Multi-Asset Model Portfolios

Research‑driven ETF models designed to simplify investing

The AB Approach to Model Portfolios

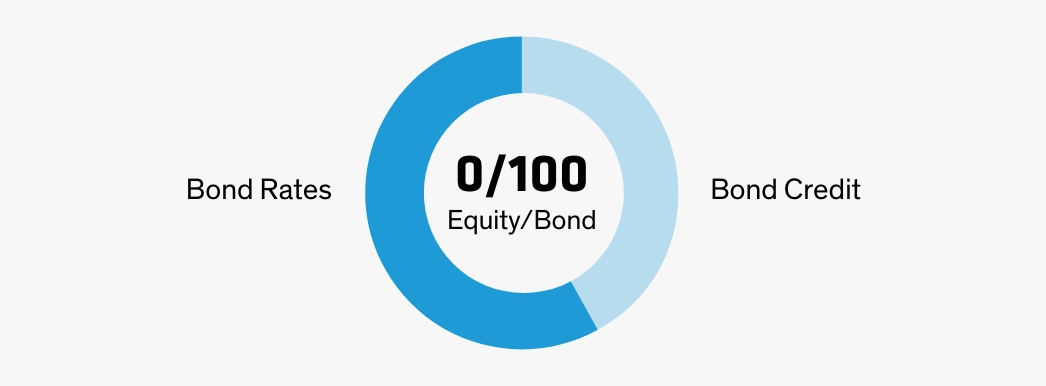

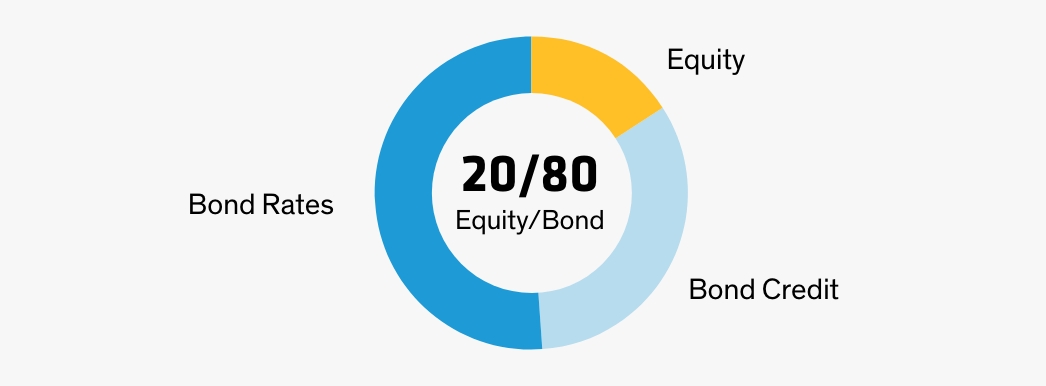

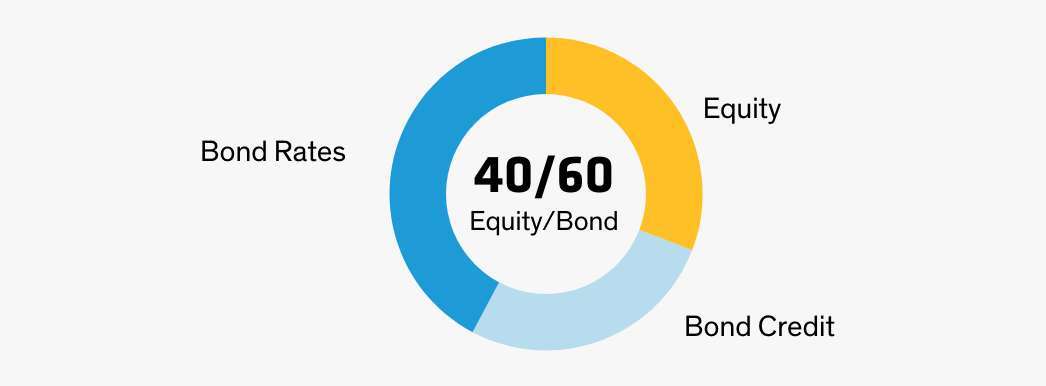

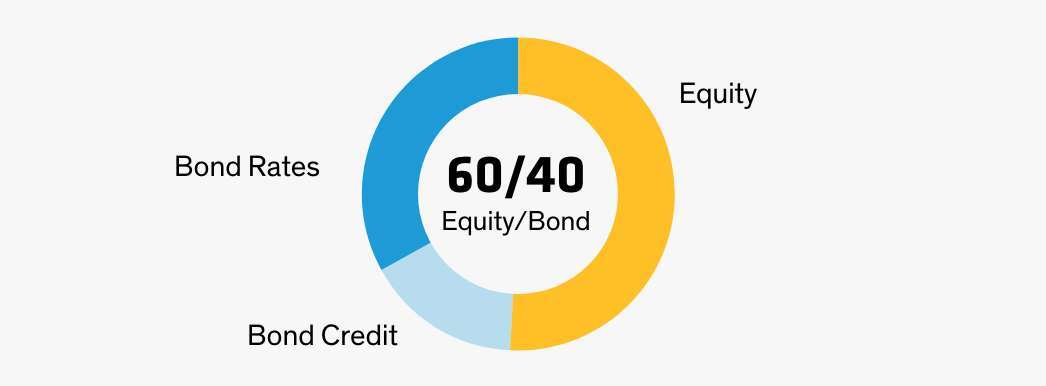

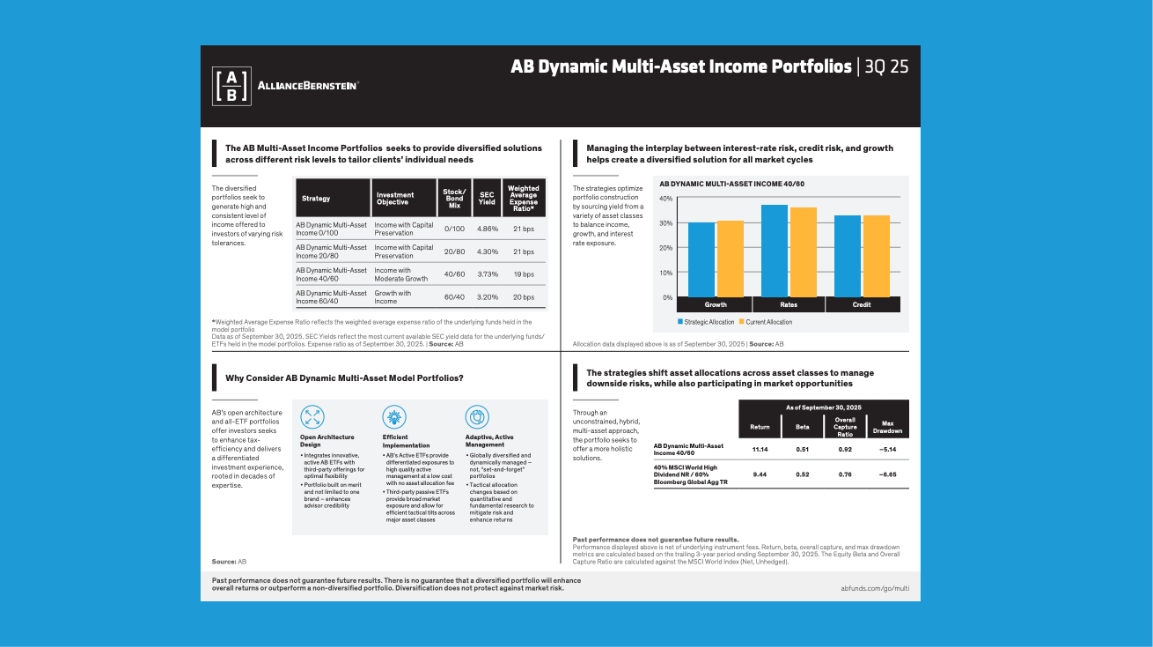

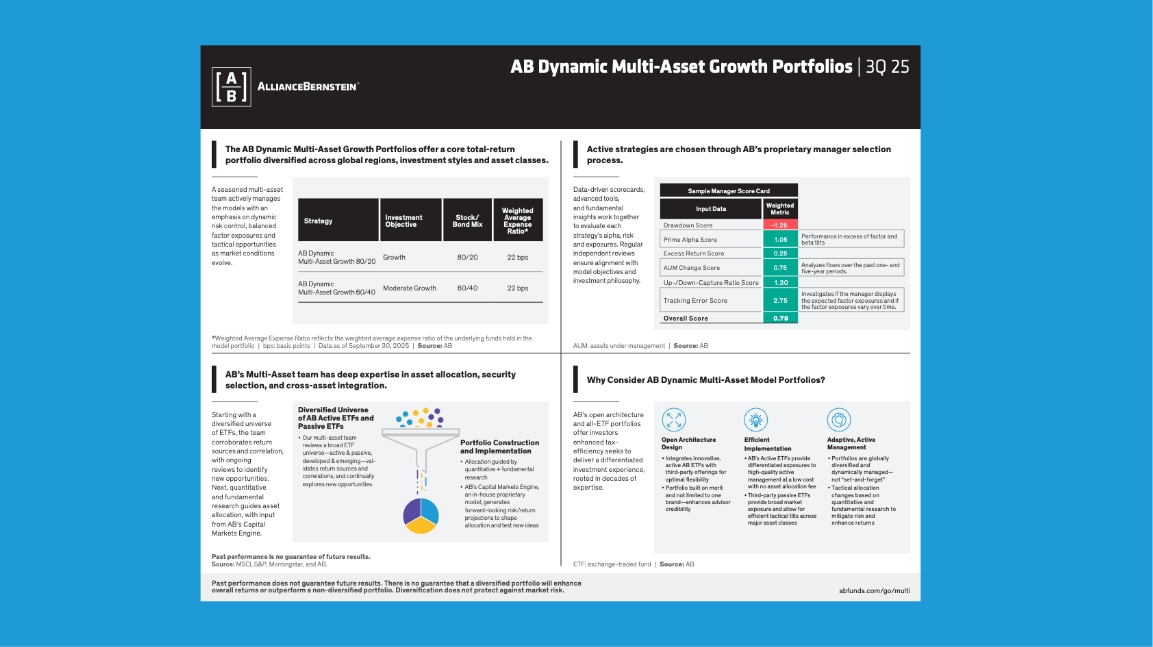

Built to simplify portfolio management, our dynamic, multi-asset model portfolios provide financial advisors with a disciplined framework for implementing diversified strategies. The open-architecture design leverages both active and passive ETFs to support flexibility, transparency, and cost efficiency – helping advisors manage portfolios with clarity and consistency.

Explore our Model Portfolios by Goal

-

Income

-

Growth

- Income

- Growth

Resources

Access detailed insights, fund data, and portfolio allocations for the full suite of Dynamic Multi-Asset Model Portfolios

Dynamic Multi-Asset Model Portfolios Solutions

What Makes AB’s Approach Different

Building portfolios is complex—but investing in them shouldn’t be.

Our approach to model portfolios is grounded in a disciplined process, global research, and ongoing oversight to support investor confidence amid shifting markets.

Our Model Portfolio Managers

of Investment Management

With expertise in multi-asset solutions

Institutional Scale with Retail Accessibility

Frequently Asked Questions

Get in touch for help getting started.

[[fa-icon-phone]] 800-247-4154, select 3

[[fa-icon-envelope]] ETFSpecialist@alliancebernstein.com

Risks To Consider

