Q1 2026

Capital Markets Outlook

Highlights

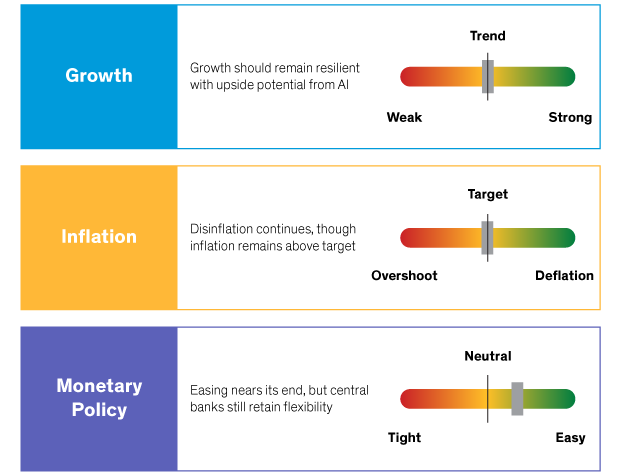

- Macro

- Rates

- Credit

- EMD

- Equity

As of December 31, 2025

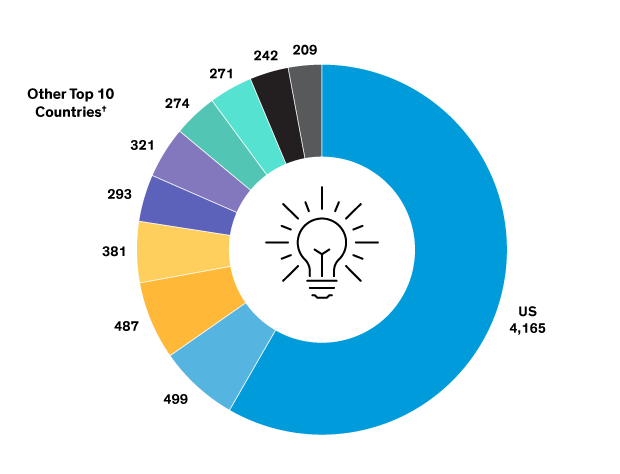

Source: Statista and AB

As of November 30, 2025

Source: Statista and AB

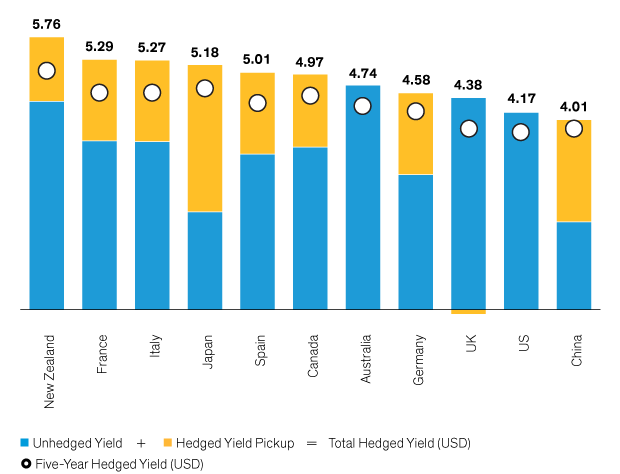

As of December 31, 2025

Source: Bloomberg and AB

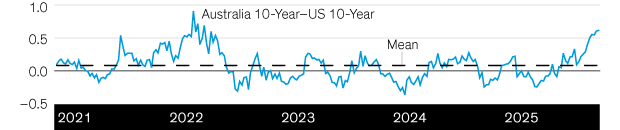

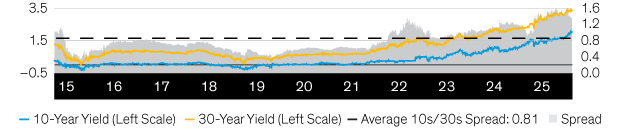

As of December 31, 2025

Source: Bloomberg and AB

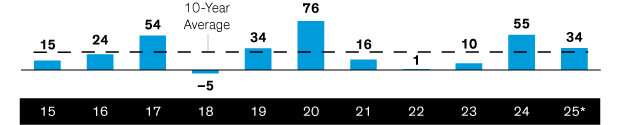

As of December 31, 2025

Source: Bloomberg and AB

As of December 31, 2025

Source: Bloomberg, J.P. Morgan and AB

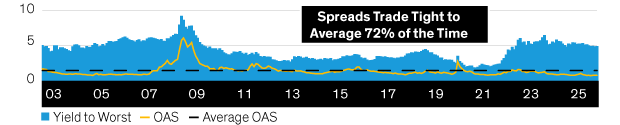

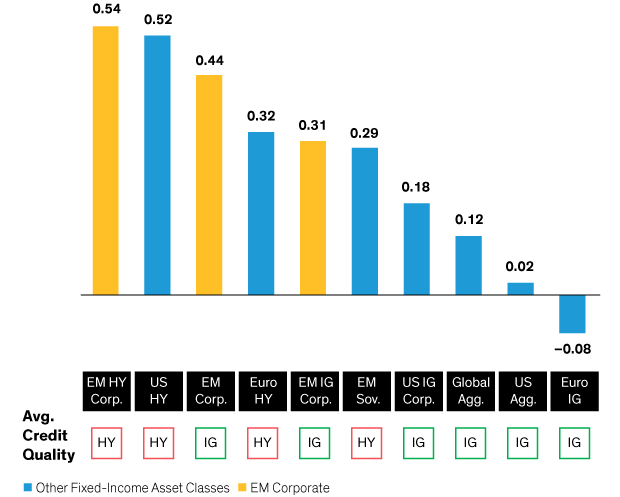

Average since January 1, 2003

