Accordingly, we believe it’s a mistake to forgo interest-rate risk, particularly with further volatility likely in the months to come.

Credit Looks Compelling, Even as Defaults Rise

We think continued central bank support and ultralow government bond yields will drive strong demand for higher-yielding credit sectors, even as fundamental conditions appear to deteriorate in the corporate market.

And investors should prepare to see more bond downgrades and defaults this year. In April, we expected the US high-yield default rate to exceed 10% over the next 12 months. Since then, many weaker corporations have defaulted. As a result, we now expect the 12-month forward default rate to average 6% to 9%. Global default rates will likely be somewhat lower.

But high default expectations aren’t a sign that a credit apocalypse is coming. Instead, defaults lag instigating events such as recessions and tend to be well signaled through market pricing for months—sometimes years—in advance. In other words, by this time, potential losses and recoveries are already baked into the price. It’s common, in fact, for a credit rally to couple with high default rates, as both tend to follow a cyclical downturn.

So what can yield-hungry investors expect in return over the next few years?

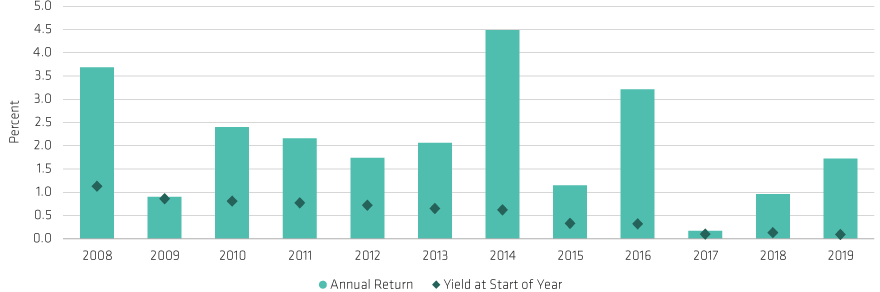

For credit sectors in general and for high-yield corporates in particular, investors can expect to clip the coupon. Forty years of data show that, while the average yield to worst on the US high-yield sector is not a good predictor of return over the next six to 12 months, starting yield has mapped almost perfectly to return over the subsequent five years. That relationship has held through nearly every kind of market environment.

In our view, with valuations still above long-term averages and the technical picture a positive one, investors should consider leaning into credit risk as the global economy heals and spreads continue to compress.

Today, investors can find opportunities to enhance yield and potential return by diversifying into:

Lastly, given today’s uncertain environment, be selective; fundamentals matter.

Manage Interest-Rate and Credit Risks Together

Investors who strike a balance between interest-rate risk and credit risk—and then dynamically manage that balance—can expect to achieve both downside protection and efficient income.

That’s because the two asset classes are negatively correlated during risk-off environments, just when a buffer is needed most. In other words, safety-seeking assets, such as government bonds, tend to do well when return-seeking assets, such as high-yield corporates, have a down day.

We expect occasional down days in the second half of 2020 as countries emerge from lockdowns and global economic activity resumes. But don’t forgo exposure to rate and credit risks because of low yields and rising defaults. Investors who stay the course in fixed income can expect their bond portfolios to provide ballast, yield and healthy return potential as the trend toward a full recovery continues.