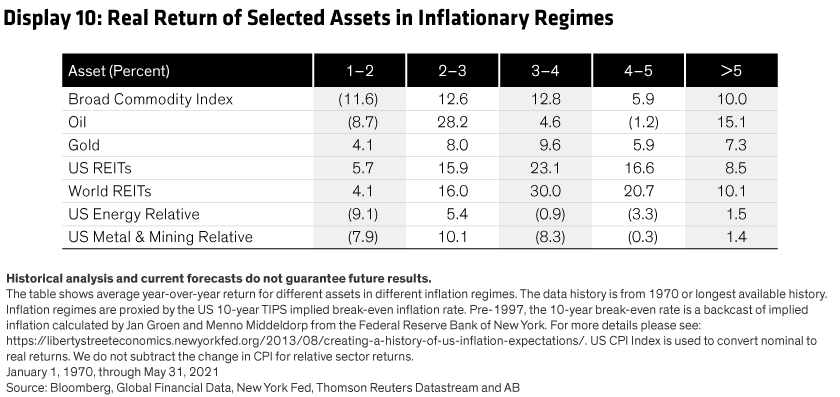

From an ESG perspective, some commodities, such as copper, aluminum and nickel, play a critical role in the transition to net-zero carbon emissions. But others, such as oil, coal and steel, are clearly at odds with the current climate agenda and will have to be replaced over time by renewable resources. Energy- and mining-linked equities have also tended to outperform in moderate-inflation environments of 2%–3%, but also hedged effectively in periods of very high inflation.

Tactical underperformance in certain episodes, or at a specific point in the cycle, might not be too much of a problem for long-horizon investors. However, there are strategic questions too. If the inflation path is higher for a sustained period, what are the protection options? Likewise, if a particular ESG definition excludes any defense companies, does it miss the bigger picture need for defense in exchange for protecting broader social interests? And if this is the case, are there other avenues for inflation protection?

Real Estate: Real estate can help protect against inflation. Public real estate investment trusts (REITs) tend to perform best in the moderate-inflation range of 3%–4%, but they also post high returns in high-inflation environments, when inflation is above 4%. Private real estate, proxied by the Case-Shiller US National Home Price Index, has historically delivered a similar pattern.

Real estate is very established as an inflation hedge, both empirically and theoretically. The empirical data show an ability to deliver robust real returns in times of higher inflation. From a fundamental perspective, this makes sense given the way rental incomes stem from the real economy. There are potential short-term problems from rapid inflation changes and the slower response of rental incomes, but over longer horizons, we’re comfortable with real estate as a way to better enable portfolios to deliver positive long-term real returns when inflation is elevated.

There are relatively few overall constraints on real estate investing right now from an ESG perspective, in principle. There’s a focus on the “E” part of ESG and the potential for new buildings to be more efficient, which is all well and good. But we think that a more holistic view reveals challenges—investors need to be more aware of the “S” part of ESG. In September 2021, Berlin voters backed a referendum to force large corporate landlords to sell housing they own in the city, which could affect a quarter of a million apartments. The vote is non-binding, and arguably the high incidence of renting in Berlin makes the city different from others in developed markets, but it could presage a broader question around ESG considerations.

A similar backlash is forming in Spain where, according to the Financial Times, Blackstone is now the country’s biggest landlord.7 At the end of last year, Spain’s government approved a draft bill aimed at landlords with more than 10 properties. The measure could introduce rent caps in certain areas where rents have risen much faster than inflation and might also ban the sale of social housing to investment funds. Similar pressures are apparent in other countries.

