Tax-Advantaged Solutions

Help Unlock Tax Efficiency...and More

Time to Spend on Your Clients

Tax-loss harvesting shouldn’t be based on a calendar. It takes a year-round effort to optimize portfolios and enhance after-tax returns, but time is in short supply for advisors with thriving practices. That’s where AB’s tech-empowered approach comes in. We manage tax-advantaged separate account solutions to help your clients keep more of what they earn. And to free up time on your own calendar.

Why Tax Management Matters

Managing the impact of taxes smartly—and systematically—can make a big difference

in your accumulated wealth over time. That opens a lot of possibilities.

On a $1,000,000 initial investment, a tax drag of 1% over 10 years could cost about $325,000 in wealth. On the other hand, tax savings of 1% could yield an extra $355,000 or so. That gap of nearly $700,000 could fund a wealth of possibilities: Giving heirs a head start. Opening a small business. Traveling the world. Supporting a favorite charity.

Being Smart with Taxes Opens Up Possibilities

For illustrative purposes only. There can be no assurance that any investment objectives will be achieved.

1% Tax Advantaged assumes 1% of incremental return annually. Passive is the S&P 500. 1% Tax Drag assumes 1% return loss annually due to taxes. January 2015-December 2024 (USD).

Explore Tax-Advantaged Solutions

-

Direct Index SMAs

-

Active Equity SMAs

- Direct Index SMAs

- Active Equity SMAs

Implement Tax Advantaged Solutions with Direct Indexing

Direct indexing is an equity strategy enabling investors to own individual stocks that seek to replicate the pre-tax performance of an index with potential for enhanced after-tax returns. This approach provides flexibility to customize portfolios and efficiently manage taxes. With AB’s Tax-Advantaged solutions, investors can access tailored portfolios with effortless tax management across an entire account, helping to maximize their benefits.

Explore the Next Generation of Balanced Investing

It’s what your clients keep after taxes that really matters. Learn how our systematic tax management in both stock and bond allocations—with intelligent rebalancing—has the potential to drive substantial after-tax benefits for high-net-worth investors.

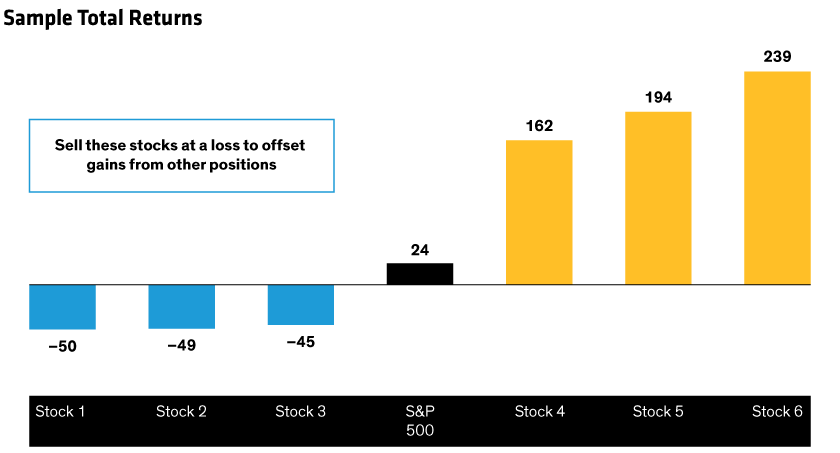

An Active Approach to Harvest Losses Over Time

As individual stocks suffer losses during the year, AB can sell them and harvest a loss, replacing the exposure with similar stocks. We can deploy these losses across an investor's entire portfolio, which could offset gains from other positions outside the SMA.

For illustrative purposes only. There can be no assurance that any investment objectives will be achieved.

Related Content

It’s What You Keep: Why Focusing on After-Tax Returns Matters

Maximizing after-tax returns should be the goal for assets in investors’ taxable accounts.

Common Questions

There is no assurance that a separately managed account will achieve its investment objective. Separately managed accounts are subject to market risk, the market values of securities owned will fluctuate so that your investment, when redeemed, may be worth more or less than its original cost.

AllianceBernstein L.P. does not provide tax, legal or accounting advice.