The Book 2025 Edition

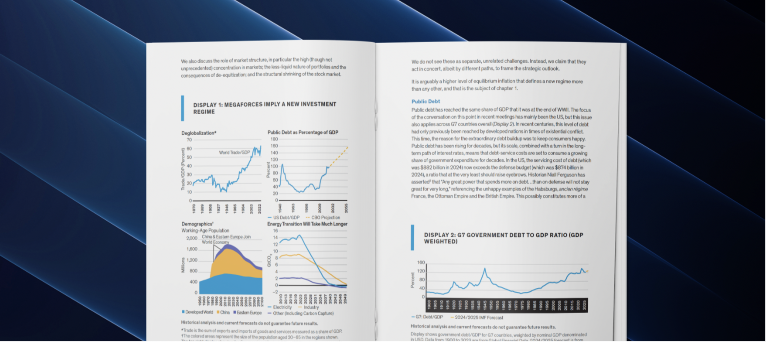

Instability: Debt, Inflation and AI’s Impact on Investing

Challenges and Responses for Investors

Challenges and Themes for the Road Ahead

Responses for Investors

-

Overweight to equities, as we believe they are the largest real asset if inflation rates are elevated but not unanchored; an overweight to the US in recognition of better earnings potential

-

Significant exposure to other real assets, including inflation-protected securities, real estate and commodities. Gold and potentially cryptocurrencies may also be part of this allocation.

-

Underweight to traditional bonds, given that they could deliver lower real returns and be less effective at diversifying equity in a higher-inflation world

-

A distinct allocation to investment factors, given their potential to enhance overall portfolio returns and diversification

-

A meaningful allocation to private assets for their illiquidity premium and diversification from access to returns streams unavailable in public markets

-

Higher exposure to active strategies with potential to deliver persistent alpha—portable alpha mechanisms offer a potential solution to a mismatch of beta and alpha sources

Read the Research