CITs offer reasonable, cost-efficient investment options and they can help plan sponsors fulfill their fiduciary duty. As tax-exempt, pooled investment vehicles—available only to DC and other ERISA-qualified plans—CITs are now used in more than 75% of plans.

CITs: Myths & Facts

This two-minute video explains how CITs can be a versatile, cost-effective and competitive alternative to mutual funds.

Why Consider CITs?

How CITs Add Value

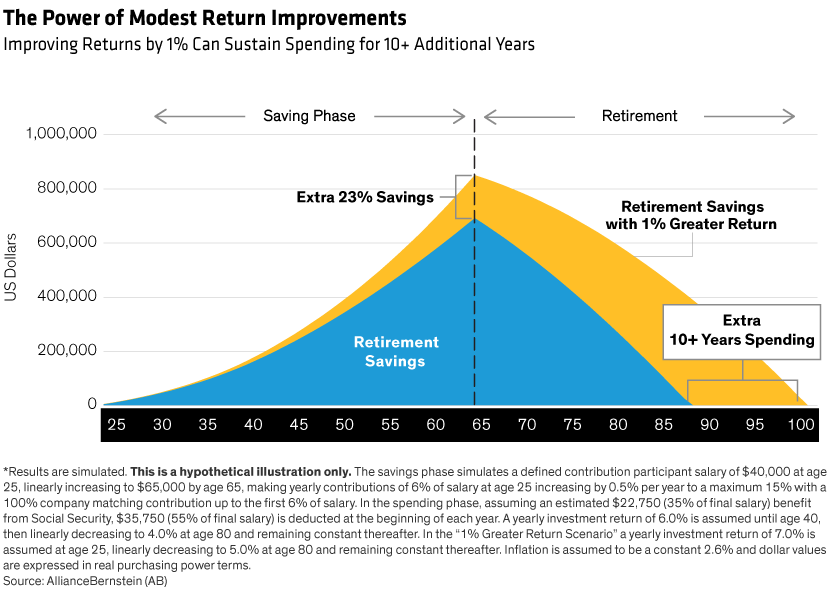

For qualifying retirement accounts, CITs have lower administrative costs and a lower-cost structure than mutual funds.

Over the life of the plan, expense savings can result in better outcomes for participants.

CITs are easy to implement and operationally equal to mutual funds.

AB's CIT Products

-

Core Strategies

-

Packaged Target-Date Strategies

- Core Strategies

- Packaged Target-Date Strategies

US Large Cap Growth

Inception Date: 8/31/2007

AB Global Core Equity

Inception Date: 6/15/2015

AB Global Real Estate Investment

Inception Date: 8/31/2007

AB Global Strategic Core

Inception Date: 1/3/2012

AB US High Yield**

AB Relative Value ***

AB US Small & Mid Cap Core

Inception Date: 03/13/2020

AB US Small & Mid Cap Growth

Inception Date: 8/31/2007

AB US Small & Mid Cap Value

Inception Date: 8/31/2007

AB Sustainable US Thematic*

Inception Date: 1/20/2023

AB US Small Cap Growth

Inception Date: 8/3/2020

*Launched January 2023; AB Sustainable US Thematic Composite has an inception date of 12/31/1981 , **This CIT has not yet funded; the composite for this investment strategy has an inception date of 12/31/1986

***This CIT has not yet funded; the composite for this investment strategy has an inception date of 12/31/1994

AB Multi-Manager Retirement 2010 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2015 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2020 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2025 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2030 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2035 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2040 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2045 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2050 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2055 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement 2060 Fund

Inception Date: 08/12/2016

AB Multi-Manager Retirement Allocation Trust Fund

Inception Date: 08/26/2016

Learn More about CITs

CIT Frequently Asked Questions

Connect with us!

Thank You

Thank you for contacting us. Expect a reply within one business day.

The Trust is a Collective Trust formed by the Trustee. The Trust is not a mutual fund and Units of the Collective Trust are not deposits of AllianceBernstein Trust Company, LLC or AllianceBernstein Investments. The Units are securities which have not been registered under the 1933 Act and exempted from investment company registration under the Investment Act of 1940. Therefore, Participating Plans and their Participants will not be entitled to the protections under these Acts. AllianceBernstein L.P. is the Trust Advisor and provides investment management services. AllianceBernstein Trust Company, LLC is the Trust’s Trustee and provides customized securities processing services. Effective April 2, 2007, AllianceBernstein Trust Company, LLC was appointed successor trustee to the Trusts. The Trust serves as a pooled investment vehicle for (i) pension and profit-sharing trusts of employers that are qualified under section 401(a) of the Internal Revenue Code of 1986, and (ii) governmental plans described in Code Section 414(d) (the “Eligible Plans”). An Eligible Plan becomes a participating plan and unitholder of the Trust (a “Participating Plan”) upon the execution and acceptance of an adoption agreement in the form prescribed by the Trustee (the “Adoption Agreement”) and delivery of assets to the Trustee. AllianceBernstein Trust Company (“ABTC” or the “Trustee”) formed the Series Trust pursuant to a Declaration of Trust dated Month, Day Year (as may be amended from time to time, the “Declaration”) and is the Trustee of the Series Trust. AllianceBernstein L.P. serves as the investment advisor “AllianceBernstein” or the “Investment Advisor”) to the Trust. Decisions as to which securities will be bought or sold for the Trust will be made by the Trustee, although the Trustee intends to rely on the investment recommendations of AllianceBernstein as a general manner. The Units are securities which have not been registered under the 1933 Act, or the securities laws of any state and are being offered and sold in reliance on an exemption from the registration requirements of such act and such laws. The Units have not been approved or disapproved by the Securities and Exchange Commission, any state securities commission or other regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of this offering or the accuracy or adequacy of this document. Any representation to the contrary is unlawful. Neither the Series Trust nor the Trust will be registered as an investment company under the Investment Act of 1940, as amended (the “1940 Act”), pursuant to the exemption from the registration requirement of the 1940 Act contained in section 3(c)(11); therefore, the protections available to investors under these acts are not available. Management of the Trust, however, is generally subject to the fiduciary duty and prohibited transaction rules under the Employee Retirement Income Securities Act of 1974 (“ERISA”). Commingled funds are not required to file a prospectus or registration statement with the SEC and, accordingly, neither is available. Mercer Investment Management, Inc. (MIM) provides sub-advisory services to the AB Multi-Manager Retirement Trusts. MIM is a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing nondiscretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.