Cash Could Be Losing Its Luster—Consider Bond ETFs

8 min read

Bonds might see a big boost with rate cuts likely this year, but trillions in cash is still on the sidelines in the “T-bill and chill” strategy made popular during 2022’s sharp rate-hike cycle. AB offers multiple actively managed bond ETFs to help investors get back in the game.

Changing Fortunes for Cash Investments?

The sidelines may have seemed sensible place in 2022, with cash rates high and bond prices slumping under aggressive Fed rate hikes, but bonds outpaced cash in 2023. While fixed-income markets have been turbulent early in 2024 as investors digest incoming data, rate cuts are likely on the way—and that bodes well for bonds.

With money market funds at a record US$5.8 trillion in assets by the end of last year, many investors are looking to time their bond market reentry. Historically, Fed easing has caused cash to flood into longer-term debt, pushing bond prices up and yields down. With a lot of cash in play, the demand surge could be very high.

Early Bond Entry Could Set Up More Potential

To capitalize, we think investors should consider switching from cash to bonds now, because government bond yields often fall and prices rise before the Fed moves.

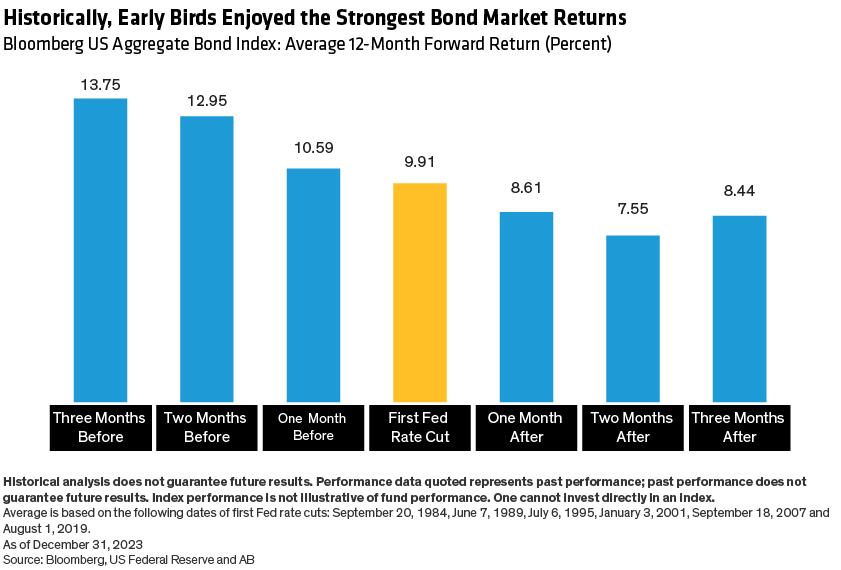

In the six months before initial rate cuts, the 10-year US Treasury yield has historically dropped an average of 90 basis points1, leaving the biggest returns for investors who got in months earlier (Display). Bonds enjoyed a late rally in 2023 as investors expected an end to rate hikes, but we think there’s plenty of room for yields to fall more—though bumps are likely.

Cash Returns May Disappoint Ahead

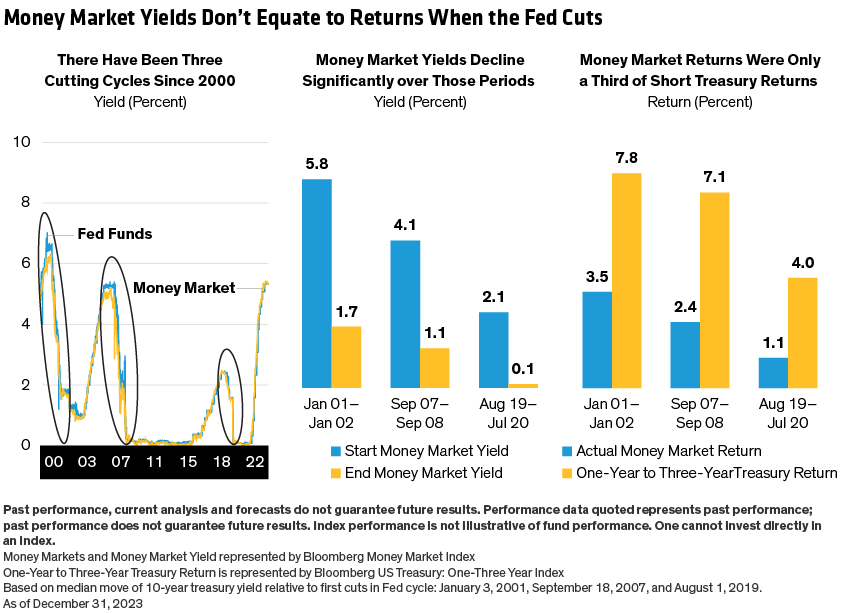

On the flip side, investors who stay in money markets could see a rapid drop in cash yields, which have been nearly perfectly correlated with the fed funds rate—and the Fed tends to ease fast. That’s what happened in the last three rate-cut cycles (Display), and money markets ended up returning only one-third as much as short-term Treasury bonds. Given consensus expectations for a sizable decline in the fed funds rate, that’s a looming risk for cash.

