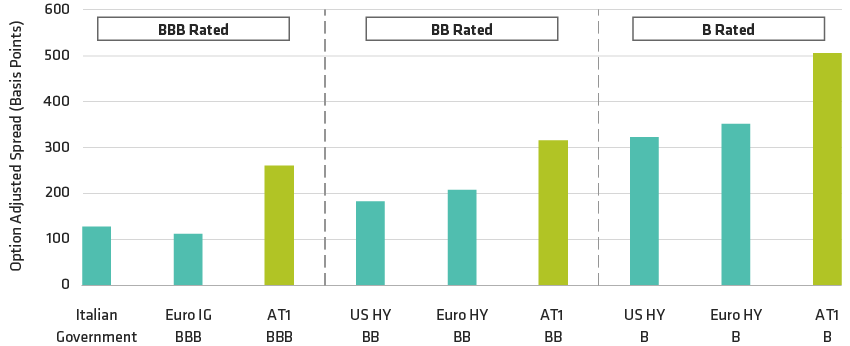

Of course, this like-for-like credit rating comparison does not tell the full story. That’s because the credit ratings of the issuing banks are typically investment-grade (that is, senior in the capital structure). So while the AT1’s ratings result from their subordinated status, they do not fully reflect the underlying strength of the balance sheets that support them.

Bank Balance Sheets Are Still Strong

Recently, there’s been a lot of talk about de-regulating the US banking sector through changes to the Volcker rules. In our view, this is more noise than fact. Actual US changes have been very modest and have applied mainly to regional banks. The US Federal Reserve (Fed) still has a tight grip on the larger banks, with Fed approval still needed for their capital plans and dividend distributions. In less laissez-faire Europe, we see deregulation of the banking sector as particularly unlikely.

We’re not overly concerned about other potential risks to European banks’ financial strength. Maybe the improvement in non-performing loan (NPL) levels in Europe has peaked. But if economic growth slows down, we still don’t expect a sharp deterioration in asset quality. Compared with historical standards, European banks are in a very strong position. Their balance sheets are relatively clean, as they were not driving the significant credit expansion of the last decade. Because European banks were forced to de-leverage, they did not lend much new money to the economy, while borrowers accessed different sources of credit instead.

Still Preferable to Bank Equity

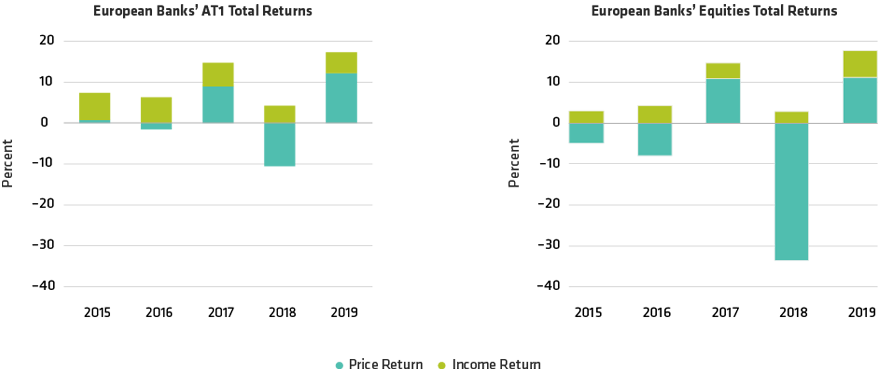

AT1s represent a good alternative to European bank equities, which we expect will continue to face headwinds from the low-rate and low-profitability backdrop.

In this environment, AT1s have also provided better upside/downside capture than bank equities. The Display below shows how AT1s have historically captured all the upside of banks’ equities, with less downside. While bank profits remain depressed, we expect this pattern will continue, with future AT1 performance mainly driven by the coupon which remains relatively high.