What do airline ticket prices, car sales and thousands of corporate filings have in common? In each of these areas, we applied advanced big data techniques to tackle an equity investing conundrum that couldn’t be solved by human researchers alone.

Figuring out how to use big data is the next frontier for the asset-management industry. But applying analytical tools such as machine learning and artificial intelligence to disparate investment research themes also presents huge challenges. There’s no simple recipe for translating oceans of data into investment advantages. Equity investors must have the right culture—and ask the right questions—to successfully integrate data science into research and investment processes.

Why Is Big Data So Important?

There’s a colossal amount of data available to investors today. For example, more than 8,000 US-listed companies produce quarterly 10-Q reports and annual 10-K reports, each hundreds of pages long. We’ve collected 675,000 of these reports that were filed over the past 26 years. Globally, companies also conduct about 20,000 earnings calls a year in English, each yielding detailed transcripts. And if you include non-English corporate documents, the data mountain would mushroom exponentially.

In theory, portfolio managers have a fiduciary obligation to pore over thousands of pages of data to fully gauge the risks and opportunities that a company faces. Practically speaking? It simply isn’t humanly feasible to parse so much information efficiently. For the US market alone, you would need at least 30 full-time research analysts just to read every filing and call transcript. Investment firms need to ask whether this is a cost-effective effort that would lead to good investing outcomes.

Data science offers a solution by applying machine learning and artificial intelligence to the mountains of information. Yet even the smartest software requires human direction and expertise to translate data into actionable fundamental research conclusions.

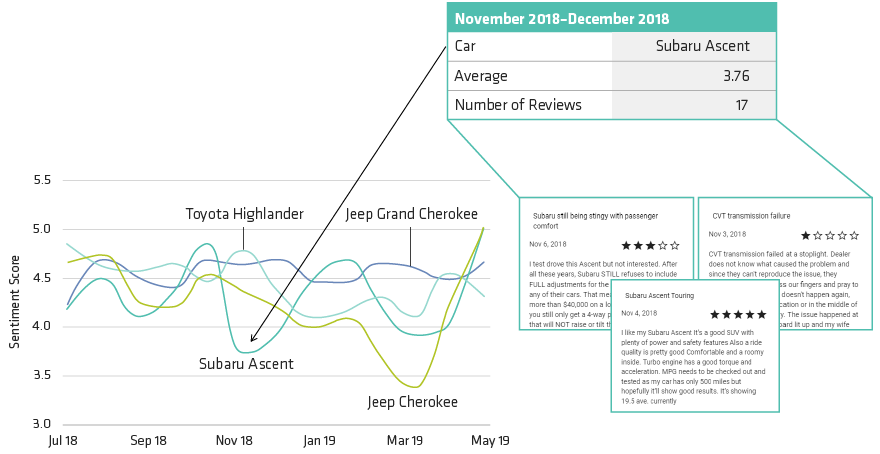

For example, consider an analyst researching the cycle of a car sale. The information available today is varied and vast. During the initial engagement, potential US-based customers might conduct web research on sites such as Caranddriver.com or Edmunds.com while consuming information from social media marketing campaigns. As customers near a decision, price comparison websites create more data, along with surveys, apps and webcarts. Completed transactions generate email receipts. After a sale, customer satisfaction is gauged via online reviews.

Collectively, all these data should provide an analyst with unprecedented intelligence. But to generate insight, the analyst must ask questions that make sense out of the data: How many customers are coming into the store to research the product? What’s the competitive pricing environment? Which product features are being praised or panned in reviews?

These questions must be as specific as possible. Better questions will lead to better outcomes and generate the investment insight that can support a high-conviction portfolio position.

How Can Skills Be Brought Together to Generate Insight?

Generating this insight requires combining a broad set of investment skills. Large data sets must be crunched and combined with complex statistical and economic models. Investment organizations rooted in quantitative research may seem more attuned to data science, but they might not be equipped to make sense of the information.

Fundamental analysts can apply research intuition by asking the right questions needed to extract useful information from huge pools of data, but they may lack the technical skills to process it efficiently. In the following case studies, we aim to show how a hybrid approach that draws upon diverse analytical skill sets—combining data science with fundamental and quantitative analysis—can help investment teams rise to the data challenge.

Case Study 1: Big Data to Study Airline Capacity Utilization

Question: How does additional airline capacity affect pricing power and what are the implications for specific airline holdings?

As any traveler knows, airfare pricing is extremely complex and opaque. Prices on different routes can fluctuate dramatically from one day to the next, as seat supply and passenger demand shift to the tune of multiple market forces. This makes it very difficult for a transportation analyst to draw conclusions about an airline’s capacity, its pricing and ultimately its profitability.

So in 2018, we set out to mine big data in order to learn more about how airline capacity affects pricing power. The project reinforced the importance of applying thoughtful fundamental research techniques to derive insights from the data.

The research question was straightforward: How does additional capacity impact pricing power? To answer the question, we scraped millions of rows of ticket pricing data from airline websites. But the raw, unstructured data first needed to be aggregated and cleaned up by our data scientists.

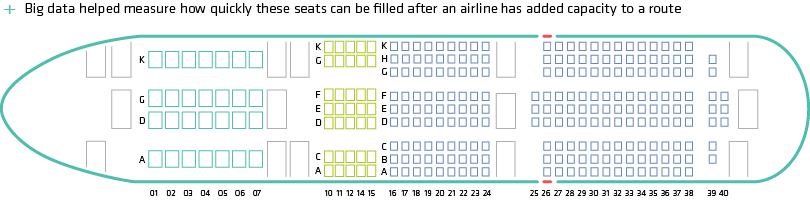

This was a good start, but our fundamental analysts weren’t satisfied. The pricing data alone couldn’t really answer the research question. What we needed was more information on aircraft capacity and how many seats were actually being filled on each flight (Display). For that, we turned to a data set provided by the Department of Transportation (DOT) on airline capacity.