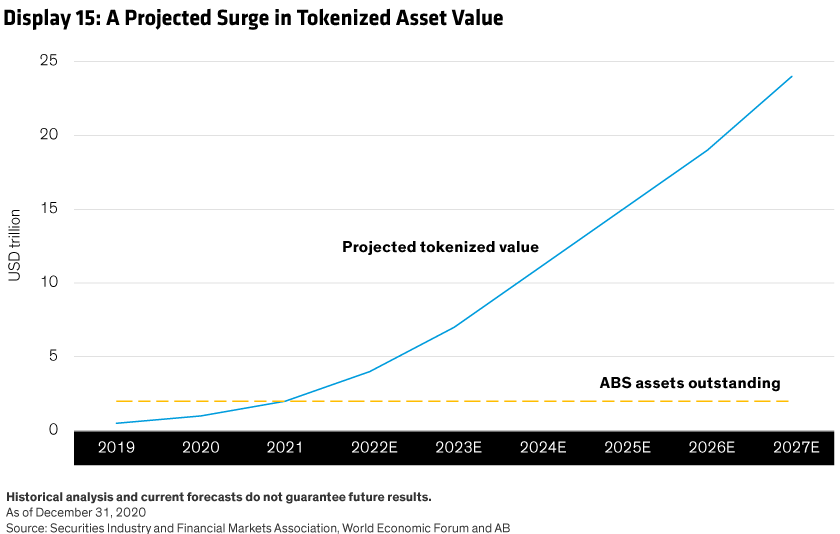

Seen in this light, the role of institutionally owned residential real estate is bound up with broader questions of inequality and social fairness. We think a shift to permanently higher inflation will drive up institutional demand for real estate. In the world of real assets, real estate is the only asset class that could be sizable enough to rival the capacity of equity markets. There have been constraints to this point on how much of the real estate market is investable, but large strides have been made to open more of it up to investors. The potential of tokenization could better enable investors to access a larger share of real estate markets—by making fractionalized ownership easier, for example.

However, there are dangers and limits. We expect a growing social and possibly political backlash against the financialization of real estate, particularly residential. In some cases, in Berlin for example, this opposition might limit investors’ ability to own such assets at scale. That might be an extreme example, but more broadly it could directly limit the ability of real estate income to rise with inflation as it has historically. The potential for rent controls to limit real estate’s ability to hedge inflation might have to be included when modeling returns. However, this also raises questions about the interaction of rent controls and the supply of real estate, given insufficient residential construction in many key markets..8

Cryptocurrencies: There is currently no empirical evidence of cryptocurrencies providing inflation protection. Bitcoin, for example, has dramatically failed as an inflation hedge—or a hedge for anything—over the past year. The day Russia invaded Ukraine saw gold and Bitcoin move in opposite directions: gold worked, and Bitcoin didn’t. The return history of cryptocurrencies is simply too short, and prices too volatile, to demonstrate any meaningful inflation hedging properties.

Nevertheless, we would note that if one treats this asset as “digital gold” because it is a zero-duration non-fiat asset with a programmatically limited supply, a case could be made that it should act as an inflation hedge, particularly when the money supply is expanding rapidly. It could be most useful in an environment where moderately elevated inflation was a policy goal to reduce public debt—debasing fiat currencies. The likelihood that such a shift in policy, either explicit or implicit, could occur has increased. Our view is that the pandemic marked a critical moment in the transition between monetary and fiscal policy as the key cushion for economies in times of stress. The fiscal genie is out of the bottle and there will be popular pressure to reach for it again in future downturns. A fiscal response to the elevated energy and food prices brought about by the Ukraine crisis could further entrench such a view.

The energy consumption required to mine some cryptocurrencies, most notably Bitcoin, is strongly at odds with the environmental principles of ESG. Some of these issues could be alleviated if more renewable energy sources are used for future mining, but that point is open to debate. A move to proof-of-stake could also blunt this ESG concern in some cases. However, the use of Bitcoin and other cryptocurrencies in money laundering and other illicit activities is highly problematic from a social perspective. To be fair, there is a positive offset to this downside, as crypto enables banking access to those shut out of traditional banking systems, while also making it cheaper and easier to repatriate money to poorer countries.

Private Assets: There’s nothing inherently anti-ESG about private equity (PE) assets—unless one wants to argue that, from a policy point of view, direct access to these return streams is biased toward the wealthy. But private assets have historically not been subjected to the same kind of ESG constraints as active equity funds have. This disparity is being addressed but it will likely take time before it’s reflected in the majority of assets.

We’re seeing growing scrutiny of PE firm investments that are filling the financing gap in oil, gas and coal project funding left by public firms.9 The New York Times cites a report by the Private Equity Stakeholder Project showing that about 80% of the top 10 PE firms’ current holdings are in oil, gas and coal sectors. Because PE firms’ disclosure requirements are much less stringent than their public counterparts, it’s harder to evaluate their ESG practices, resulting in less pressure and fewer incentives to reduce emissions or divest non-ESG assets.

4. A Synthesis Is Needed

We’ve laid out the case for ESG driving inflation and the tension between inflation hedging a portfolio while complying with some of the traditional constraints of ESG investing (e.g., simple approaches based on screening and exclusion). We think that this macro trend of inflation and the industry trend of an increasing focus on ESG will persist. Returning to our comment on seeing this as a dialectic, a synthesis is required, part of which is an evolution of what ESG investing really means. But critically, this also requires developing new return sources.

