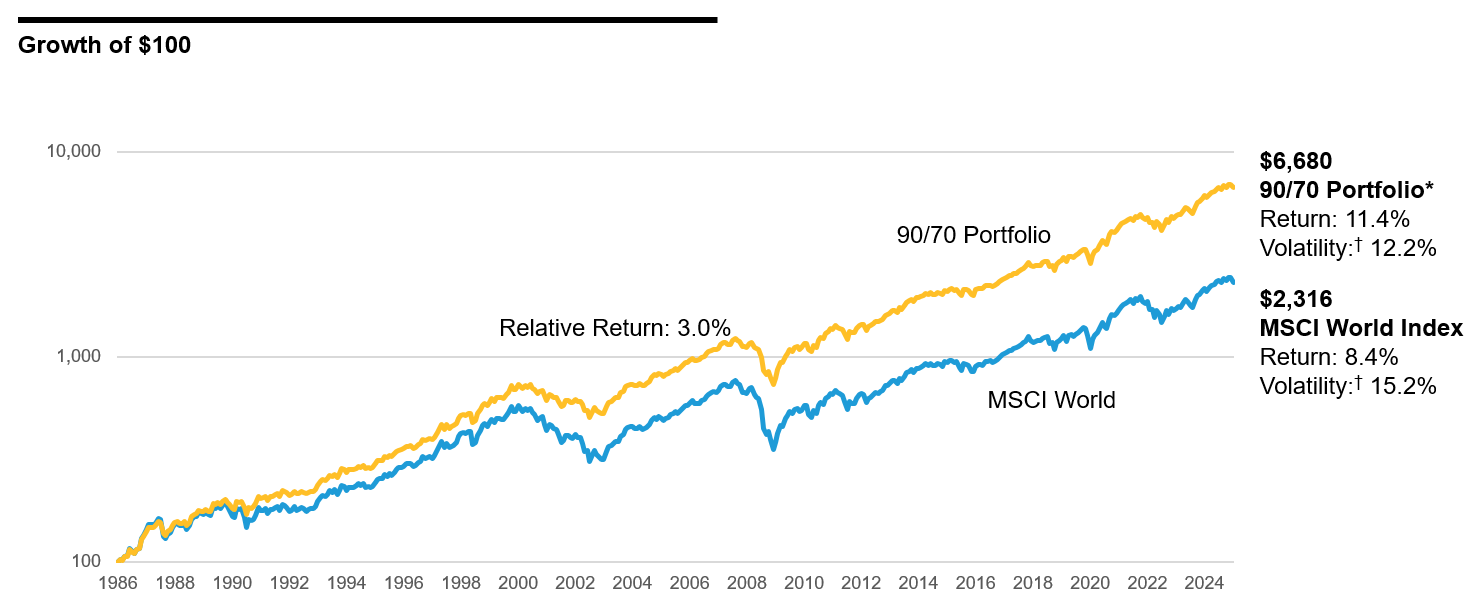

Our research suggests that a strategy seeking to capture 90% of market gains but only 70% of losses can outpace the broad market (Display). That’s the approach of the AB International Low Volatility Equity ETF (NYSE: ILOW) and AB US Low Volatility Equity ETF (NYSE: LOWV).

Can Investors Reduce Losses in Downturns and Still Beat the Market?

Past performance does not guarantee future results. Returns shown are for illustrative purposes only and are not representative of any AB fund. It is not possible to invest in an index.

*Performance calculated by multiplying all positive monthly returns (0% or greater) of the MSCI World Index by 90% and all negative returns (less than 0%) by 70%; shown in logarithmic scale

†Annualized standard deviation

Data from March 31, 1986 (inception date of MSCI World Index) through March 31, 2025

As of March 31, 2025

Source: MSCI and AllianceBernstein (AB)

Zeroing In on Fundamentals—Even Amid Tariff Turbulence

Even in unsettled environments, fundamentals are the bedrock of risk-aware equity investing. That means identifying stocks with sound pillars. High-quality businesses have consistent cashflows1 and profitability measures, such as return on invested capital2. Stable businesses tend to generate returns that vary less than the market. And attractive pricing may make them less susceptible to wide market swings.

These combined pillars of quality, stability and price (we call it QSP), are key to low volatility investing. As for gauging the impact of tariffs on companies, we believe a three-part approach makes sense:

- Estimate the exposure of revenues and inputs to diverse types of tariffs.

- Evaluate the direct impact of tariffs on profitability, which often depends on pricing power.

- Consider the indirect impact, such as the effects of economic cycles or higher inflation.

Our strategy is naturally less exposed to tariff-vulnerable firms—underweight goods and overweight services in sectors such as consumer discretionary and industrials, because services are more insulated from tariffs. In tech, we’re overweight software companies, which are less vulnerable and offer AI innovation, but underweight more-vulnerable semiconductor and hardware firms. Regional diversification is key, too: US firms are still relatively pricey and more tariff-vulnerable than European and Asian firms.

New Challenge but Timeless Principles

We believe shares of QSP stocks are a solid defensive foundation, in our view. An era of mega-cap dominance hurt many investors who focused on attractive stocks aligned with their philosophies. But 2025’s mega-cap stumble could mean that market returns are broadening—and it highlights the risk of crowded trades.

If investors understand how to cushion portfolios against volatility, they can stay confident in a core strategic allocation to equities even through tumultuous times, staying on course for their long-term goals. AB has applied this approach for over a decade, and the lessons are just as relevant today:

- Cast a wider net for durable business models.

- Be dynamic on offense and defense.

- Position for today’s risks and opportunities.

ILOW and LOWV: Helping with Defense When Markets Misbehave

Investors looking for a defensive equity approach in these uneasy times should explore the AB International Low Volatility Equity ETF (NYSE: ILOW) for exposure to non-US stocks and the AB US Low Volatility Equity ETF (NYSE: LOWV) for exposure to US stocks.

These actively managed, high-conviction portfolios of primarily large-cap equity companies are selected by focusing on QSP characteristics. ILOW seeks a similar performance pattern versus the MSCI EAFE3, while LOWV seeks capital appreciation with an emphasis on lower volatility than the S&P 500.

If you’re an investor seeking trading guidance, the AB ETF Capital Markets team offers complementary trade advisory services. Reach us at etf.capitalmarkets@alliancebernstein.com, and find out more about AB’s actively managed ETFs here.

How to Take Action

1 Cash flow refers to the movement of money in and out of a business over a specific period.

2 Return on invested capital is a number that indicates how well a company is spending its capital on profitable projects or investments.

3 MSCI EAFE stands for Morgan Stanley & Capital International Europe, Australasia, and Far East.

Risks To Consider

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Derivatives Risk: Derivatives may be difficult to price or unwind and may be leveraged so that small changes may produce disproportionate losses for the Fund.

Equity Securities Risk: The Fund invests in publicly traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased.

Foreign (Non-U.S.) Investment Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory, or other factors.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value.

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

AB funds may be offered only to persons in the United States and by way of a prospectus. This website should not be considered a solicitation or offering of any investment products or services to investors residing outside of the United States.

Investment Products Offered:

Are not FDIC Insured | May Lose Value | Are Not Bank Guaranteed

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

© 2025 AllianceBernstein L.P.