Managing Your Risk Framework for Crisis Conditions

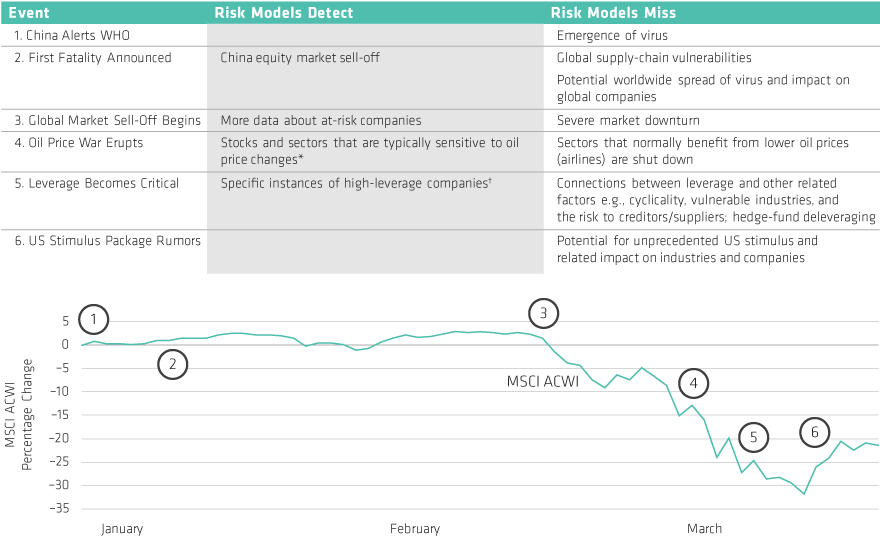

Risk models work best when the world economy is in a relatively steady state. In this environment the past is a helpful guide to the future, historical correlations are reliable, and trends tend to persist. Under current crisis conditions investors need to fall back on a simpler risk containment approach based on human judgement and fundamental analysis. Key lessons include:

1. Supplement your factor risk models with exposure-only models

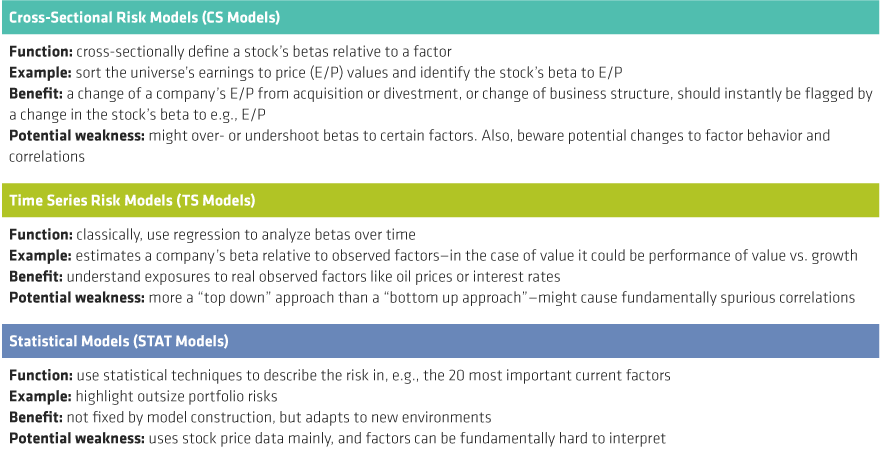

In a crisis, correlations might change or even flip, while volatilities will certainly increase. So investors should expand their risk-control framework with additional tools. In particular, they should complement their statistical risk models with simple exposure models. These can be based on fundamental analysis of stocks’ exposures to, for instance, styles, countries and industries. Volatility-adjustment features can also be added to risk models.

2. Don’t overreact and consider multiple scenarios

It’s impossible to predict either the precise timeline for the crisis or exactly how securities markets will react at each stage. So structuring a portfolio with a significant bias to recent winners, or in accordance with a specific narrative or scenario, risks being whipsawed by changes in market mood or perceptions.

3. Blend your risk model forecast

Although short-term risk models are better at predicting risk during crises they also come with high volatility and turnover. If your strategy is long-term, blend your risk model input with short- and long-term models, for instance using both short- and long-term model betas when considering portfolio construction.

4. Cash-flow modelling is key

Sustainable cash flows provide a strong basis for future performance—particularly under crisis conditions. Companies must be able to generate enough cash to withstand a prolonged crisis/revenue shortfall.

5. Don’t rely on a single factor

The crisis has repeatedly upended conventional factor relationships and correlations. At any time, relying on a single dominant factor to construct a portfolio carries higher risks. Under crisis conditions it invites random outcomes. Investors should also be mindful that their larger positions may be driving much of their factor exposure. This can create outsize risks if factor relationships change.

6. Avoid cluster risks

Standard risk models are unlikely to identify companies that are linked by common coronavirus themes and that as a group are vulnerable to the same factors. Cluster analysis can identify groups of stocks whose returns have become correlated and that may not be found in the same sectors or that don’t typically share similar characteristics.

We advocate implementing a cluster risk analysis framework that can help define new clusters (say, companies exposed to social distancing, such as restaurants, dentists and fitness centers), and can provide a structured way to determine the level of risk (either relative or absolute) appropriate for that cluster. Determining the size of a portfolio’s exposure to a given cluster should be consistent with both the level of investment insight and the risk/return characteristics of the cluster.

7. Make diversification effective

When conventional style and factor relationships are breaking down, it’s critical to understand the nature of each company’s business model and to analyze potential vulnerabilities on a bottom-up fundamental basis. Instead of relying on historic correlations, there may be a case for diversifying your portfolio across a larger number of carefully researched names. This will enable continued risk-taking in areas of investors’ expertise while limiting and diversifying risks associated with the current market environment.

8. Consider key factors both separately and together

Underlying exposures to the coronavirus, leverage, liquidity and volatility are all crucial to understand—particularly when crisis conditions cause them to interact in a way that magnifies risk. Analyzing these factors manually will pay off under conditions when risk models are struggling to adapt. We advocate rigorous stress-testing of any companies that are vulnerable to a combination of these factors. Stress-testing should drill down to a company’s supply chain too, as that’s where hidden risks may surface later.

9.Look for opportunities among the risks

Forced deleveraging has caused indiscriminate selling during the crisis, for instance through large-scale ETF redemptions and hedge-fund selling. This has created great potential for skilled fundamental investors with a clear game plan who can find opportunities in market rotations.

Know Your Models and Their Limitations

As the COVID-19 pandemic challenges risk models, we believe that examining risk through different lenses using different models will help achieve a more balanced view. Combining fundamental company analysis with a holistic view of how stocks, sectors and scenarios interact in new and unexpected ways can help investors manage unprecedented portfolio risks through a historic market event.