ESG, or responsible investing, is a very broad field. Answering the question we posed up front—how to address inflation responsibly—requires the recognition of the broad spectrum of ESG investment approaches. Historically, relying heavily on screening or identifying certain segments of the economy as “good” or “bad” has been a dominant approach. This can take the form of either excluding “sin” stocks from broad market indices or using “best-in-class” indices of companies that score highly on ESG metrics. Much of this form of investing has gone under the label of socially responsible investing.

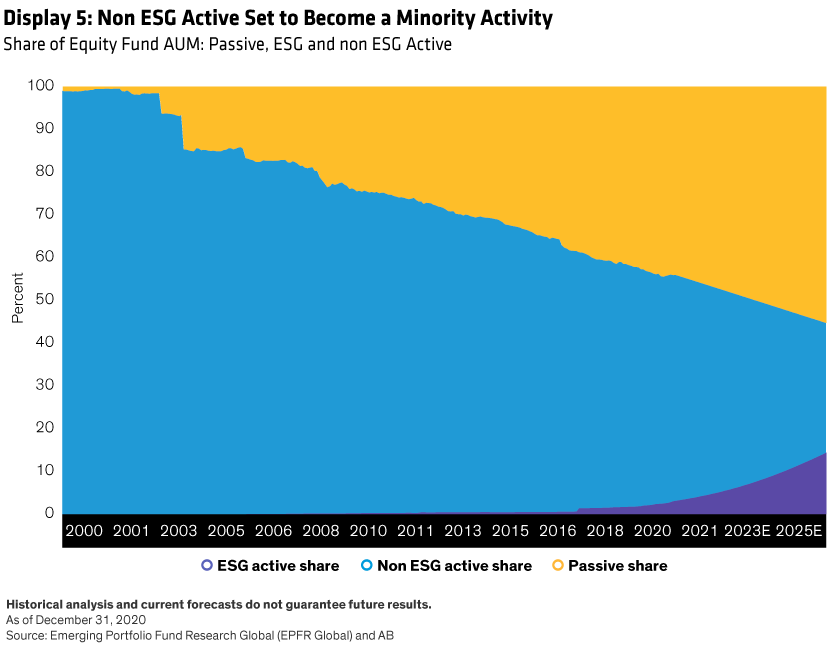

When we think about the spectrum of ESG approaches, screening and exclusion still have a role to play, but represent a more passive approach, in our view: they should be considered akin to rules that determine broad market indices or “smart beta” simple factor tilts.

We argue that an active ESG approach should employ active engagement with the underlying issuers and investments, with the intent to gain insight, foster corporate change or promote certain outcomes. As a first step, it should acknowledge that ESG rules are dynamic and contingent, not static and absolute. This allows active ESG approaches to adapt rather than waiting for the deliberations of index providers. As a case in point, the war in Ukraine raises questions as to whether excluding defense companies is a sustainable approach. At the very least, the role of defense companies in enabling democratic societies to take a stance against existential threats deserves a discussion.

We also believe that active ESG needs to go further by fully integrating ESG into the financial considerations of buying or selling an asset, without necessarily imposing any exclusions. In this way, the financial materiality of ESG becomes an important element of any investment decision, implicitly placing a coefficient on an ESG input alongside other financial considerations.

