Stuart Rae

25 Years at AB|32 Years of Experience

Stuart Rae is Chief Investment Officer of Emerging Markets Value Equities since 2023 and Chief Investment Officer of Asia-Pacific Value Equities, a position he has held since 2006. He is also a long-standing Portfolio Manager for China Equities. Previously, Rae was CIO of Australian Value Equities from 2003 to 2006. He joined the firm in 1999 as a research analyst covering the consumer sector, initially working in New York and London before moving to Sydney in 2003, Hong Kong in 2006 and Melbourne in 2021. Before that, Rae was a management consultant with McKinsey for six years in Australia and the UK. He holds a BSc (Hons) in physics from Monash University, Australia, and a DPhil in physics from the University of Oxford, where he studied as a Rhodes Scholar. Location: Melbourne

Published Work

As more Chinese companies get comfortable paying dividends, investors may find new sources of equity return potential.

John Lin, Stuart Rae | 03 September 2024

In this episode, we speak with Stuart Rae, AB’s Chief Investment Officer—Emerging Markets Value. Stuart talks about how he first became involved in emerging market investing and highlights some of the interesting insights he uncovers when conducting his on the ground research.

Stuart Rae | 14 August 2024

Governance issues have long been a source of concern in emerging markets investing, but over the past decade, a persistent focus on capital management, disclosures and shareholder friendly policies in Japan have created a blueprint that Korea is now trying to emulate. Can the Korean market emulate Japan’s success? And who’s next?

Stuart Rae | 02 May 2024

The disruption and dislocation caused by Covid-19 taught us many lessons. Perhaps one of the most enduring lessons for global businesses was the fragility of their supply chains – many of which were at the mercy of one supplier and one market. Now companies are looking to future proof their operations, and well-positioned emerging markets outside China are set to benefit.

Stuart Rae | 12 March 2024

Since the end of the global pandemic, rising oil prices have seen the Middle East region flooded with cash. From a low of around $11 a barrel in 2020, to its peak at over $120 a barrel in 2022 – demand for oil has bolstered the wealth of some of the world’s already largest sovereign wealth funds.

Stuart Rae | 15 February 2024

There's a whiff of hope in the air across emerging markets. Recent equity market gains may signal the start of a broader recovery after years of underperformance.

Sammy Suzuki, Stuart Rae | 25 January 2023

Despite new challenges in emerging-market equities this year, value stocks have held up relatively well as changing conditions revive dormant recovery potential.

Stuart Rae | 09 June 2022

As China begins the year of the Ox, many investors are wondering whether another bull run is possible in 2021. Given that last year's rally was extremely narrow, we believe many parts of the market still offer pent-up recovery potential.

Stuart Rae, John Lin | 26 January 2021

Chinese stocks have been resilient this year because of relatively modest earnings downgrades amid an early recovery from the virus-induced shock.

John Lin, Stuart Rae | 01 June 2020

Tensions between the US and China are flaring up again. With pressure mounting on Chinese stocks listed in the US, including those widely held in emerging-market portfolios, investors need to consider how to prepare for the mounting risks.

John Lin, Stuart Rae | 27 May 2020

Asian businesses are gradually rebooting after governments quelled the initial wave of the pandemic. Conditions may be improving for regional value stocks that were beaten down before and during the pandemic.

Stuart Rae | 12 May 2020

The current market outlook is bleak. But if the US and Europe take the right steps and follow China’s playbook, we believe the world could ultimately follow the Chinese markets’ road to recovery.

John Lin, Stuart Rae | 16 March 2020

Growing fears about the coronavirus have hit Chinese stocks. While markets will remain unstable until China gets the outbreak under control, equity investors should revisit lessons from previous epidemics and consider the potential longer-term effects of the current crisis.

John Lin, Stuart Rae | 16 February 2020

Now that the US and China have agreed to begin easing trade tensions, the fog over China's markets is starting to lift. Investors should consider Chinese equity opportunities that have been overlooked because of tariff fears.

