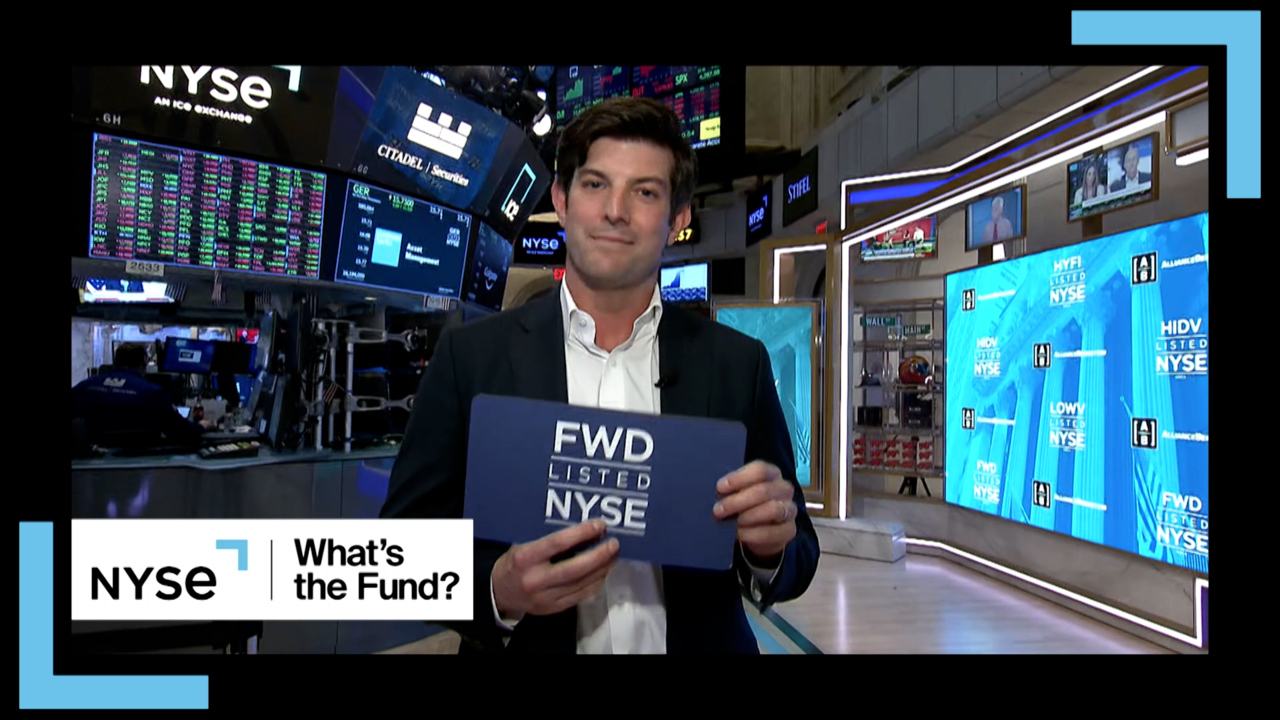

Equity

Overview

An actively managed strategy that takes a thematic approach to identify disruptive leaders across sectors and geographies and seeks long-term growth of capital

About this Fund

- Seeks to outperform global growth equity markets by investing in innovative market leaders who are poised to disrupt their respective industries

- Combines top-down thematic research with rigorous, bottom-up fundamental analysis and a robust risk-management process

Investment Approach

- Normally holds 80–100 stocks that are aligned with long-term secular growth trends

- Selects companies at the rapid adoption phase of the S-curve in an effort to provide access to durable high-growth opportunities, with proven business models and a clear path to potential profitability

Why Invest in the AB Disruptors ETF?

- Harness the Growth of Industry Disruptors

FWD provides exposure to companies at the forefront of innovation—including artificial intelligence, cloud computing, fintech, clean technology and digital commerce—positioned to reshape industries and deliver powerful earnings growth. - Diversify Beyond Traditional Benchmarks

By targeting innovators often underrepresented in broad-market indexes, FWD seeks to complement traditional equity holdings and offer differentiated sources of return with lower correlation to core exposures. - Stay Ahead with Active Management

Disruption evolves too quickly for passive approaches. FWD combines thematic research with rigorous fundamental analysis to identify emerging leaders early, avoid outdated business models and actively manage innovation risk. - Capture Innovation While Managing Risk

Through disciplined valuation, thoughtful position sizing and active oversight, FWD aims to capture innovation-driven upside while controlling volatility and potential downside.