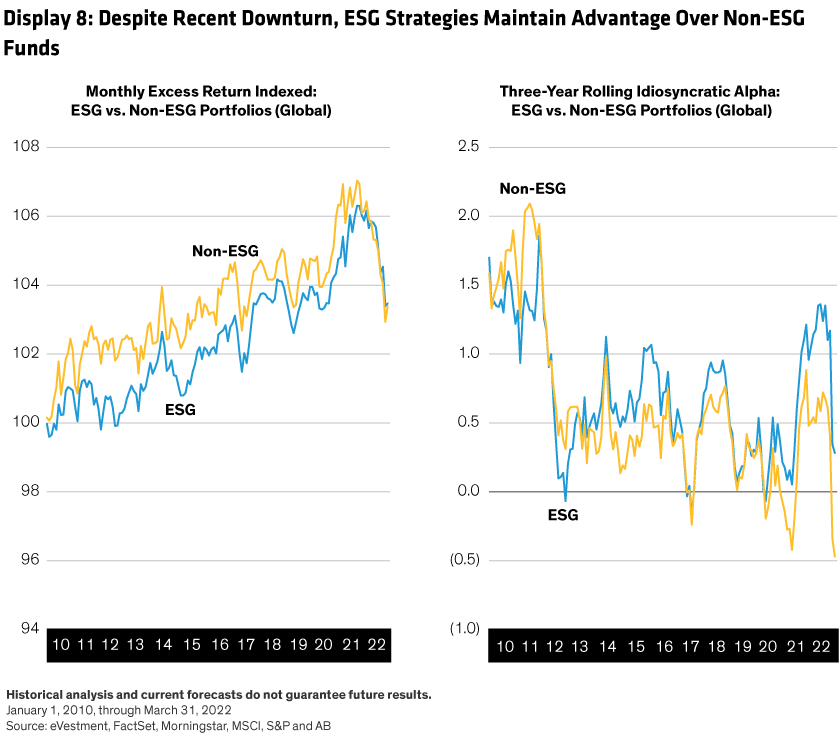

A further extension of this active approach incorporates specific ESG-related outcomes in addition to integrating ESG into financial analysis—we’d include impact and sustainable funds in this category. Given their more thematic bias, some of these strategies could be susceptible to underperforming in certain phases of the cycle when specific themes aren’t in favor. However, the fund buyer would presumably have signed up explicitly for that tactical risk when making an allocation. As we showed earlier in the note, a broad sample of ESG funds has managed to achieve more idiosyncratic alpha than non-ESG funds in recent years—an important pillar of the case for an active approach to ESG.

Another route for a definitively active approach to investing under the aegis of ESG is engagement. We think this could become the core of what it means to be an active investor. From a purely commercial perspective, such an approach has advantages, would be much harder to create through passive strategies and could make it possible to defend fees. There are three other crucial benefits of an active engagement approach:

- Extending the time horizons of investments: If asset owners care about ESG in the form of engagement, they’re more likely to stick around to see the fruits of that engagement. This then becomes important not only for E, S or G reasons but also benefits the asset owner, making them less likely to incur an excessive churn cost from bad fund-selection decisions. It also becomes important for asset managers, enabling them to have longer investment horizons.

- Generating idiosyncratic alpha: In a world where smart beta is becoming free, we think the only kind of return that managers can charge a fee for is idiosyncratic returns.10 Engaging with companies and bringing about corporate change is at least a candidate for generating idiosyncratic returns.

- Competing with private equity: Engagement blurs the distinction between private and public equity managers. The most egregious differences in fee spreads across the industry aren't between active and passive managers but between active public equity managers and private equity managers. By encouraging active engagement and bringing about positive governance changes, active public funds would be bringing about the kind of returns that private equity managers aim to deliver, assuming that such ESG engagements lead to positive returns. So, if used correctly, engagement can be a strong element in narrowing the fee spread between public and private equity managers. Ultimately, this would benefit asset owners, too, in our view.

We think engagement-driven ESG is a key part of the active/passive debate. One line of reasoning sometimes used holds that because passive managers can’t decide to sell a given security in an index, they care more about engaging on ESG than active managers who have the option to sell. This leads to another view that many companies view passive managers as long-term investors because their capital allocation is stable—in a survey we conducted, corporations told us that they saw this attribute of passive managers as being a key attraction.11

We think both views are misguided. Not being able to sell an asset raises questions about the degree of power (other than voting power, which all owners have). It also presumes that one knows the right questions to ask or points of engagement to push. Moreover, thinking of passive investors as long-term investors is to conflate frequency of capital reallocations with the time horizon of investment. Tracking a broad-market index is necessarily a backward-looking exercise, not an endorsement of the future.

In our experience, asset owners might like this line of reasoning, but we also hear pushback. Surely, some argue, if ESG is to carry any moral or intellectual force, it must exclude certain types of economic activities altogether. Given these attitudes, we believe that there’s a need for other ESG approaches, rather than relying on engagement alone, to provide asset owners with new kinds of return streams—including renewable power, timberland and farmland.

Delivery of renewable power: This seems like a highly attractive option that neatly meets sustainability requirements and has a natural inflation-hedging property. In fact, as renewable power offsets older power sources, it can be thought of as naturally replacing part of a portfolio’s commodities exposure. Because it addresses the same “real” need in the economy for energy consumption, green-energy delivery should have a similar return profile in inflationary environments. Moreover, it helps address many ESG goals, so the asset class should enjoy the support of significant and sustained investment inflows from ESG-oriented investors and the public sector in the coming years.

In Display 11, we gauge the possible range of renewable investment in coming years—this analysis was completed before the Ukraine war, which will accelerate some of these goals. The exhibit shows the annual global renewables investment required under three different scenarios considered by the International Energy Agency. The Stated Policies scenario reflects the spending forecast under current stated climate policies. The more ambitious Sustainable Development scenario reflects the spending needs to meet the goals set by the Paris Agreement, with countries reaching net-zero emissions between 2050 and 2070. The most ambitious scenario aims for net-zero emissions by 2050 and is consistent with limiting the global temperature rise to 1.5°C.