John Lin, Stuart Rae | 17 December 2019

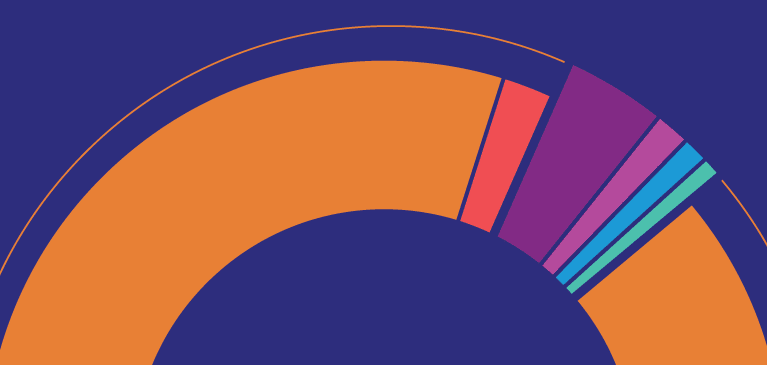

China is the world's second-largest economy, but its equities are underrepresented in market indices and portfolios worldwide. With a growing stock market capitalization—and more inflows expected from greater index inclusion—foreign investors should take a closer look.

John Lin, Stuart Rae | 18 November 2019

Complex ties between US and Chinese technology sectors are being tested by trade war tensions. But some steps taken by the US against Chinese multinational giant Huawei Technologies could backfire and spark a new phase of development for the Chinese technology sector.

John Lin, Stuart Rae | 02 October 2019

China's rise as a preeminent economic power makes it impossible for globally minded investors to ignore. With the integration of China's domestic-listed equities and bonds into major global indices, the potential of investing in the broad economy is increasingly opening to the world.

Hua Cheng, John Lin, Stuart Rae | 05 June 2019

African swine fever is ravaging China's pork supply and having a global impact on protein prices. For equity investors, the crisis serves as a reminder that even amid trade-war uncertainty, research into domestic trends can help investors access the country's vast stock market.

John Lin, Stuart Rae | 20 May 2019

In the investing industry, we're all well aware that our business isn't a one-person endeavor. The basic problem-solving unit is quite often a group or team. But how do we create the right formula that ensures groups make thoughtful, effective decisions and avoid bad ones?

Stuart Rae | 18 March 2019

After MSCI decided today to boost the allocation to Chinese onshore stocks in its emerging-market indices, global investors are likely to pump more money into the market. But watch out for crowds. Flows into China are concentrated in a small group of large-cap stocks.

John Lin, Stuart Rae | 28 February 2019

The Chinese stock market is changing at breathtaking speed and is on track to reach maturity faster than any other in history. Global investors have been reluctant to dive in, but there are good reasons to get acquainted with the companies serving the world's second-largest economy.

John Lin, Stuart Rae | 14 February 2019

Whenever the Chinese economy slows and its stocks take a serious hit, investors have come to expect the government to unleash large-scale fiscal and monetary stimulus. Another heaping spoonful of sugar may do more harm than good this time around, however. It's time for the ailing market to take some medicine.

John Lin, Stuart Rae | 27 November 2018

In our many travels through China to explore the changing market landscape, we've discovered countless companies and industries that are jumping ahead of the West. These leapfroggers are creating exciting opportunities for investors as China's equity and debt markets open to the world.

Sammy Suzuki, John Lin, Stuart Rae, Brad Gibson | 20 June 2018

President Trump's plans for tariffs on about $60 billion of Chinese imports have rattled equity markets. Investors should begin to study which types of industries, countries and companies could win or lose if an all-out trade war erupts.

Stuart Rae, John Lin | 22 March 2018This information is for exclusive use of the wholesale person to whom it is provided and is not to be relied upon by any other person. It is not intended for retail or public use and may not be further distributed without prior written consent of ABAL.

This webpage has been prepared by AllianceBernstein Australia Limited (“ABAL”)—ABN 53 095 022 718, AFSL 230 698. Information in this webpage is only intended for persons that qualify as “wholesale clients,” as defined by the Corporations Act 2001, and is not to be construed as advice. This webpage is provided solely for informational purposes and is not an offer to buy or sell securities. The information, forecasts and opinions set forth in this webpage have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither this webpage nor the information contained in it are intended to take the place of professional advice.

You should not take action on specific issues based on the information contained in this webpage without first obtaining professional advice. Past performance does not guarantee future results. Projections, although based on current information, may not be realized. Information, forecasts and opinions can change without notice and ABAL does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained in this webpage, ABAL does not warrant that this webpage is free from errors, inaccuracies or omissions. ABAL disclaims any liability for damage or loss arising from reliance upon any matter contained in this webpage except for statutory liability which cannot be excluded.

No reproduction of the materials on this webpage may be made without the express written permission of ABAL. This information is provided for persons in Australia only and is not being provided for the use of any person who is in any other country.