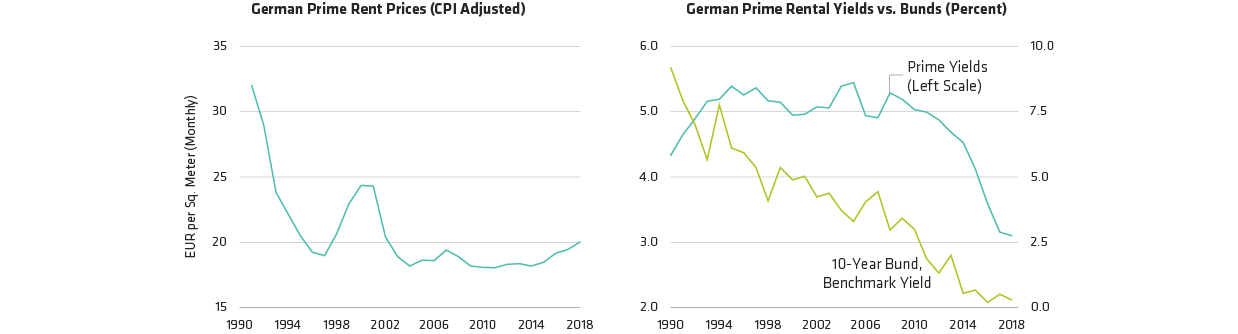

Many German office buildings now need renovation. As this takes place, landlords are often able to secure higher rents. Yet despite the pickup in rents, office rental yields are still falling as strong investor interest pushes property values up at a faster rate. But even prime office rental yields of about 3% are still historically quite high versus long-term Bund yields, which have now fallen to negative territory with 10-year Bunds at –0.4%. As a result, we expect investor demand to stay strong, driving prices higher. Our research suggests that these favorable industry conditions offer compelling opportunities for selective stock pickers.

From Cold War to Hot Property

Take TLG Immobilien, for example, a specialist German office real estate company. It has the highest exposure among listed real estate companies to Berlin, Germany’s fastest-growing rental growth city. TLG is well placed to increase rents as many current leases expire. And it has major development opportunities in Berlin, where numerous central buildings in the east of the city that were constructed during the Cold War will be demolished over time and replaced with much higher quality space. These new commercial buildings will be an even more important part of the portfolio as TLG disposes of noncore assets, especially in the challenged retail sector.

Aroundtown offers a different mix of exposures which our research suggests should support strong return potential. Its primary expertise has been in acquiring and turning around “value-add” buildings in primary business locations; these have historically included buildings with high vacancy rates requiring renovation, buildings sitting on banks’ balance sheets that were repossessed or buildings with difficult tenants or planning issues. With its expertise, Aroundtown typically refurbishes the buildings, usually to much higher environmental standards, and finds clients willing and able to pay much higher rents.

In our view, company-specific opportunities such as these offer investors unusual exposure to superior cash flows, in stocks with valuations that are more attractive than most other defensive sectors of the European equity market.