By 1 October 2019, the Department for Work and Pensions (DWP) guidance states that both DB and DC trustees need to state in their Statement of Investment Principles: 1) their policy on how they take into account financially material considerations, including ESG and climate change; 2) their stewardship policy (voting and engagement); 3) their approach (if any) to taking account of member views; and – for DC schemes only – 4) publish their Statement of Investment Principles on a public website. They must also update this policy document for their approach on these issues in the default strategy. From October 2020 DC trustees also need to publish an implementation report detailing how they have taken these steps and the changes they have actually made.

That’s a lot to do in a short time – especially considering that some DC trustees may likely have just one trustee meeting between now and September. At Mercer, we believe it’s very important to have a framework for thinking about these complex questions that impact every part of the investment process. Indeed, we encourage our clients to make sure that ESG considerations are embedded throughout investment frameworks, from beliefs to policy and processes and all the way through to the portfolio.

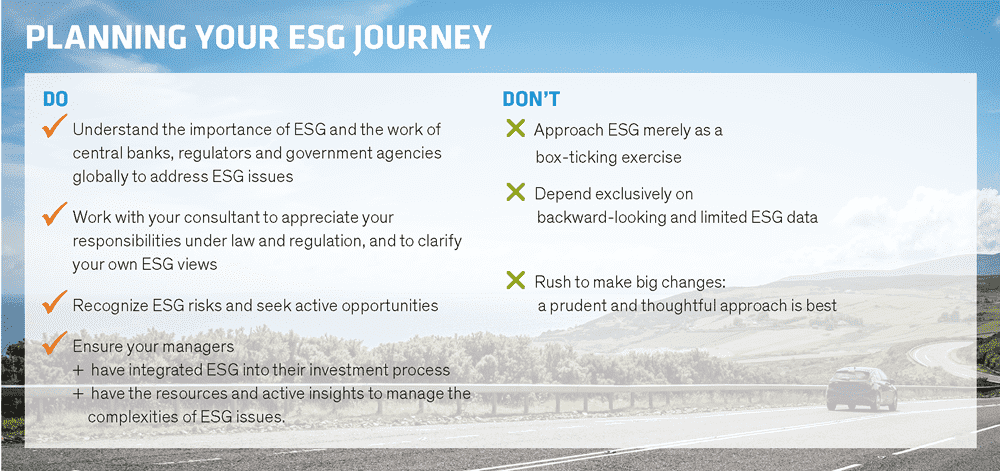

That’s why we applaud the DWP’s focus on getting trustees to deliberate and arrive at their own ESG beliefs rather than just ticking a box. And we believe it’s very important for trustees to devote enough time to these ESG discussions and to agree solutions that are right for them. ESG is not a straightforward area and there’s a lot for trustees to understand. Addressing different viewpoints can be hard. To get the best out of trustees’ discussions – and their engagement with members – we direct our clients away from focusing on the negative, and instead get them to think about how they can invest in the right industries for the future.

At Mercer, we have a team of about 16 globally, just focusing on responsible investment. We saw its importance early, and we were one of the drivers behind the UN Principles for Responsible Investment (PRI). Responsible investment is absolutely not a flash in the pan. In fact, over the last two to three years awareness of ESG factors has accelerated enormously. It’s great to see the regulator pushing trustees on ESG; at the moment, their guidance is a series of nudges, but it’s inevitable that there will be further regulation in due course.

Key Takeaways

- Trustees face though deadlines to set out their ESG beliefs

- They need the right framework for their deliberations

- It's very important that they devote enough time for discussion, and focus on positive outcomes

- ESG is so important that trustees should expect futher regulation in future

Including ESG products in a scheme’s fund range can raise several issues. Pressure on costs is always a problem area for trustees, particularly at smaller funds, so indexed funds are sometimes a more cost-effective option. There are a growing number of good active products but some can be expensive. And it can be particularly tough on cost grounds to include ESG-focused alternative strategies.

A lot of our analysis centres on testing whether active managers are just applying an ESG veneer or whether they are genuinely addressing the underlying issues and integrating ESG in their investment process. We also have a concern about how well trustees understand the growing number of manager products that are halfway between active and passive, using tilts to express specific ESG views. Trustees need to be aware that these tilts will change over time and need monitoring – it’s not like buying a passive fund and saying, “job done”. Consultants can help by ranking and rating the different products and analysing the growing volume of data. We also encourage clients to apply their ESG beliefs consistently across their whole fund range – some people might question the rationale of adopting an ESG focus in your default and not in your freestyle funds.

