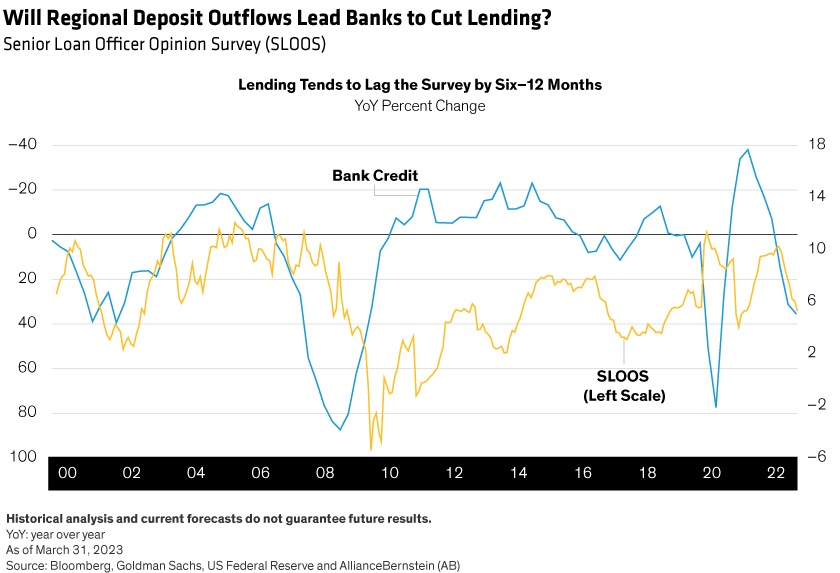

The Fed stayed the course in raising rates, hiking by another 25 basis points late in the quarter and signaling another likely hike this cycle. The Fed’s approach is essentially expressing optimism that the banking sector can weather this episode, but will keep a watchful eye on bank liquidity to ensure the broader system doesn’t come under stress.

Tighter financial conditions would likely help the Fed tamp down inflation. Some price measures, including headline inflation, are painting a rosier picture, but certain services categories are still stubbornly hot. The Fed’s top priority remains bringing a more “natural” balance to the labor market, and this requires weakening overall demand.Economic growth has indeed come down, and we expect it to be challenged in 2023, Our forecasts call for US gross domestic product (GDP) to decline slightly by –0.1% this year, with global growth muted—China is the notable exception. For 2024, we expect US growth to recover to 1.8%, accompanied by inflation roughly in line with a higher long-run structural level of 2.0%.

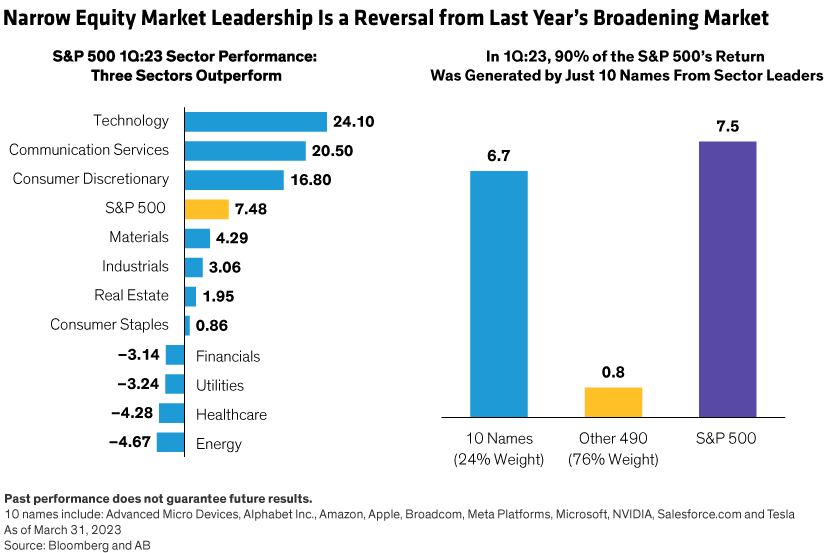

Equity Earnings Growth Stalls, with Valuations Still High

With growth fading, corporate earnings estimates are bottoming out and forward guidance remains mostly negative. Yet the S&P 500 still posted a blistering 7.5% first-quarter return, leaving valuations hovering near a ceiling that’s only been breached during the dot-com bubble and post-COVID-19 period.

A look under the hood reveals the disconnect (Display). Only three sectors beat the index, and 90% of the S&P500 return came from only 10 stocks—mostly tech giants. With winners limited to only 24% of the index’s market cap, investors should be wary of a concentrated market.