As of December 31, 2025

Source: Bloomberg, J.P. Morgan and AB

Index represented by Bloomberg US Corporate

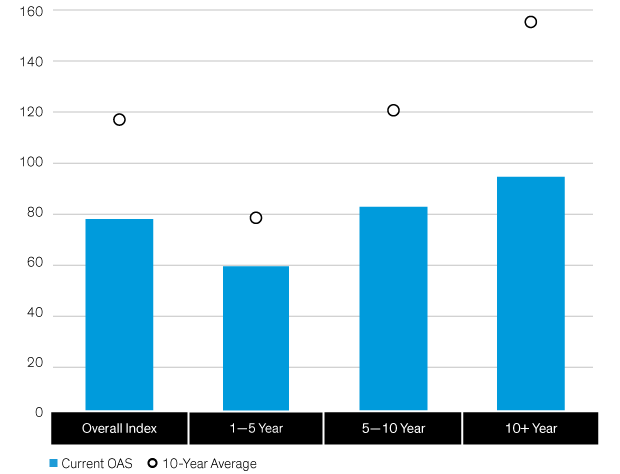

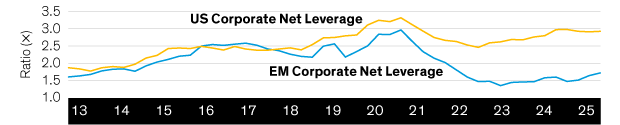

As of December 31, 2025

Source: Bloomberg, J.P. Morgan and AB

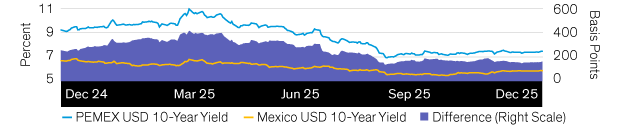

As of December 31, 2025

Source: Bank of America, Bloomberg, J.P. Morgan and AB

As of June 30, 2025

Source: Bank of America, Bloomberg, J.P. Morgan and AB

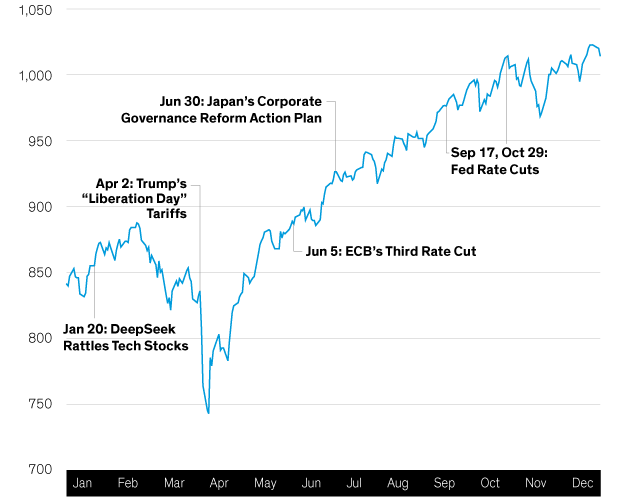

As of December 31, 2025

Source: Bank of America, Bloomberg, J.P. Morgan and AB

As of December 31, 2025

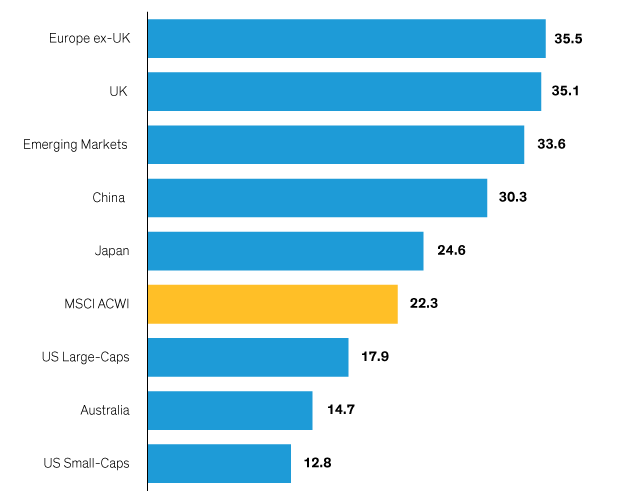

Source: FactSet, FTSE Russell, MSCI, S&P and AB

As of December 31, 2025

Source: FactSet, FTSE Russell, MSCI, S&P and AB