Interacting with your investment manager is very important. Managers are getting used to answering questions about how workers are being paid, diversity issues, supply chains, how suppliers are being treated and so on. Trustees need to have a dialogue with their managers and make sure that ESG is not just an add-on for their investment process, it’s really integral to what they do. And they need to ensure their managers are voting their shares at company meetings, and reporting on how they use their votes and engage with company management.

Key Takeaways

- Fund selection raises several issues, notably cost and manager monitoring

- Trustee need to monitor their managers'ESG credentials and their voting and engagement work

At AB we are firm believers in the importance of ESG, and we have made ESG considerations an integral part of our investment process. We aim to make ESG work for the majority of members, and not just for an enthusiastic minority. So we have created a fund range that can cater for the different circumstances and needs of most DC schemes, and can address the specific beliefs of individual boards of trustees.

Our DC products include target-date fund (TDF) default ranges, a retirement income solution, and a range of DC-friendly specialist funds for lifestyle default solutions.

We recognize that trustees may need to implement their ESG beliefs using custom solutions – in fact, customization is an important part of our offer. So, for instance, in our standard packaged TDF range we use a mix of passive and systematic strategies, and we have already actively incorporated a positive ESG tilt. This creates underweight positions in companies with the lowest ESG scores and reallocates capital to more sustainable investments. We also offer simple-to-customize TDFs, where we can go further to reflect clients’ very specific requirements – for example excluding tobacco companies, or placing a greater emphasis on carbon reduction than we have already adopted in our standard range.

At AB, integrating ESG into our investment process is central. Every one of our analysts considers ESG factors when they are researching a stock, and every one of our portfolio managers considers ESG impacts as they construct their portfolios. That comprehensive integration drives superior investment outcomes for clients, and helps create strategies that better reflect clients’ particular values and beliefs.

Key Takeaways

- Our fund range outs ESG to work for the majority of members, not just an anthusiastic minority

- We integrate ESG strategies into our standard range, and can offer different levels of ESG customization

- Comprehensive integration drives superior investment outcomes for clients

Because our TDFs use an open-architecture approach, we build our strategies to include a number of third-party managers. We need to make sure that we hire managers that align with AB’s own policies and are also PRI signatories. Recently, for predominantly ESG reasons we divested from two managers that only offered passive products. We felt that they lacked the research resources and active manager insights that come from managing active funds, and that this impaired their ability both to engage with companies and to use their voting rights to full effect. For a passive manager to hold over 10,000 stocks and bonds from different issuers, but to employ only about 30 research staff, inevitably means they cannot research in-depth or engage with insight. By comparison, at AB we employ over 200 specialist active analysts who each focus on a relatively limited number of stocks. We also employ a discrete team of governance specialists – because we believe voting and engagement really do matter.

We exclude controversial weapons from the funds and mandates which AB controls, which is a further differentiator from purely passive investment houses, which have to date struggled to adopt ESG alignment on this issue.

In our discussions with clients we strongly advise a prudent pace for implementing big changes. If you see addressing climate change as a 30-year project, there is no point in creating regret risk by making all the changes to your portfolio in one go. We also caution against relying too much on historical ESG data – this can be limited in terms of history and completeness, so you need to be very careful, especially when implementing ESG views purely systematically. Active management of the process is unavoidable. And of course, trustees need to consider how much ESG news has already been priced into markets. For instance, Tesla’s high valuation already reflects expected rapid growth from their new electric vehicle technologies, whereas arguably Ford’s lowly-rated shares do not reflect their potential to use their deep resources to create clean auto technologies.

Our ESG work is part of a continuous programme, not a “one and done” project. We base each initiative on research and on the feedback from our regular DC member surveys. Our aim is to stay very focused on trustees’ and members’ needs, to create superior governance solutions and to provide exceptional value for money.

Key Takeaways

- Pure passive mangers lack the resources and insights to engage in-depth with company management

- Trustees need to implement ESG views carefully - without rushing big changes, and without replying too much on historical ESG data

- We focus on members'needs, on creating superior governance soultions, and on providing exceptional value for money