Many international investors have been underweight US equities for years, fearing they’ve missed the boat after a nine-year bull market. But we think American stocks are more attractive than perceived for three main reasons.

The skepticism is understandable. From April 2009 through June 2018, the S&P 500 Index rose by an annualized 16.6%, the longest bull run in postwar history. Equities have been powered by steady earnings growth and the US Federal Reserve’s quantitative easing policies, which have kept rates down and propped up valuations. Perhaps the good times are about to end.

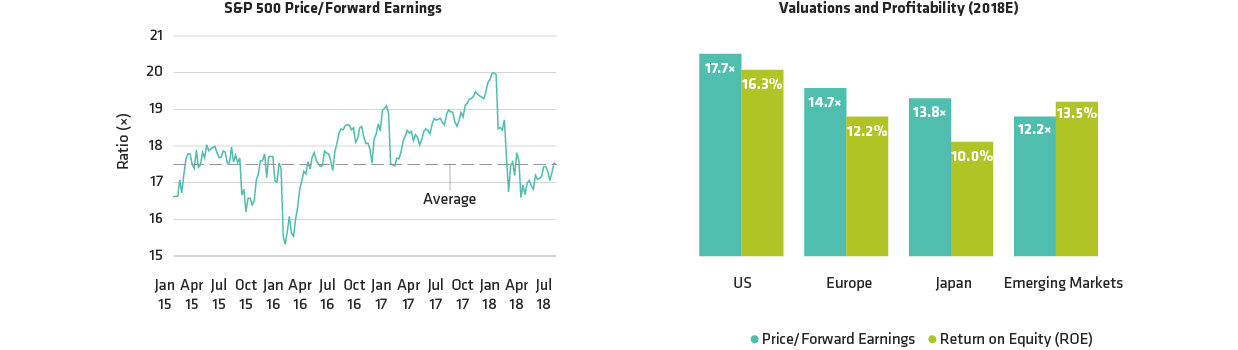

But in fact, US stocks look resilient from three perspectives: Market fundamentals are solid. Technical forces are supportive. And even stock valuations—a lingering concern—are relatively attractive today.

1. Fundamentals: Economic Growth and Strong Earnings

Equity market performance is always tied to macroeconomic growth. In 2017, stocks performed well globally amid strong, synchronized GDP gains around the world. But developed economies diverged in 2018. In the six largest economies outside the US, GDP growth has decelerated, whereas in the US, the growth rate is expected to rise, from 2.3% last year to over 3% in 2018. In the second quarter, US real growth surged by 4%, firing on almost all cylinders and fueled by the December 2017 tax reform, which helped boost corporate profits and is triggering positive second- and third-order effects. As a result, the ISM index, a leading US growth indicator, continues to point to further economic momentum.

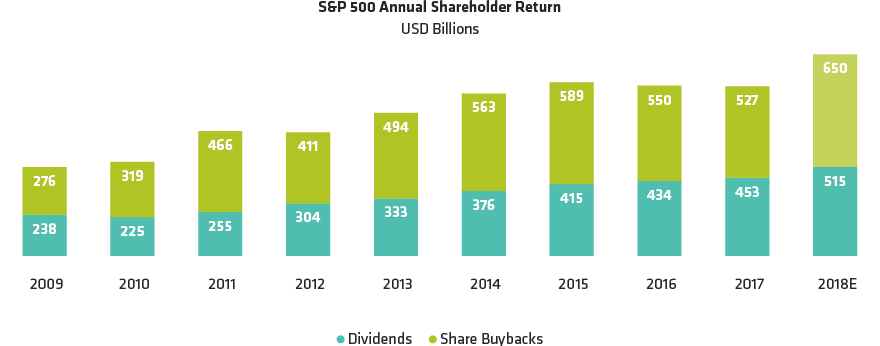

The robust economy is supporting revenues and earnings for US companies. Earnings are expected to advance by 23% year over year in 2018, according to consensus estimates. Many analysts estimate that tax reform is responsible for about a third of earnings growth as well as much of the upward earnings revisions early in the year. Yet since April, earnings revisions have been driven more by strong business fundamentals. Indeed, aggregate year-over-year revenue growth reached 9% in the second quarter of 2018. That’s the highest since the global financial crisis, and suggests that business is booming for US firms.

Will the “Sugar Rush” End?

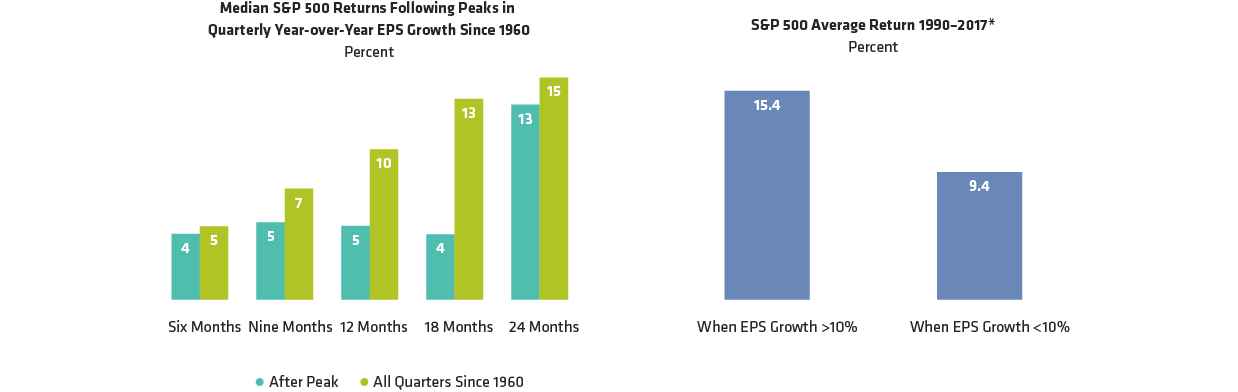

Earnings growth is a consistent signal for strong equity returns. Since 1990, when earnings growth for S&P 500 companies exceeded 10%, the index has returned 16% on average, and has never been negative.

But what happens after the “sugar rush” growth from tax reform fades? In our view, US equities can still deliver positive returns after quarterly profit growth peaks. In the past, stock returns decelerated sharply—but remained positive—long after earnings growth peaked (Display, left). Today, consensus estimates still expect earnings to exceed 10% in 2019, which signaled strong stock returns in the past (Display, right).