Investing in ETFs involves risk and there is no guarantee of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit our Literature Center or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

The Morningstar Rating™ for funds, or star rating, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. The star rating is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10.0% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35.0% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10.0% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five- and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36–59 months of total returns, 60% five-year rating/40% three-year rating for 60–119 months of total returns and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating period.

AB International Low Volatility Equity ETF was rated against the following numbers of US Funds Foreign Large Blend over these time periods: 4 stars against 659 funds in the last three years, 4 stars against 637 funds in the last five years, and 4 stars against 538 funds in the last 10 years based on risk adjusted returns.

Derivatives Risk: Derivatives may be difficult to price or unwind and may be leveraged so that small changes may produce disproportionate losses for the Fund.

Equity Securities Risk: The Fund invests in publicly traded equity securities, and their value may fluctuate, sometimes rapidly and unpredictably, which means a security may be worth more or less than when it was purchased.

Foreign (Non-U.S.) Investment Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be more difficult to trade than domestic securities due to adverse market, economic, political, regulatory, or other factors.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value.

New Fund Risk: The Fund is a recently organized, giving prospective investors a limited track record on which to base their investment decision.

Distributed by Foreside Fund Services, LLC. Foreside is not affiliated with AllianceBernstein.

AB funds may be offered only to persons in the United States and by way of a prospectus. This website should not be considered a solicitation or offering of any investment products or services to investors residing outside of the United States.

Investment Products Offered: Are not FDIC Insured | May Lose Value | Are Not Bank Guaranteed

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

Prior to close of business on 7/15/2024, the AB International Low Volatility Equity ETF operated as an open-end mutual fund. The Fund has an identical investment objective and substantially similar investment strategies and investment risk profiles as the predecessor mutual fund. The NAV returns include returns of the Advisor Share Class of the predecessor mutual fund prior to the Fund’s commencement of operations. Performance for the Fund’s shares has not been adjusted to reflect the Fund’s shares’ lower expenses than those of the predecessor mutual fund’s Advisor Share Class. Had the predecessor fund been structured as an exchange-traded fund, its performance may have differed. Please refer to the current prospectus for further information. Prior to 7/15/2024, the Fund was called AB International Low Volatility Equity Portfolio. Data prior to 7/15/2024 relate to AB International Low Volatility Equity Portfolio.