Equity

Overview

An actively managed portfolio of primarily US large-cap equity companies that seeks long-term growth of capital

About this Fund

- The portfolio is an actively managed, high-conviction, core equity portfolio designed to outperform the S&P 500 over time, while emphasizing risk mitigation and seeking to capture most of the upside in rising markets

- It invests in stocks of quality companies that have stable performance patterns and that trade at attractive prices

Investment Approach

- Holds approximately 60–80 stocks with balanced exposure to quality, stability and reasonable price

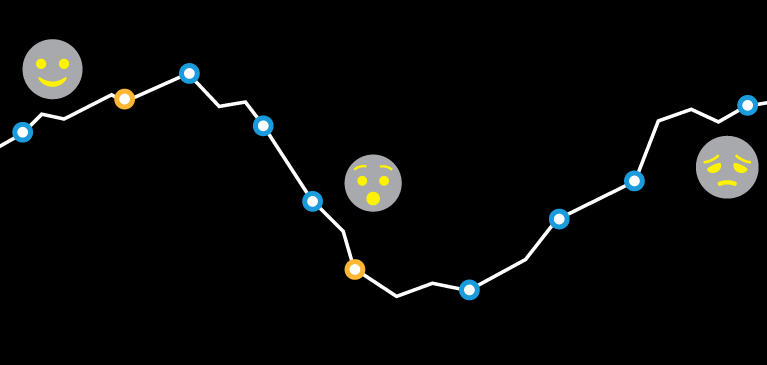

- Target upside and downside capture of 90%/70%

Why Invest in the AB US Low Volatility ETF?

- Attractive Growth Potential

LOWV is an actively managed core equity portfolio that seeks to outperform the market with lower volatility. - Focus on QSP

We believe an effective defensive strategy should be grounded in company fundamentals and focused on firms that exhibit characteristics of quality (consistent cash flows and measures of profitability like return on invested capital), stability (low volatility of returns relative to the market) and attractive pricing that make them less susceptible to wide market swings (QSP). - Better Outcome

By focusing on the fundamental drivers of high-quality, resilient business models at attractive prices, our US low-volatility ETF allows investors to participate in rising markets (upside capture of 90%) and mitigate risk (downside capture of 70%) when markets are declining, enabling investors to stay in the market through challenging conditions. - Access the Active Advantage

While traditional passive approaches to low volatility tend to focus on individual equities with low standard deviation, which can sacrifice high-growth names, the active approach to targeting lower down capture with relatively higher up capture can provide more of a core exposure with the benefits of lower volatility. - High-Conviction Stock Selection

Integrated use of both quantitative and fundamental research in making investment decisions allows us to build a high-conviction, core equity portfolio for this US equity low-volatility ETF. - Experienced Team

With over a decade of live track record, our investment team members use their judgment and experience to correct for biases and unintended risks, supporting the stability of our US low-volatility ETF. We have successfully navigated turbulent market conditions since the launch of our platform in September 2011. - Uncorrelated Source of Return

Our active core equity portfolio with lower volatility, the AB US Low Volatility ETF, can be used diversify the equity bucket or to complement existing defensive strategies in other asset classes.

Meet the Team

Additional Information

Frequently Asked Questions:

Risks To Consider

-

There is no guarantee the fund will meet its investment objectives.

-

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

-

Equity Securities Risk: The Fund invests in publicly-traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased. These fluctuations can be based on a variety of factors including a company’s financial condition as well as macro-economic factors such as interest rates, inflation rates, global market conditions, and non-economic factors such as market perceptions and social or political events.

-

Foreign (Non-U.S.) Investment Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory, or other factors.

-

Non-Diversification Risk: The Fund is a "non-diversified" investment company, which means that the Fund may invest a larger portion of its assets in fewer companies than a diversified investment company. This increases the risks of investing in the Fund since the performance of each stock has a greater impact on the Fund's performance. To the extent that the Fund invests a relatively high percentage of its assets in securities of a limited number of companies, the Fund may also be more susceptible than a diversified investment company to any single economic, political or regulatory occurrence.

-

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

-

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

-

AB funds may be offered only to persons in the United States and by way of a prospectus. This website should not be considered a solicitation or offering of any investment products or services to investors residing outside of the United States.

Investment Products Offered:

Are not FDIC Insured | May Lose Value | Are Not Bank Guaranteed

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.