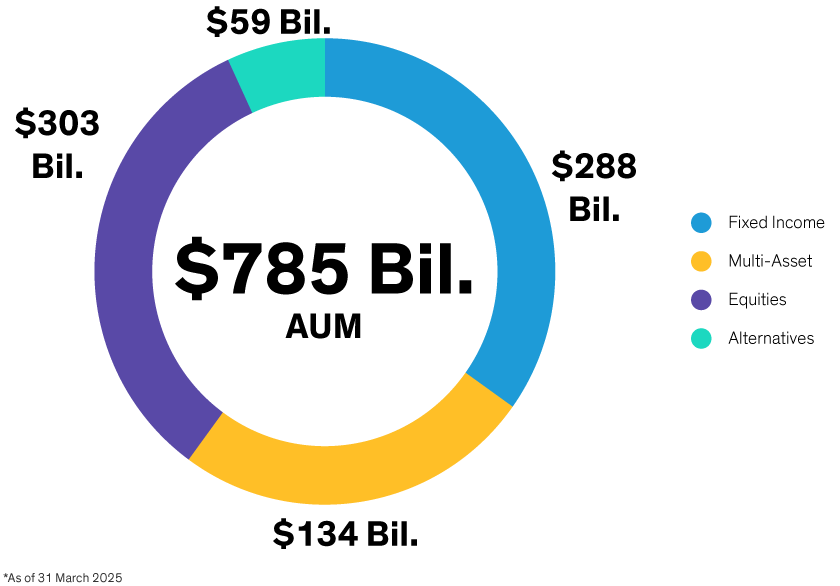

Asset Class Capabilities

Focused on Client Outcomes

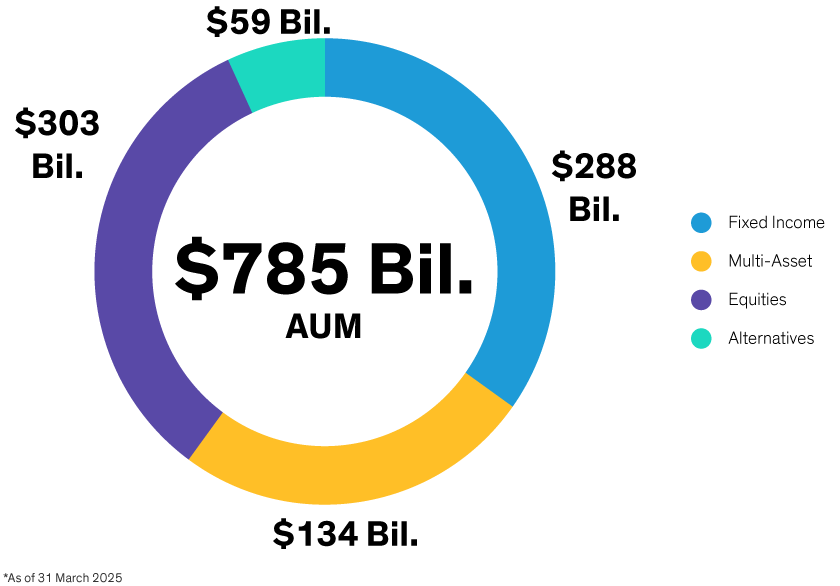

| Experienced Teams | Investment Professionals | Average Years of Experience |

|---|---|---|

AB Fixed Income |

120 | 16 |

AB Equities |

143 | 19 |

AB Multi-Asset |

78 | 17 |

AB Alternatives |

189 | 15 |

| Experienced Teams | Investment Professionals | Average Years of Experience |

|---|---|---|

AB Fixed Income |

120 | 16 |

AB Equities |

143 | 19 |

AB Multi-Asset |

78 | 17 |

AB Alternatives |

189 | 15 |