Invest in Innovative and Disruptive Companies with AB ETFs

Key Takeaways

- Innovation offers potential profitability and growth—but not every innovative company is a good investment opportunity.

- From relentless culture to distinctive products and competitive moats, true disruptors have a distinctive formula for long-term success.

- Picking innovative companies to invest in is difficult. The AB Disruptors ETF actively invests in innovative market leaders poised to disrupt their industries.

Featured Fund

Innovative doesn’t necessarily mean investable. Firms may win early in paradigm changes only to later be disrupted themselves. Companies dedicated to making chips for WiFi, Bluetooth and GPS early in the smartphone cycle were later disrupted by integrated leaders such as Broadcom and QUALCOMM.

The same goes for AI data centers. As AI architecture evolves, the gap between transitory winners and long-term leaders with defensible competitive moats and pricing power will likely grow, as was the case between the hundreds of internet startups and the few internet survivors. It’s critical to actively monitor and manage opportunities in AI data centers.

Finding the Right Innovation—and the Right Company Behind It

The diverse beneficiaries of innovative breakthroughs and applications span healthcare, consumer retail, media, financials, energy and industrials. But what ingredients make a long-term opportunity?

The ability to thrive amid further disruption. Companies should be able to endure further disruption over time. They never stop innovating, continually reinventing themselves and introducing unique features or attributes in products, services or processes.

Innovation with lasting profit potential. Some innovation is evolutionary, creating a better experience or more efficiency (ride-sharing models or hybrid cloud infrastructure). And some is breakthrough (synthetic biology, electric vehicles (EVs) or true AI and autonomous driving). The key is enduring profit potential.

Markets seeking distinctive offerings. Investable disruptors have big markets hungry for distinctive products that foster durable profits and high entry barriers. Firms with network effects are especially attractive. The internet age saw digital network effects in social media and ride sharing—more users boosted the per-user value proposition. We expect the AI revolution to produce tech-enabled physical network effects.

For example, Tesla’s huge network of drivers sharing video data means better-trained full-self driving, which could bring more adoption and drivers. This moat helps Tesla lead in autonomous transportation. In our view, the race to become the GenAI leader broadly follows the same principle: bigger datasets and higher computing scale should drive more robust results and greater adoption.

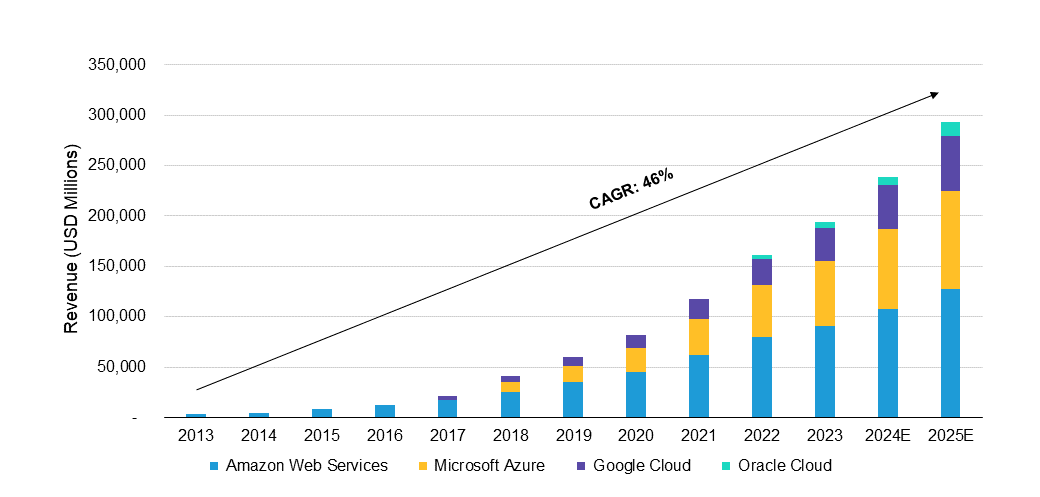

The sweet spot of innovation. There’s fertile ground in the rapid-growth phase of innovation, when adoption rates of new technology reach inflection points and increase sharply. It takes time to reach that phase, but when it begins, the path points steeply upward. We’ve seen this in smartphone adoption and streaming media. And we see it today in EV adoption, robotics, cloud computing (Display) and digital payments.

Hyperscalers’ Revenue is Expected to Grow at a Rapid Speed

Analysis provided for illustrative purposes only and is subject to revision.

As of October 31, 2024

CAGR, or compound annual growth rate, is calculated from 2013 through 2025E.

Source: Bloomberg and AllianceBernstein (AB)

Strong management teams. Exceptional management teams with focus and vision are essential to guiding innovative companies. These teams never seem to overlook competitive threats. They’re hyperaware of peers and willing to “self-disrupt” processes to stay ahead.

It’s all about the magnitude of surprise. Stock potential is highest when investors underestimate growth potential and the profit pool. This has happened with transformative innovation like the smartphone or even the original internet, creating alpha1 potential. Some innovators may have high valuations but lower near-term profits from investing to reach dominant scale or keep a competitive moat. They may seem expensive today, but if well-spent capital accesses greater growth potential, it could be worth it.

AB Disruptors ETF (NYSE: FWD): Capturing Disruptive Opportunities…Thematically

Powerful megatrends and a new economy with a thriving digital infrastructure are fueling an “industrial revolution” of innovation. But investing in innovation requires disciplined active management.

That’s where the AB Disruptors ETFcomes in. It seeks to outperform global growth equity markets by investing in innovative market leaders poised to disrupt their industries. FWD combines top-down thematic research with rigorous, bottom-up fundamental analysis and robust risk management.

If you’re an investor looking for trading guidance, the AB ETF Capital Markets team offers complementary trade advisory services. You can reach us at etf.capitalmarkets@alliancebernstein.com. And you can find out more about AB’s actively managed ETFs here.

How to Take Action

1Alpha measures risk-adjusted “excess returns” over a benchmark.

Investing in securities involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF's shares may be at, above or below the ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Active Trading Risk: The Fund expects to engage in active and frequent trading, which will increase the portfolio turnover rate. A higher portfolio turnover increases transaction costs and may negatively affect the Fund’s return.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Emerging-Market Risk: Investments in emerging-market countries may have more risk because the markets are less developed and less liquid as well as being subject to increased economic, political, regulatory or other uncertainties.

Equity Securities Risk: The Fund invests in publicly traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased.

Foreign (Non-US) Investment Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory or other factors.

Global Risk: The Fund invests in companies in multiple countries. These companies may experience differing outcomes with respect to safety and security, economic uncertainties, natural and environmental conditions, health conditions and/or systemic market dislocations. The global interconnectivity of industries and companies, especially with respect to goods, can be negatively impacted by events occurring beyond a company’s principal geographic location, which can contribute to volatility, valuation and liquidity issues.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified,” meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value.

Sector Risk: The Fund may have more risk because it may invest to a significant extent in one or more particular market sector, such as the information technology sector. To the extent it does so, market or economic factors affecting the relevant sector(s) could have a major effect on the value of the Fund’s investments.

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

AB funds may be offered only to persons in the United States and by way of a prospectus. This website should not be considered a solicitation or offering of any investment products or services to investors residing outside of the United States.

Investment Products Offered:

Are Not FDIC Insured | May Lose Value | Are Not Bank Guaranteed

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

© 2024 AllianceBernstein L.P.