The Challenge to Investors

The Impact and Broader Implications of AI

What Is The Book?

Explore the 2025 Edition

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

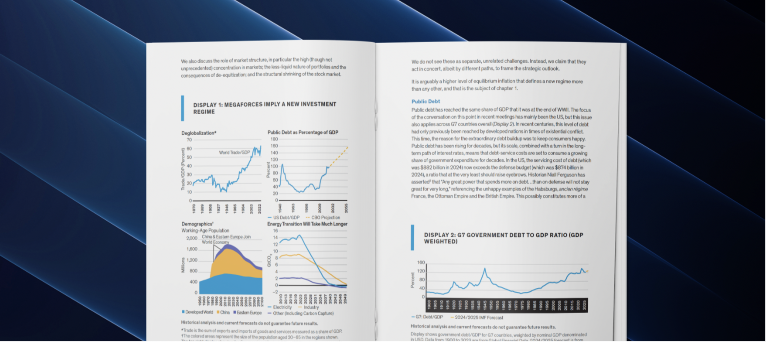

The future likely holds higher inflation, so investors will need to put more weight on maintaining purchasing power.

This point is highly relevant, given questions about long-term public-debt sustainability and the temptation to use inflation as a relief valve.

The government debt burden across G7 economies has returned to its lofty heights at the end of WWII, mainly to keep consumers happy.

The cost of servicing that debt is growing, and letting inflation run hotter might be the easiest political way out of the problem.

The energy transition seems to be going more slowly than initially hoped. As it stands, it may not meet the current expectations for achieving net-zero emissions by 2050. This creates additional uncertainties for investors.

Markets struggle to price the risks from geopolitics, adding another layer of uncertainty to investment plans. With geopolitical dynamics shifting, investors must take a broader view of potential future scenarios.

Questa è una comunicazione di marketing. Le presenti informazioni sono fornite da AllianceBernstein (Luxembourg) S.à r.l. Société à responsabilité limitée, R.C.S. Lussemburgo B 34 305, 2-4, rue Eugène Ruppert, L-2453 Lussemburgo. Autorizzata in Lussemburgo e regolamentata dalla Commission de Surveillance du Secteur Financier (CSSF). Vengono fornite unicamente a scopo informativo e non rappresentano una consulenza d’investimento né un invito all’acquisto di titoli o altri investimenti. I giudizi e le opinioni espressi sono basati sulle nostre previsioni interne e non vanno intesi come indicazioni della futura performance dei mercati. Il valore degli investimenti in qualsiasi fondo può diminuire o aumentare e un investitore può anche non riottenere l’intera somma investita. La performance passata non costituisce garanzia di risultati futuri.