If Yields Rise, Bonds’ Asymmetry Could Work in Your Favor

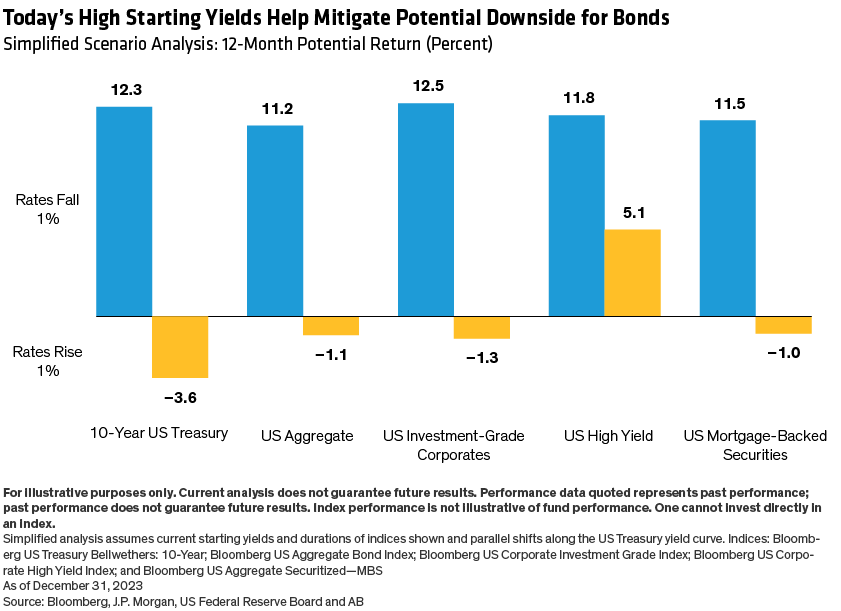

If the Fed cuts rates as widely expected, bonds appear likely to outpace cash this year. If yields rise instead, which is much less likely, bonds still seem to be in a good position, because high starting yields may help cushion against losses.

In a theoretical example, a 1% decrease in yields across all maturities suggests strong return potential in the bond market, while an unlikely 1% increase in yields across the board suggests modest negative returns at worst (Display).

Actively Managed ETFs: An Effective Path Off the Sidelines

Investors can expect continued volatility as yields trend lower over the next few months. However, given a likely surge in demand for bonds and an expected erosion of cash yields, we think investors who act now can position themselves for strong potential returns.

AB offers two actively managed short-duration fixed-income ETFs, the AB Ultra Short Income ETF (YEAR) and the AB Tax-Aware Short Duration Municipal ETF (TAFI). These funds offer a liquid and low-cost way for clients to put cash to work on the short end of the yield curve.

For clients looking for more duration and exposure to fixed-income securities of corporate issuers, AB offers the AB Core Plus Bond ETF (CPLS) and the AB Corporate Bond ETF (EYEG). Find out more about AB’s actively managed ETFs here.

Important Information

Investors should consider the investment objectives, risks, charges, and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

1 A basis point is a common unit of measure for interest rates and other percentages in finance. Basis points are typically expressed with the abbreviations bp, bps, or bips. One basis point is equal to 1/100th of 1%, or 0.01%.

Bloomberg US Aggregate Bond Index: The Bloomberg US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities.

Bloomberg US Corporate Bond Index: The Bloomberg US Corporate Bond Index measures the investment-grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Bloomberg US Corporate High Yield Index: The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded. The US Corporate High Yield Index is a component of the US Universal and Global High Yield Indices.

Bloomberg US Aggregate Securitized-MBS Index: The Bloomberg US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index coBloomponents for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities.

Bloomberg US Treasury Bellwethers 10 Year Index: The Bloomberg Barclays 10-Year U.S. Treasury Bellwethers Index is a universe of Treasury bonds, and used as a benchmark against the market for long-term maturity fixed-income securities. The index assumes reinvestment of all distributions and interest payments.

Bloomberg US Treasury One to Three Year Index: The Bloomberg US Treasury: 1-3 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 1-2.999 years to maturity. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Active Trading Risk: The Fund expects to engage in active and frequent trading, which will increase the portfolio turnover rate. A higher portfolio turnover increases transaction costs and may negatively affect the Fund’s return. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline. Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns. Depositary Receipts Risk: Investing in depositary receipts involves risks that are similar to the risks of direct investments in foreign securities. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. Emerging Market Risk: Investments in emerging market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory, or other uncertainties. Foreign (Non-U.S.) Investment Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory, or other factors. Global Risk: The Fund invests in companies in multiple countries. These companies may experience differing outcomes with respect to safety and security, economic uncertainties, natural and environmental conditions, health conditions, and/or systemic market dislocations. The global interconnectivity of industries and companies, especially with respect to goods, can be negatively impacted by events occurring beyond a company’s principal geographic location, which can contribute to volatility, valuation, and liquidity issues. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Interest Rate Risk: As interest rates rise, bond prices fall and vice versa; long-term securities tend to rise and fall more than short-term securities. Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear to layers of asset-based expenses, which could reduce returns. Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage transactions such as reverser purchase agreements—magnifies both gains and losses, resulting in greater volatility. Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value. Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities may negatively impact the yield or value of a municipal security. New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision. Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value. Tax Risk: The U.S. Government and the U.S. Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income received by shareholders from the Fund by increasing taxes on that income.

AllianceBernstein L.P. (AB) is the investment advisor for the Fund.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

The AB ETFs are distributed by Foreside Fund Services, LLC. Foreside is not related to AB.

AL-510801-2024-03-08