Meet the Team

Additional Information

Frequently Asked Questions:

Risks To Consider

-

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

-

Active Trading Risk: The Fund expects to engage in active and frequent trading, which will increase the portfolio turnover rate. A higher portfolio turnover increases transaction costs and may negatively affect the Fund’s return.

-

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

-

Emerging Market Risk: Investments in emerging market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory, or other uncertainties.

-

Equity Securities Risk: The Fund invests in publicly-traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased. These fluctuations can be based on a variety of factors including a company’s financial condition as well as macro-economic factors such as interest rates, inflation rates, global market conditions, and non-economic factors such as market perceptions and social or political events.

-

Foreign (Non-U.S.) Investment Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory, or other factors.

-

Global Risk: The Fund invests in companies in multiple countries. These companies may experience differing outcomes with respect to safety and security, economic uncertainties, natural and environmental conditions, health conditions, and/or systemic market dislocations. The global interconnectivity of industries and companies, especially with respect to goods, can be negatively impacted by events occurring beyond a company’s principal geographic location, which can contribute to volatility, valuation, and liquidity issues.

-

Non-Diversification Risk: The Fund is a "non-diversified" investment company, which means that the Fund may invest a larger portion of its assets in fewer companies than a diversified investment company. This increases the risks of investing in the Fund since the performance of each stock has a greater impact on the Fund's performance. To the extent that the Fund invests a relatively high percentage of its assets in securities of a limited number of companies, the Fund may also be more susceptible than a diversified investment company to any single economic, political or regulatory occurrence.

-

Sector Risk: The Fund may have more risk because it may invest to a significant extent in one or more particular market sectors, such as the information technology sector. To the extent it does so, market or economic factors affecting the relevant sector(s) could have a major effect on the value of the Fund’s investments.

-

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

-

*For Best New Active ETF, it was Awarded to an ETF recently launched in 2023 that has demonstrated exceptional expertise and success managing investments with an active, hands-on approach, including a clear and well-defined strategy that differentiates it from passive index-based ETFs. etf.com Award winners are selected in a three-part process designed to leverage the insights and opinions of leaders throughout the ETF industry. Step 1 - The awards process begins with open nominations, which will commence on December 1, 2023, and close on January 8, 2024. Interested parties are invited to submit nominations via the publicly available submission form. Self-nominations are accepted. A single fund/issuer can be nominated for multiple awards as long as it meets the criteria of the category. All entries related to funds are strictly for U.S.-listed ETFs. Step 2 - Following the open nominations process, the etf.com Awards Nominating Committee, made up of etf.com editorial staff, will review nominations. Nominations are screened for eligibility (appropriate timing and category). If more than five unique entries are received in the nomination process, the members of the Nominating Committee will force-rank their top five, resulting in a final slate for each category. Votes will be resolved on a majority basis, and ties broken where possible with head-to-head runoff votes. If ties cannot be broken, more than five finalists are allowed. The Nominating Committee will complete this process and short list of nominees will be published on etf.com January 29, 2024. Step 3 - Winners among these finalists will be selected by a majority vote of the etf.com Award panel of judges, a group of independent ETF experts from the ETF industry. Judges will recuse themselves from voting in any category in which they or their firms appear as finalists. Ties will be decided where possible with head-to-head runoff votes. Voting will be complete by March 1, 2024. Results will be kept confidential until they are announced at the etf.com Awards ceremony on April 17, 2024, and published on etf.com.

-

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

-

AB funds may be offered only to persons in the United States and by way of a prospectus. This website should not be considered a solicitation or offering of any investment products or services to investors residing outside of the United States.

Investment Products Offered:

Are not FDIC Insured | May Lose Value | Are Not Bank Guaranteed

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.