A Painful Epiphany

Content Preview

- PART I: THE INVESTMENT ENVIRONMENT

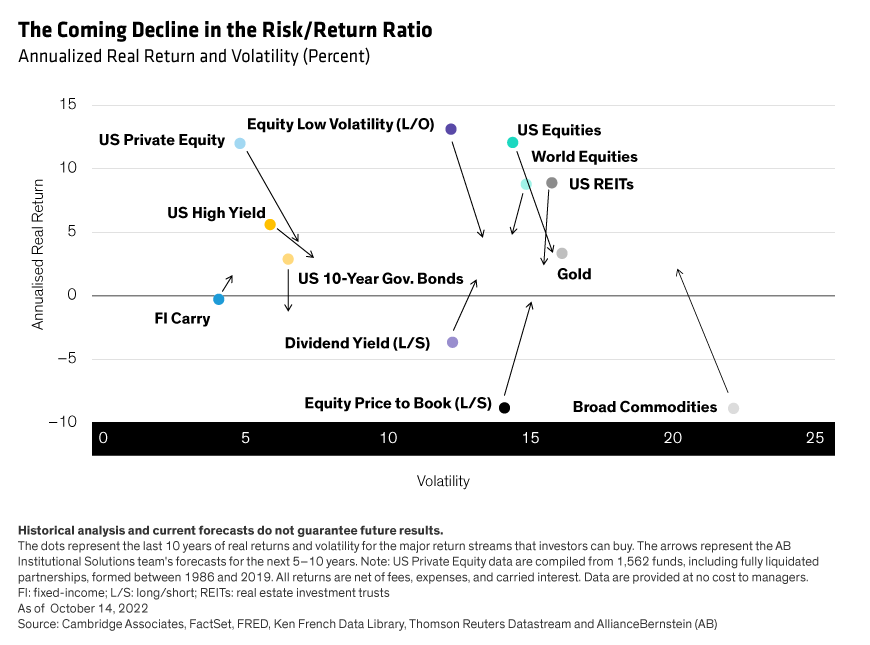

- PART II: ASSET CLASSES, FACTORS AND ALLOCATION

- PART III: THE INVESTMENT INDUSTRY

-

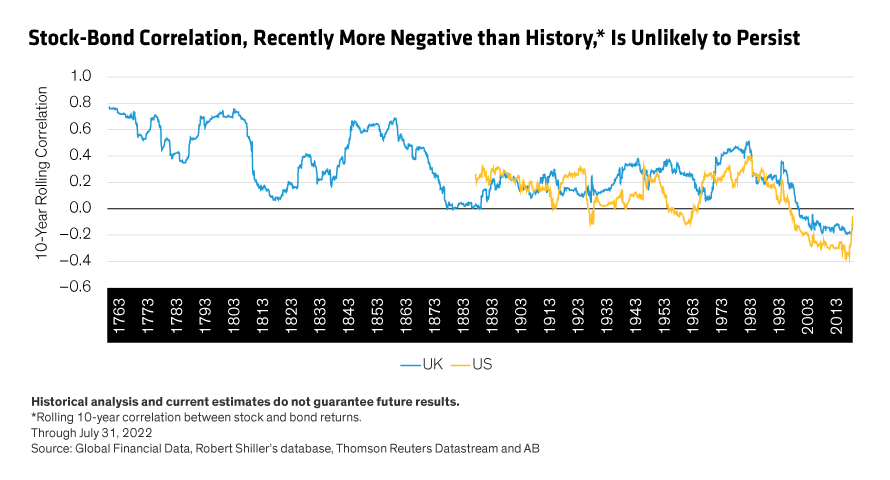

Adapting to a new investment regime after an extraordinary few decades

-

How to protect against strategically higher inflation

-

Public vs. private markets and the future of asset allocation

-

The role of ESG in investment methodology

-

A new lens on the active-passive investing debate

-

The role of digital assets in portfolios

-

Asset classes may not be the only basis for allocation—factors may work, too